Ways to lock your bank cards when you lose or reveal information

There are many cases where people use a bank card to reveal their card information, and sometimes your bank card information is leaked in case you don't expect it. Currently there are many forms of fraud to entice users to fill in card information like winning messages and ask users to fill in bank card information to get money.

Or with VISA / Mastercard , just the person who uses the card to lose the card is the money inside that will risk "not flying". Usually the card information will be available on data files that are recorded as user billing information from the store or supermarket system. In particular, credit card numbers and some other customer information, this is very dangerous because hackers can take advantage of it to get money in their accounts.

In those cases, locking the bank card is a solution that will keep your account safe. Users can perform account lock in many different forms, the following article QuanTriMang will introduce you to a few ways to temporarily lock your bank card.

Instructions on how to lock bank cards

1. Lock the card via the bank's online website

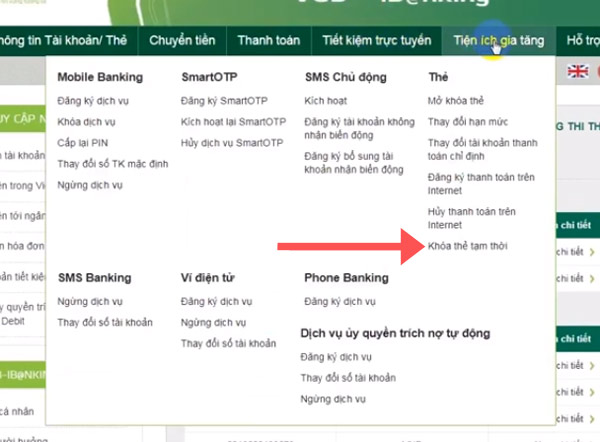

Step 1: Here I will take the example of some of the most popular banks, that is Vietcombank's website. Please log in your account number to the homepage of Vietcombank, then select Add-ons> select Next temporary card lock in the Tags tab .

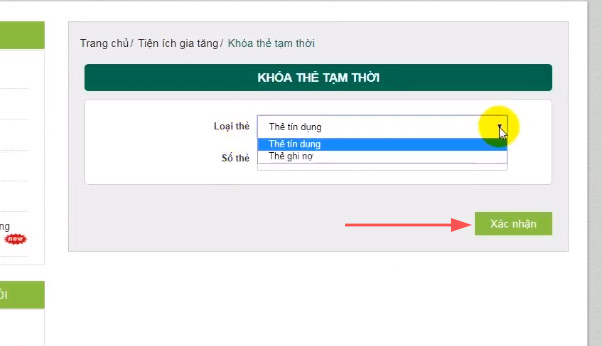

Step 2: Select the type of card you want to lock, select the card number and click Confirm to temporarily lock the account. Soon the payment card you choose will be temporarily locked.

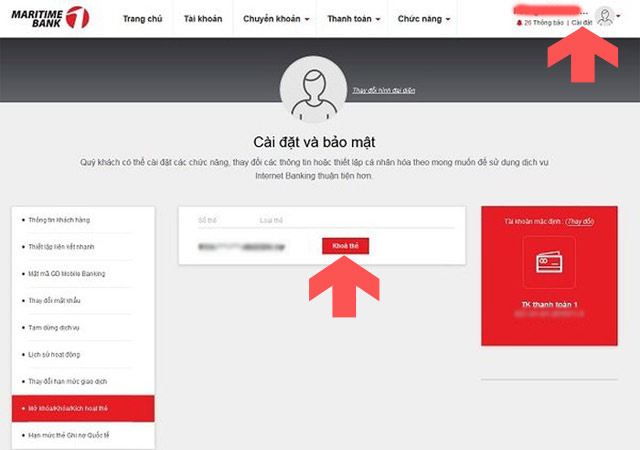

You can do the same with other banks, almost all banks now support Internet Banking so users can perform account lock on computers or phones, just have Internet connection. .

2. Lock your bank account with the phone number

In addition to locking the account from Internet Banking service on the website, users can also call directly to the phone number of that bank to request to lock the account, just provide the account number, card number or number. The identity card is the operator who has been able to temporarily lock your bank account.

But the phone number of the switchboard is using, not everyone knows to call the switchboard and ask for support. However, you can view the list of bank switchboard numbers in the list of telephone numbers of switchboards of banks in Vietnam.

3. Lock bank card with Mobile Banking application

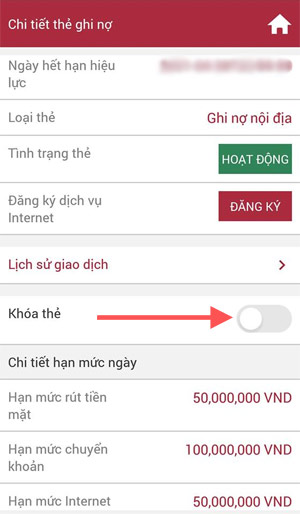

Some banks are currently developing their Mobile Banking applications on the phone so that users can control and manage their accounts, along with these applications also have other features to serve the transfer needs. money, online payment . Including temporary card lock feature.

Just log in the phone number registered on the Mobile Banking application and then go to Debit Card details or in the Card section. If you see the Card Lock section, turn it on and your card has been temporarily locked.

Here are a few Internet Banking applications

- Download Vietinbank iPay for iOS

- Download Vietinbank iPay for Android

- Download F @ st Mobile for iOS

- Download F @ st Mobile for Android

- Download Vietcombank for iOS

- Download Vietcombank for Android

- Download Maritime mBanking for iOS

Causes of card information disclosure

There are many reasons for the disclosure of card information, as I mentioned in the first part, there are many types of scams that make users fill in the information on a certain form related to winning. So the crook will take advantage of the information gained to appropriate the money in the account.

Secondly, users often use magnetic cards, cards that have black tape on the back. This card has lower security than the EMV chip card (the card has a small piece of copper like the SIM card). Usually this EMV chip card is available on VISA, Mastercard international payment cards.

You should use this card with your own bank account to ensure a safer level, but the disadvantage of this card is that when payment via POS will not use a PIN. So if anyone can pick up your card, they can pay online without a password, you should keep this card carefully.

ATM tree is also a place where crooks often get card information from there, surely you also know that they often install devices to get card information on ATM trees such as installing fake keyboards, inserting card slots and getting PIN codes. and the card number from there. So when you go to withdraw money from an ATM, be aware of the difference between the keyboard and the slot. Another advice is that you should use an ATM card to pay instead of using a card to withdraw money.

These are the ways that you can protect your bank card information, in addition to the Mobile Banking or Internet Banking applications, users can also pay via online payment support applications such as Zalo Pay.

Especially payment via QR code, you just need to link your bank account to that application to use the payment feature to scan QR codes. See more articles How to link bank cards with ZaloPay to transfer / receive money with QR codes to know how to pay with QR codes.

See more:

- Is the ATM card locked, withdraw money, transfer money?

- The necessary procedures when going to Vietcombank ATM card, Agribank, Techcombank, Vietinbank, BIDV

- Will losing ATM card be lost, how should it be handled?