TBILLEQ function - Calculates the returns corresponding to bonds in treasury in Excel

The following article details the meaning and usage of TBILLEQ function - Calculate the profit corresponding to bonds in the treasury.

Description: The function calculates the returns corresponding to bonds in the treasury.

Syntax : = TBILLEQ (settlement, maturity, discount) .

Inside:

- settlement : The settlement date of the securities is the date after the issue date of securities to be sold to buyers, which is a required parameter.

- maturity : The maturity or maturity date of a security, which is a mandatory parameter.

- discount : Discount rate of the stock.

Attention:

- TBILLEQ function () performs calculations according to the following formula:

- Use the Date function (year, month, day) when entering date values.

- If and invalid function returns error value #VALUE!

- If discount ≤ 0 -> the function returns the #VALUE! Error value

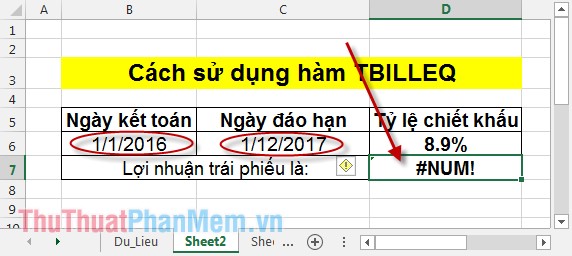

- If settlement> maturity or settlement - maturity> 12 months -> the function returns the #NUM! Error value

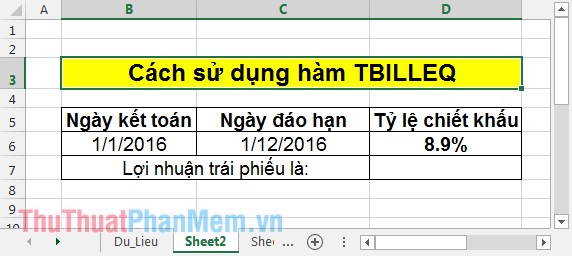

For example:

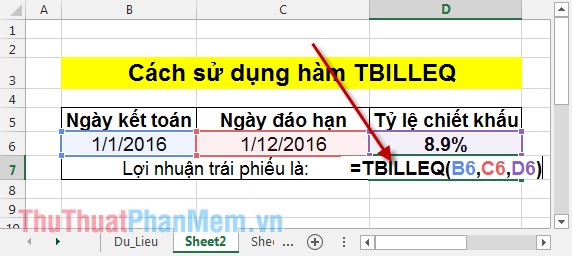

Calculate the profit of the bond knowing the settlement date is 1/1/2016, the maturity date is 1/12/2016 and the discount rate is 8.9%.

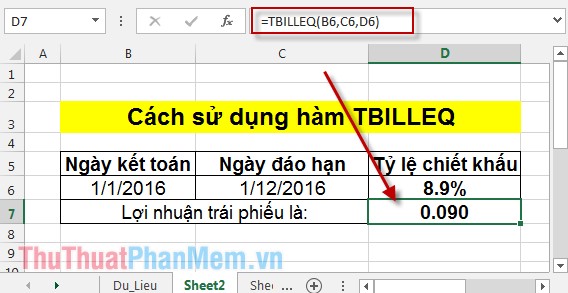

In the cell to calculate the bond yield enter the formula: = TBILLEQ (B6, C6, D6) .

Press Enter -> Bond yield with a discount rate of 8.9% is:

If you enter the due date greater than 1 year from the settlement date -> the function returns the #NUM! Error value.

The above is a usage and some special cases of TBILLEQ function hope to help you.

Good luck!

You should read it

- ★ FREQUENCY function - Function that calculates and returns the frequency of occurrences of values in a range in Excel

- ★ TRIMMEAN function - The function returns the average of the inner part of a dataset in Excel

- ★ CHISQ.TEST function - The function returns the independence test in Excel

- ★ How to use the IF function in Excel

- ★ How to use the DAVERAGE function in Excel