SLN function - Returns the depreciation value of an asset using the straight-line method in Excel

The following article details the syntax and usage of SLN in excel.

Description: Returns the depreciation of assets according to the straight-line method over a given period.

Syntax: SLN (cost, salvage, life) .

Inside:

- cost : The initial cost of the property, is a required parameter.

- salvage : Value after depreciation, also called the value of product recall, is a mandatory parameter.

- life : Number of periods of depreciation, also known as useful life of assets, is a required parameter.

Attention:

- SLN function is calculated by the formula:

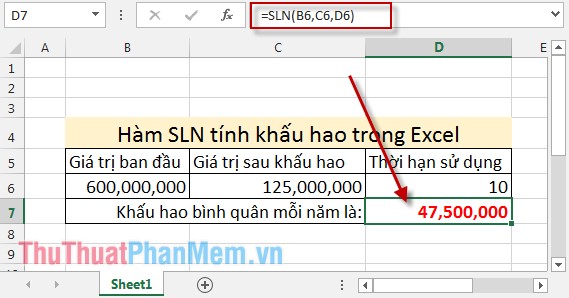

For example: Calculating the annual average depreciation for an asset with initial value of 600,000,000 and the remaining value after depreciation is 125,000,000 and the asset has a shelf life of 10 years.

In the cell to calculate enter the formula: = SLN (B7, C7, D7) .

Press Enter -> the average depreciation per year of the property over a 10 year period is:

The above is a detailed guide of usage and specific example of SLN function. Hope to help you in the case of depreciation calculation.

Good luck!

You should read it

- ★ DDB function - Calculate depreciation of assets in Excel

- ★ AMORDEGRC function - The function returns the depreciation for each accounting period in Excel

- ★ LINEST function - The function returns a line description array using the least square method in Excel

- ★ DB function - The function calculates the depreciation of assets with specific maturity in Excel

- ★ SLOPE function - The function returns the slope of a linear regression line through data points in Excel