DDB function - Calculate depreciation of assets in Excel

Before investing in any field, anyone has to calculate very carefully. The depreciation of properties during use is equally important. The following article introduces the DDB Function - The depreciation of assets in Excel.

Description: The function returns the depreciation value of the asset in the specified period, which can be used by the method of double descending balance or other method proposed by yourself.

Syntax: DDB (cost, salvage, life, period, [factor]) .

Inside:

- cost : The initial cost of the property, is a required parameter.

- salvage : The recovery value of assets after the investment process, also known as the depreciation value, required parameters, this parameter value can be zero.

- life : Number of periods of depreciation, or useful life of assets, is a required parameter.

- period : The number of periods you want to calculate the depreciation, is a required parameter and has the same unit as the life of the asset.

- factor: The declining rate of the balance, if omitted has value = 2 in the declining dual balance method, is an arbitrary parameter.

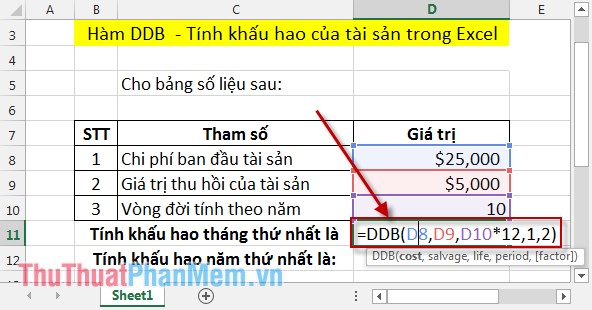

For example: Give the table of data for depreciation in the first month, the first year and the depreciation for the 2nd year with a decreasing rate of 2.5.

In the cell to calculate depreciation enter the following formula: DDB (D8, D9, D10 * 12,1,2) .

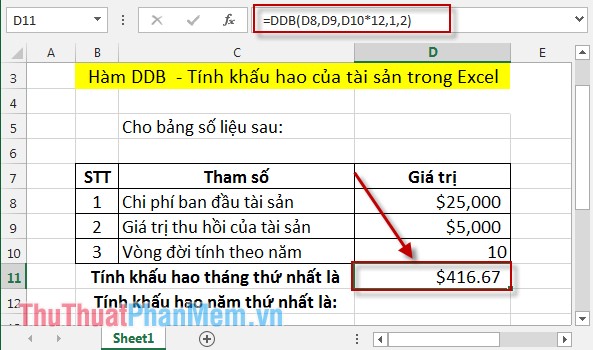

Result:

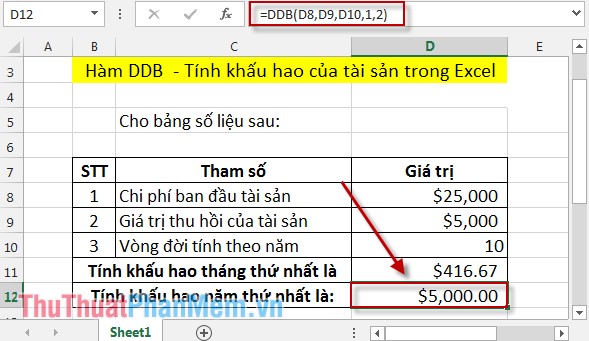

- Calculating depreciation in the first year:

In the cell to calculate the depreciation value, enter the formula: DDB (D8, D9, D10,1,2) .

Result:

- Calculating depreciation for the 2nd year with factor = 2.5:

In the cell to calculate enter the formula: DDB (D8, D9, D10,2,1.5) .

Result:

You observe the depreciation in the 1st year> depreciation in the 2nd year because the value of factor = 1.5

Above is how to use DDB function in each year. Hope to help you. Good luck!

You should read it

- ★ DB function - The function calculates the depreciation of assets with specific maturity in Excel

- ★ SLN function - Returns the depreciation value of an asset using the straight-line method in Excel

- ★ How to use the SUM function to calculate totals in Excel

- ★ AMORDEGRC function - The function returns the depreciation for each accounting period in Excel

- ★ How to use the kernel function (PRODUCT function) in Excel