Withdraw money at Techcombank ATM without card

In order to give customers the opportunity to experience convenient and modern card services products. Some banks such as Techcombank already have very good features that allow users to withdraw money without a card, receive money sent without an account. This feature is quite new and convenient to rescue you in case of forgetting the card at home.

In order to withdraw money at an ATM without using a card, users need to have a transaction code, transaction amount, OTP code and you only need any Techcombank tree to execute the transaction. How to do it is quite simple and free, in the article below Network administrator will guide you to read this tricks tricks.

The main benefit of ATM withdrawals without a card:

- You can withdraw money without having to bring an ATM card, and if you forget the card and need money quickly, you can still withdraw it to use it without having to borrow or try to get it.

- The beneficiary does not need to have a bank account and can still receive money from the sender, only need the transaction code to enter when withdrawing money at ATM.

- While the status of stealing ATM information because ATMs are attached to increasingly complex tracking devices, it is safer for cardholders to withdraw money without an ATM card because there is no need to insert the card into an ATM tree. avoid disclosing card information and always worry about losing money.

1. Create cash withdrawal transactions without a card

Step 1:

Download and install Techcombank application for your phone.

- Download Internet Banking immediately for Android

- Download Internet Banking immediately for iOS

Step 2:

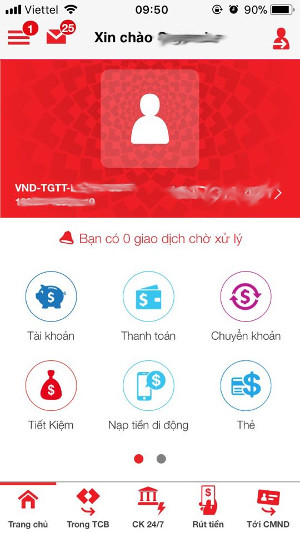

Run the application and log in to your account if you have one. In case you do not have an account, you can see the registration instructions in the online tutorial on Internet Banking Techcombank registration

Step 3:

On the application interface, click the Withdrawal command at the bottom menu.

Step 4:

Now you just need to enter the amount in VND and click Done.

Step 5:

Now the system will come back as Step 4 again so you can check the information you entered to make sure you have entered the correct information, now click on the Make to start the withdrawal transaction.

Step 6:

Re-enter the password of the card and OTP code sent to the phone, press Confirm.

Step 7:

You will receive the Transaction Code and the amount. You need to save this Transaction Code and Amount to enter correctly at Techcombank ATM.

2. Withdrawal directly from Techcombank ATM

In addition to the above, you can also make transactions directly on ATMs without using phones and cards.

Proceed as follows:

Step 1:

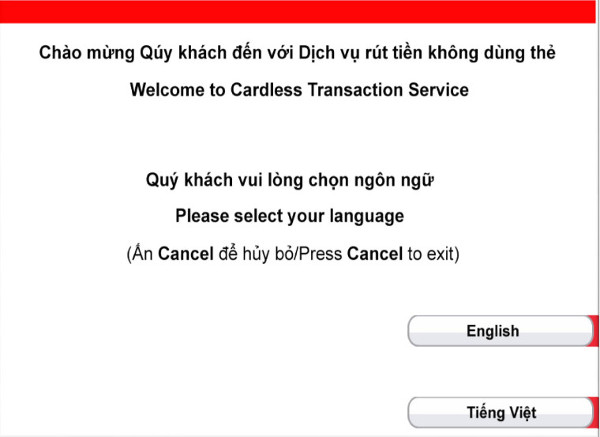

On the ATM, press the Enter button. Choose English or Vietnamese language. In the article I guide Vietnamese.

Step 2:

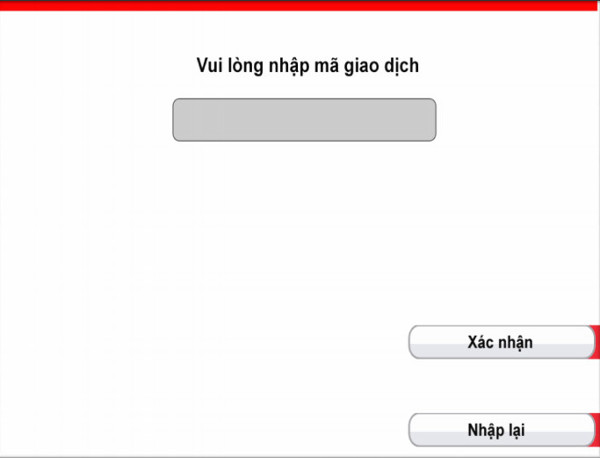

You get the transaction code, which is in step 7 in the above article, which we guide, then enter the ATM and press Enter.

Step 3:

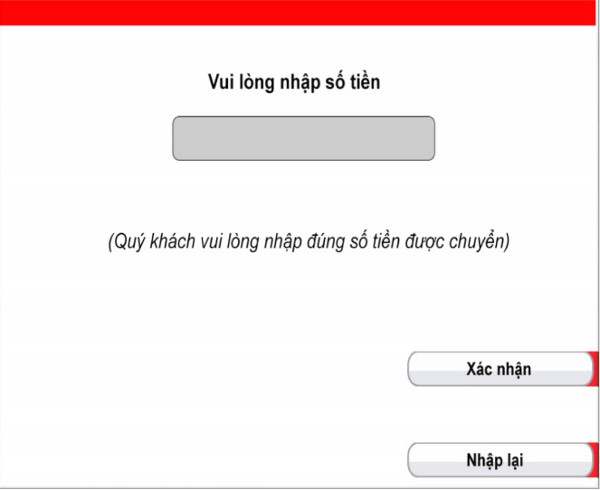

Enter the amount you want to withdraw and press Enter again.

Step 4:

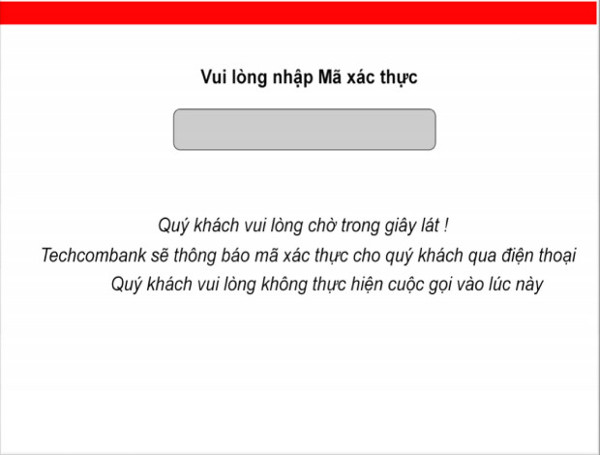

An OTP code will be transferred to the phone number, you need to enter this OTP code then press Confirm. The unique point is that this OTP code input interface has a black background, and the text is also black (make sure others don't see it), so when you enter it you think you don't click eat. Experience is that you just type in the correct OTP digits and press Confirm. If there is a mistake, do it again from the beginning.

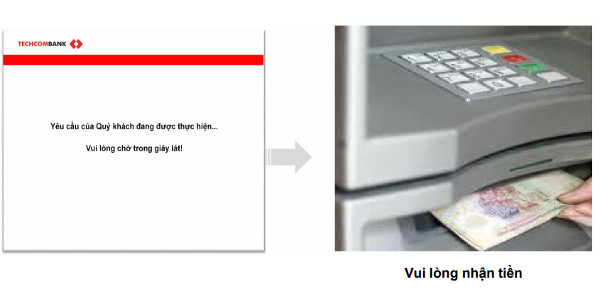

Step 5:

The last step Techcombank asked if you printed the bill or not. You choose the print option or not and Enter. That's it, wait for money to be pushed out.

So in case you transfer money and others withdraw at ATM, in step 4 you need to send OTP code for that person to withdraw money.

A few notes:

- The transfer code is valid for three days.

In case the ATM does not have enough money to withdraw or face value of money in the machine does not allow to withdraw enough money, you should re-withdraw the cash transaction at another ATM of Techcombank (the money transfer code remains unchanged). - In case you make a mistake more than 3 times (money transfer code, amount), the transfer amount will be blocked and automatically refunded the account after three working days.

Hopefully, this guide will help you withdraw money anywhere, even if you forget to bring your card.

In addition, Techcombank is also the first bank to allow Internet Banking registration at home, you only need a computer connected to the network without having to go to the bank. With Internet Banking you can shop, transfer money, load phone cards on the network a lot easier, try it.

Hope you are succesful.

See more:

- How to calculate bank loan interest rates in May

- Which is the lowest fee for internet banking and ATM withdrawal among banks: Vietcombank, BIDV, Vietinbank, Techcombank, VPBank?

- Basic banking services: accounts, cards, account numbers