TBILLYIELD function - The function calculates the discount rate for a bond in treasury in Excel

The following article details the meaning and specific examples of how to use the TBILLYIELD function - The function of calculating the discount rate for a bond in the treasury.

Description: The function calculates the discount rate, or the rate of return on bonds in the treasury.

Syntax : = TBILLYIELD (settlement, maturity, pr) .

Inside:

- settlement : The settlement date of a security, the date after the issue date of the securities sold to the buyer, is the required parameter.

- maturity : The maturity or expiry date of a security.

- pr : Value of securities based on face value of $ 100.

Attention:

- Functions that perform calculations based on formulas:

- In case settlement , maturity is invalid, the function returns the #NUM! Error value.

- If pr function returns the #NUM! Error value

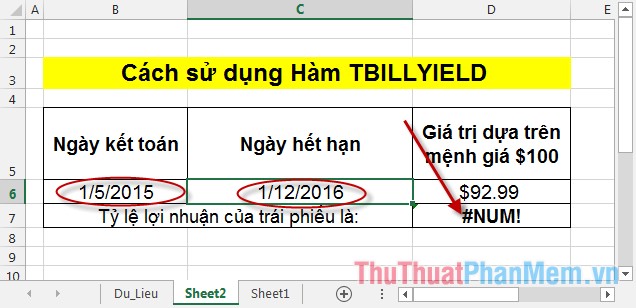

- If settlement > maturity or maturity - settlement > 12 months later => the function returns the #NUM! Error value

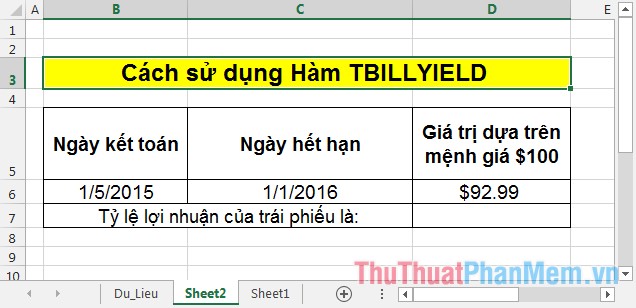

For example:

Calculate the rate of return of a treasury bond with the settlement date of May 1, 2015, the maturity date is 1/1/2016 based on the $ 100 face value of $ 92.99.

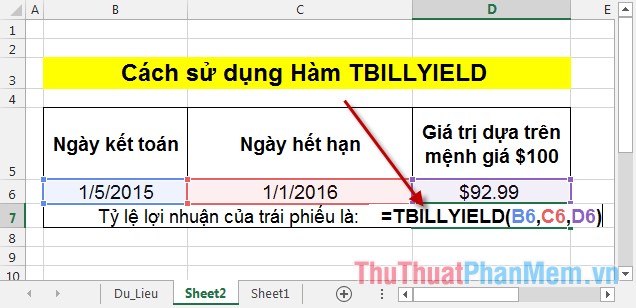

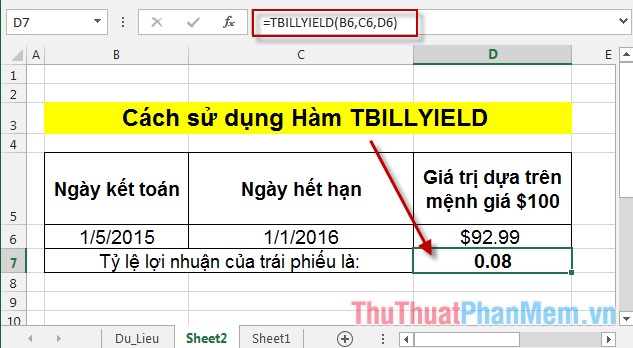

In the cell to calculate the rate of profit enter the formula: = TBILLYIELD (B6, C6, D6) .

Press Enter -> The rate of return for the bond with face value of $ 92.98 is:

If the expiration date minus the settlement date has a month number greater than 1 year -> the function returns the #NUM! Error value

Above is the usage and special cases of TBILLYIELD function hope to help you.

Good luck!