TBILLPRICE function - The function calculates the value of treasury bonds by the $ 100 face value in Excel

The following article details the meaning and usage of the TBILLPRICE function - The function of calculating the value of treasury bonds at $ 100 face value in excel.

Description: The function calculates a value based on the $ 100 face value for treasury bonds.

Syntax : = TBILLPRICE (settlement, maturity, discount) .

Inside:

- settlement : The settlement date for securities is the date after the issuance date of bonds to be sold to buyers.

- maturity : The maturity date or the maturity date of the bond.

- discount : The discount rate or the rate of return on bonds.

Attention:

- Functions that perform calculations based on formulas:

In which: DSM is the number of days from the settlement to the expiry date.

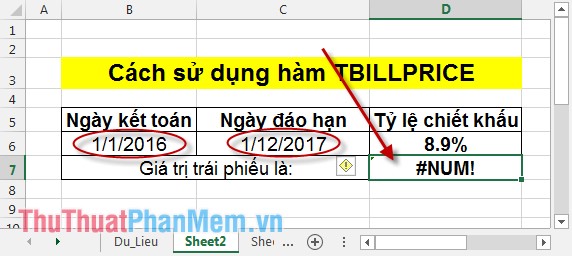

- If maturity > discount or discount - maturity > 12 months -> the function returns the error value NUM!

- Where maturity and discount are not valid dates -> the function returns the value #VALUE.

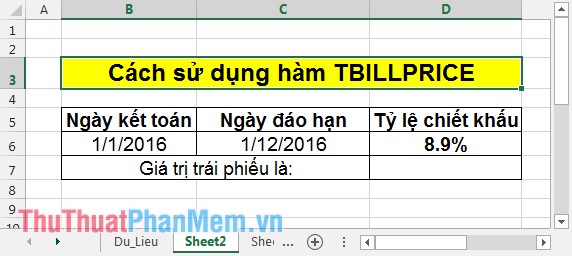

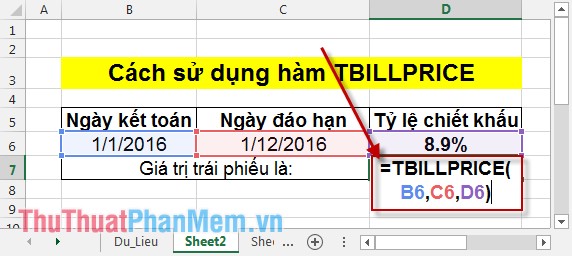

For example:

Calculating the value of bonds with settlement date is 1/1/2016, maturity date is 1/12/2016 and discount rate is 8.9%.

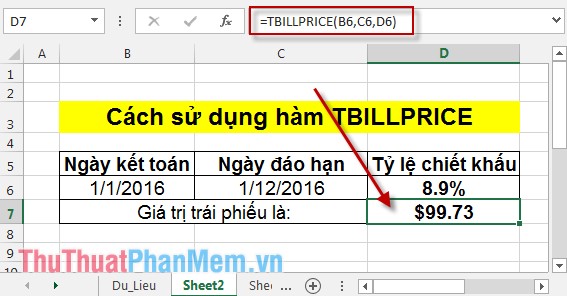

In the cell where the value to enter the formula to calculate: = TBILLPRICE (B6, C6, D6) .

Press Enter -> value of the bond based on face value of $ 100 with an 8.9% discount rate is:

If you enter due date - settlement date> 12 months, the function returns the #NUM error value .

Above is the usage and some notes when using the TBILLPRICE function .

Good luck!