VDB function - Calculate asset depreciation by the declining balance method in Excel

The following article details the meaning and usage of the VDB function - Calculating depreciation of fixed assets in excel.

Description: The function calculates the depreciation for an asset for multiple specified periods, the calculation function is based on the double-declining balance method.

Syntax : VDB (cost, salvage, life, start_period, end_period, [factor], [no_switch]) .

Inside:

- cost : The initial cost of the property, is a fixed parameter.

- salvage : The recovery value of an asset is the value after depreciation of the asset, a required parameter.

- life : Number of depreciation periods of the asset, which is a required parameter.

- start_period : The first period to calculate the depreciation of assets, is a required parameter.

- end_period : The last period you want to calculate depreciation, which is a required parameter.

- factor : The descending ratio of the balance, is an optional parameter, if omitted, the default is 2.

- no_switch : The logical value used to determine if the depreciation amount greater than the reduction of the balance will switch to the straight-line depreciation method.

+ Case no_switch = True : Do not switch to the straight-line method of depreciation even if the value of depreciation is larger than the declining balance.

+ Where no_switch = False or omitted : Carrying over to the depreciation method according to the straight line when the depreciation value is larger than the declining balance.

Attention:

- In case you do not want to use the double-declining balance method when calculating depreciation -> change the Factor value .

- All parameters (other than no_switch ) must be positive.

For example:

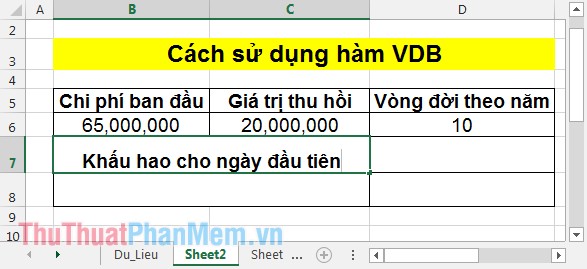

Calculate the depreciation of assets for each period of time when the purchased assets are valued at VND 65,000,000, the recovered value at the expiry is VND 20,000,000, the expiry date is 10 years and used in many periods.

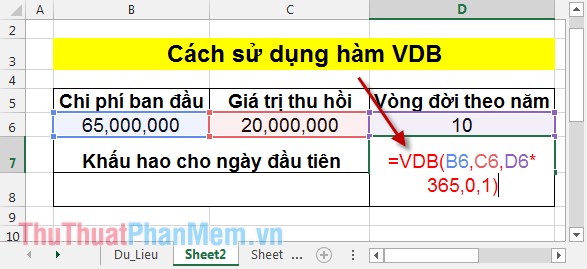

1. Depreciation on the first day

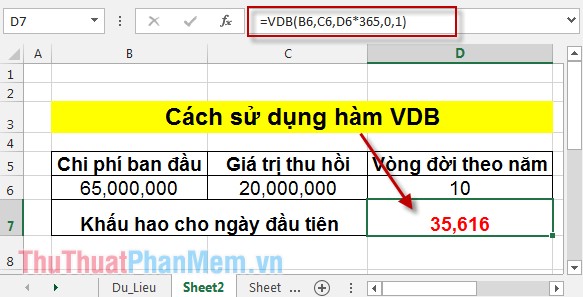

- Due to daily depreciation, life cycle value in day units => enter the formula: = VDB (B6, C6, D6 * 365,0,1) .

Press Enter -> the value of depreciation in the first day is:

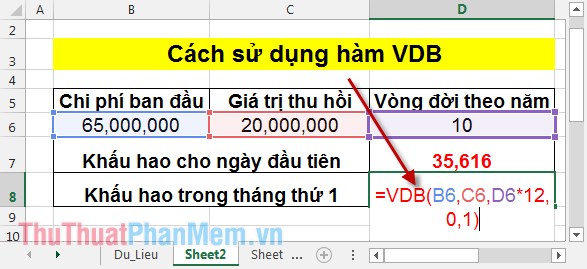

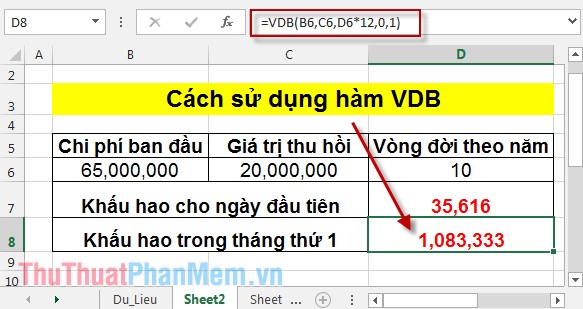

2. Depreciation in the first month

- Because of the monthly depreciation, the life cycle must be calculated by month -> enter the formula: = VDB (B6, C6, D6 * 12,0,1) .

Press Enter -> the depreciation value in the first month is:

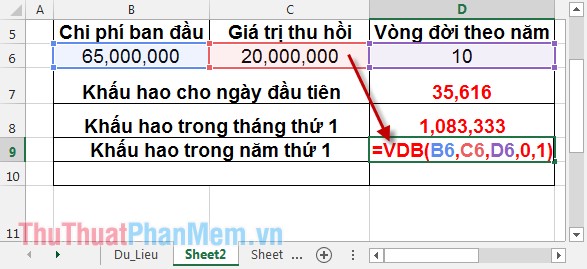

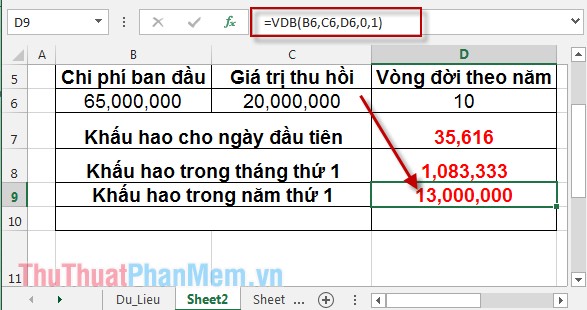

3. Depreciation in the first year

In the cell to calculate enter the formula: = VDB (B6, C6, D6,0,1) .

Press Enter -> the depreciation value in the first year is:

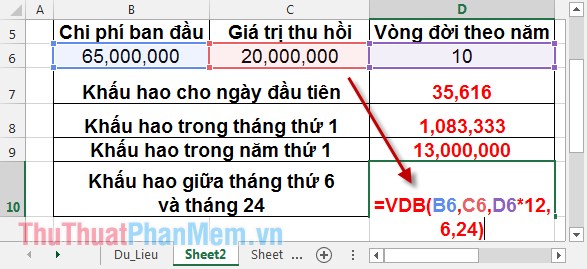

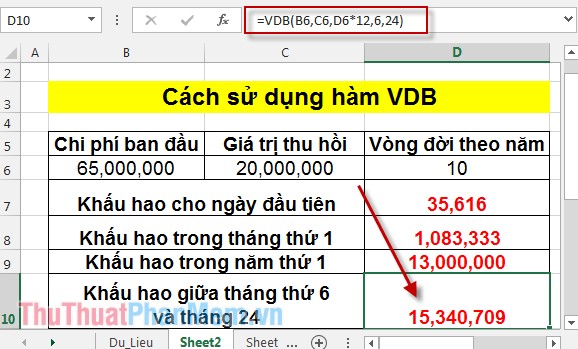

4. Depreciation for the sixth month to the 8th month using the double declining balance method

Because of the depreciation between months, the life cycle is calculated by month -> in the cell to be calculated, enter the formula: = VDB (B6, C6, D6 * 12,6,24) .

Press Enter -> the depreciation value from June to May 24 is:

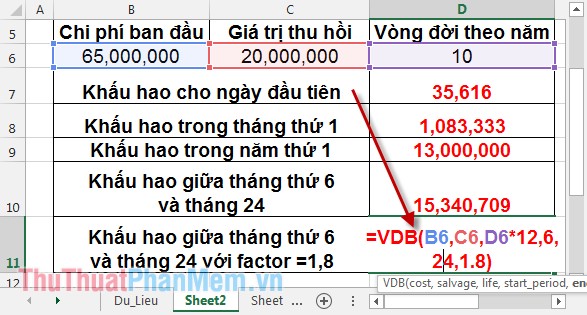

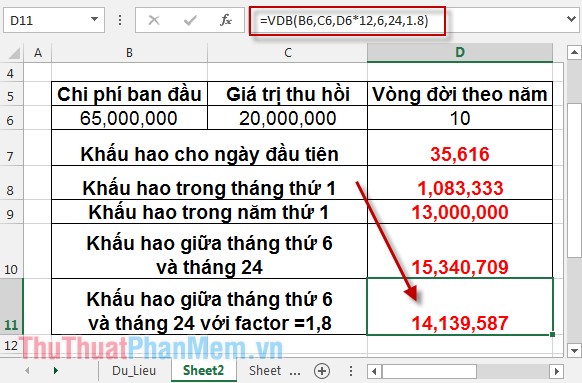

5. Depreciation 6 months to 24 months using the straight-line method with factory = 1.8

Similarly the above in the cell to enter the formula: = VDB (B6, C6, D6 * 12,6,24,1.8) .

Press Enter -> the value of depreciation from June to May 24 using the straight-line method with factor = 1.8 is:

Thus, the two straight-line method and the double-decreasing balance have completely different results.

The above is the meaning and cases of calculations in the VDB function hope to help you.

Good luck!

You should read it

- ★ SLN function - Returns the depreciation value of an asset using the straight-line method in Excel

- ★ DB function - The function calculates the depreciation of assets with specific maturity in Excel

- ★ How to use the SUM function to calculate totals in Excel

- ★ AMORDEGRC function - The function returns the depreciation for each accounting period in Excel

- ★ How to use the kernel function (PRODUCT function) in Excel