SYD function - Calculate depreciation for an asset by remaining value in Excel

The following article details the syntax and usage of the SYD function to help you understand and use it properly in all cases.

Description: The function performs depreciation of assets according to the remaining time in the specified period.

Syntax : = SYD (cost, salvage, life, per) .

Inside:

- cost : The initial value of the property, required parameters.

- salvage : The depreciation value of the property, also called the recovery value of the property.

- life : Term of the property, required parameters.

- per : The number of depreciation periods, mandatory in the same unit as the asset's maturity, is the required parameter.

Attention:

- Depreciation formula:

For example:

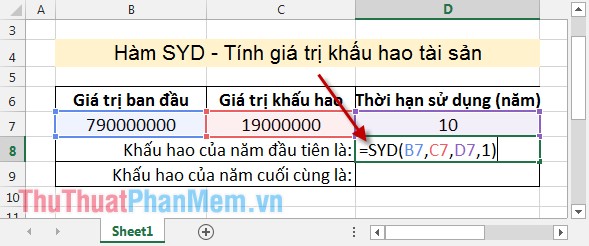

With investment properties have the following parameters. Calculate the depreciation for the first year, the depreciation for the last year.

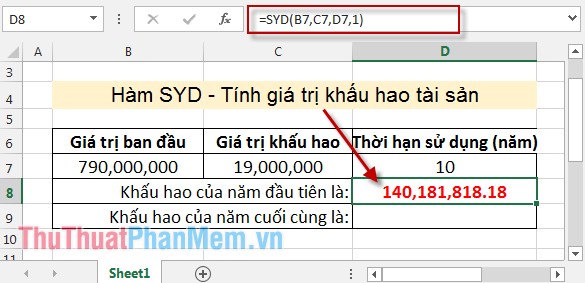

In the cell to calculate enter the formula: = SYD (B7, C7, D7,1) .

Pressing Enter results as:

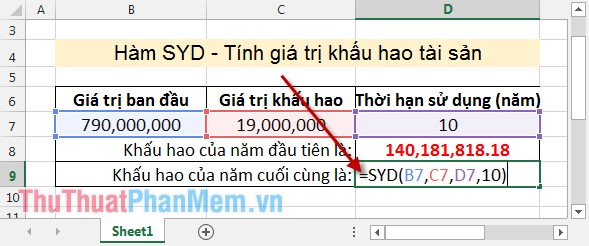

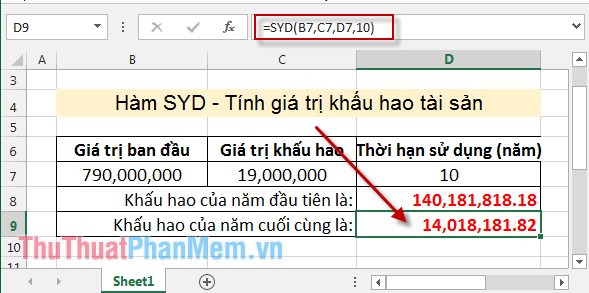

The depreciation for the last year -> the depreciation period is 10.

Press Enter the depreciation value of the property after 10 years:

Above are the uses and cases of the SYD function .

Good luck!

You should read it

- ★ SLN function - Returns the depreciation value of an asset using the straight-line method in Excel

- ★ How to use the SUM function to calculate totals in Excel

- ★ AMORDEGRC function - The function returns the depreciation for each accounting period in Excel

- ★ DB function - The function calculates the depreciation of assets with specific maturity in Excel

- ★ How to use the kernel function (PRODUCT function) in Excel