DB function - The function calculates the depreciation of assets with specific maturity in Excel

In the process of using and investing in technical equipment, you must consider the cost and calculate the cost of depreciation of assets when in use. The following article details the DB function - The function of depreciation of assets with specific maturity with the use of the method of calculating the declining balance by fixed level.

Description: The function of calculating depreciation of assets with specific maturity using the method of calculating the declining balance by fixed level.

Syntax: DB (cost, salvage, life, period, [month]) .

Inside:

- cost : The initial cost of the property, required parameters.

- salvage : The recovery value of the property or the depreciation value of the asset, is a required parameter.

- Life : The number of depreciation periods of the property, also known as the useful life of the property, is the required parameter.

- Period : The period you want to calculate the depreciation, is a mandatory parameter and must have the same life unit.

- Month : Number of months counted in the first year, is an optional parameter if omitted the default value is 12.

Attention:

- In the first and last DB function, use a special formula different from other periods:

+ The first period is calculated by the formula: DB = cost * rate * month / 12.

+ The last period is calculated by the formula: DB = (cost - total depreciation of previous periods) * rate * (12-month)) / 12.

For example:

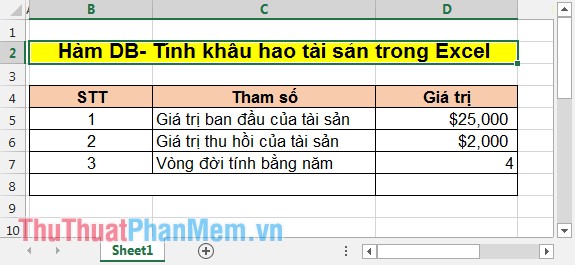

With the following data table:

Calculate:

- Calculating depreciation of assets in the first year.

- Calculating depreciation of assets in the second year.

- Calculating depreciation of assets in the fifth year, for 6 months.

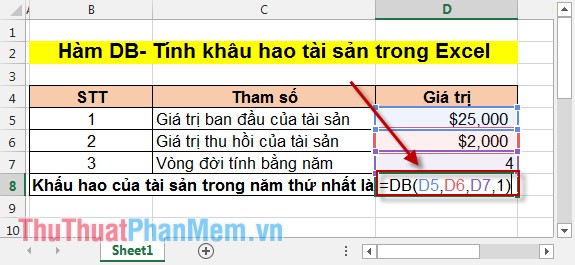

- Calculating depreciation of assets in the first year.

In the cell to calculate enter the formula: = DB (D5, D6, D7,1) .

Result:

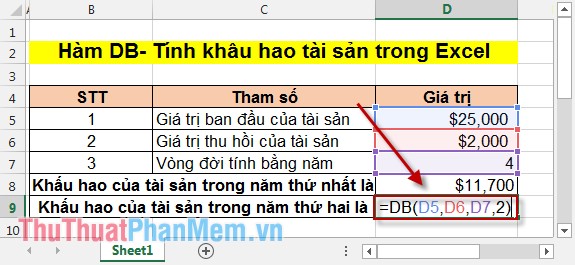

- Calculating depreciation of assets in the second year.

In the cell to calculate enter the formula: = DB (D5, D6, D7,2) .

Result:

- Calculating depreciation of assets in the 5th year, for 6 months.

In the cell to calculate enter the formula: = DB (D5, D6, D7,5,6) .

Result:

Through 3 values over the years, the depreciation value of assets has decreased over the years. Hope to help you identify and take reasonable measures when using the property.

Good luck!

You should read it

- ★ VDB function - Calculate asset depreciation by the declining balance method in Excel

- ★ SLN function - Returns the depreciation value of an asset using the straight-line method in Excel

- ★ AMORDEGRC function - The function returns the depreciation for each accounting period in Excel

- ★ Coupdays function - Calculates the number of days in a coupon period and contains the settlement date in Excel

- ★ How to use the DAVERAGE function in Excel