Compare ODDFPRICE and ODDLPRICE functions in Excel

In the process of securities investment, no one can ignore the value of bonds of securities. The following article guides 2 ways of calculating bond values by comparing ODD ODDFPRICE and ODDLPRICE functions in Excel.

1. Comparison of meanings

- Same:

+ Both functions are functions in the statistical function group.

+ They return the price per 100USD face value of the stock.

- Different:

+ ODDFPRICE function : Returns the price per $ 100 face value of a stock with an odd first cycle.

+ ODDLPRICE function : Different from ODDFPRICE, returned at the odd end of the cycle. ODDLPRICE returns the price per $ 100 face value of a stock with an odd last period.

2. Comparison of syntax

- ODDFPRICE (settlement, maturity, issue, first_coupon ,, rate, yld, redemption, frequency, basis) .

- ODDLPRICE (settlement, maturity, last_interest, rate, yld, redemption, frequency, basis) .

Through the syntax above 2 functions found:

- Same:

+ The number of parameters and the same parameters: settlement, maturity, rate, yld, redemption, frequency, basis.

+ The same parameters have the same value or meaning.

- Difference : Two different functions in the third argument:

+ Ham ODDFPRICE the third parameter is first_coupon - is the first coupon date of the stock.

+ ODDLPRICE function the third parameter is last_interest- is the last coupon date of the stock.

So the syntax for both functions is only different in the third parameter, one function is to calculate the first coupon date and the other to calculate the last coupon date of the stock.

Note: Calculation formula of ODDFPRICE function.

3. Compare function values through specific examples

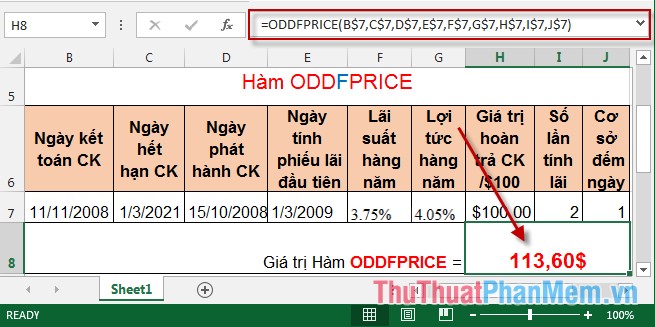

For example: Calculate the value of a bond with a redemption value (based on $ 100) and calculate the first interest period as odd.

With the following data table:

Because the bond has the first interest period is odd, the last period is also odd.

Thus, the value of bonds is determined at two different times. The first time is the first odd coupon period, the second time is the last coupon period.

- Calculate the value of bonds in the first interest period .

Because the value is calculated in the first coupon period, the ODDFPRICE function should be used . In the cell to calculate, enter the formula: = ODDFPRICE (B $ 7, C $ 7, D $ 7, E $ 7, F $ 7, G $ 7, H $ 7, I $ 7, J $ 7) press Enter to get the result:

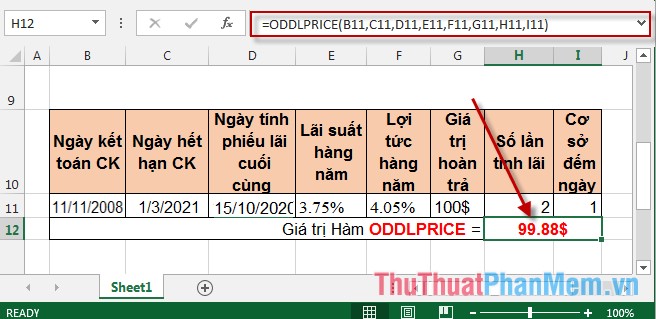

- Calculate the value of bonds in the last interest period .

Because of the final period value, use the ODDLPRICE function . In the cell to calculate enter the formula: = ODDLPRICE (B11, C11, D11, E11, F11, G11, H11, I11) .

Above are the similarities and differences between ODDFPRICE and ODDLPRICE functions .

Good luck!