How to Pay Independent Contractors in Quickbooks

Method 1 of 1:

Pay an Independent Contractor in Quickbooks

-

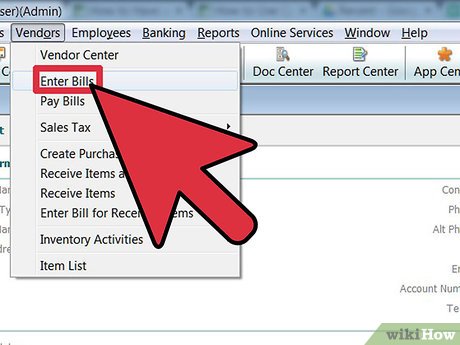

Create a bill to represent the work done by the independent contractor for your business.

Create a bill to represent the work done by the independent contractor for your business.- Point to the "Vendors" menu and select "Enter Bills."

- Select the name of your independent contractor from the drop-down box next to the "Vendor" field.

- Enter the amount of money you owe the independent contractor in the field for "Amount Due."

- Enter the independent contractor's information in the optional fields for reference number, terms, and memo, if applicable.

- Click on the "Expenses" tab and choose your independent contractor's expense account from the drop-down list next to the "Account" field.

- Click on "Save" to finish creating the bill.

-

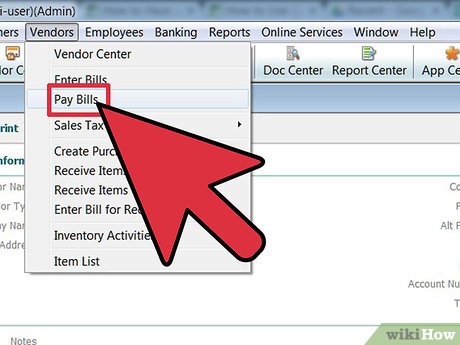

Pay the independent contractor's bill.

Pay the independent contractor's bill.- Click on the "Pay Bills" option from the "Vendors" menu in your session.

- Select the bill that needs to be paid and choose your desired payment method from the drop-down menu next to the "Payment Method" field. A variety of payment methods are available; including check, credit card, cash, debit card, PayPal, and other online payment methods.

- Select the business account from which you want to pay your independent contractor from the "Payment Account" field.

- Click on the button for "Pay Selected Bills" to successfully complete the payment process.

Share by

Isabella Humphrey

Update 05 March 2020