What is ViettelPay?

The concept of e-wallets is no stranger to people in society today, as more and more types of e-wallets appear and ViettelPay is one of them. ViettelPay, developed by Viettel, offers users a lot of useful features in making payments and recharging with various content. And like other electronic wallets, ViettelPay brings convenience for users when you implement all interfaces on the phone, saving you time compared to before. So how to register ViettelPay and how to use ViettelPay, also read the following article of the Network Administration to have basic information about ViettelPay.

1. Functions of ViettelPay e-wallet

ViettelPay is a mobile online payment service of Viettel, so all payment services such as electricity, water, buying air tickets, buying online, buying phone cards can be done on this service. . Currently, ViettelPay has linked with 32 domestic banks such as MBBank, BIDV, ACB, Bac A Bank . ViettelPay application has some main applications including:

- Support for money transfer in 2-4 hours in 63 provinces.

- Transfer money by phone number, account number, via ATM over 40 domestic banks.

- Pay your electricity, water and telephone bills automatically.

- Buy train tickets, airline tickets, hotel reservations, travel, game cards, app purchases, .

- Buy goods online, pay for finance, insurance, education.

2. Instructions for using ViettelPay

To use ViettelPay, first of all we need to create a ViettelPay account. All details on how to register and use ViettelPay How to use Viettel Pay on your phone. In addition, readers can also refer to some articles using ViettelPay below.

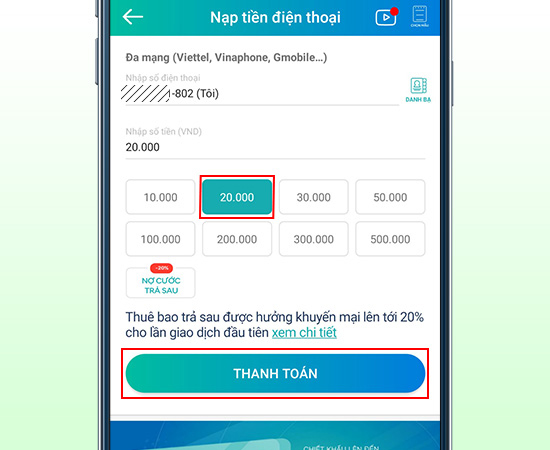

- Ways to top up on ViettelPay

- How to upgrade ViettelPay package

- How to login with fingerprint on ViettelPay

- How to retrieve and change your ViettelPay account password

3. Transaction fees on ViettelPay

Transaction fee for cash withdrawal, deposit, and transfer on ViettelPay

Name of service Fee applied Cash deposit Free of charge for the first 02 transactions / month. From the 3rd transaction, there is a fee for cash deposit service. Deposit from domestic ATM card Free Withdrawal Free First 2 Gnd / month From the 3rd transaction, cash withdrawal service fee is applied. Transfer money between ViettelPay accounts Free Transfer money to accounts outside ViettelPay FreePlans and transaction levels

Each ViettelPay account package is provided with different transaction limits. When you have just registered the default ViettelPay account, you will use Package 1 with the limit as below.

Package 1:

- A basic service package for beginners who register on the phone and have not updated personal information (ID, address, .).

- Basic utilities of the package: pay for service fee, buy scratch card, .; Do not allow customers to transfer money. To use more utilities, you can upgrade to 3.

- Minimum limit: VND 10,000 / transaction.

- Maximum limit: 5,000,000 VND / transaction.

- Maximum limit / day: 5,000,000 VND / day

Package 3:

- A package for customers who have registered information at Viettel transaction points, allowing subscribers to pay service fees, buy scratch cards, transfer money, pay QR Code .

- Minimum limit: VND 10,000 / transaction.

- Maximum limit: VND 20,000,000 / transaction.

- Maximum limit / day: VND 50,000,000 / day.

Pack 2 has now stopped serving. To switch from package 1 to package 3, you bring your ID card / passport / ID card to the nearest Viettel transaction office to upgrade the package completely free of charge.

See more:

- What is AirPay? Which bank does AirPay link to?

- What is MoMo wallet?

- How to activate VinID wallet and recharge Vin Vin wallet

- How to register for VTC Pay e-wallet

Hope this article was helpful to you!