NPER function - The function calculates the period number of an investment in Excel

Usually, the interest rate for securities is usually calculated by period. So if you are a stock player, please know this calculation offline to be able to actively calculate the interest received. The following article shows how to use the NPER function to calculate the number of periods for an investment.

Description: The function is used to calculate the number of periods for an investment with a given security based on equal payments and a constant interest rate.

Syntax: NPER (rate, pmt, pv, [fv], [type]) .

Inside:

- rate: Interest rate of securities according to maturity, required parameters.

- pmt: Payments for each period, required parameters. Typically pmt contains principal and interest.

- pv: Current value or one-off payment amount corresponding to future payments, it is a required parameter.

- fv: Future value or your desired balance after the final payment is made, this parameter is not required, if omitted the default is 0.

- type: Determine the payment time, there are 2 values: 0 => final payment and 1 => payment at the beginning of the period.

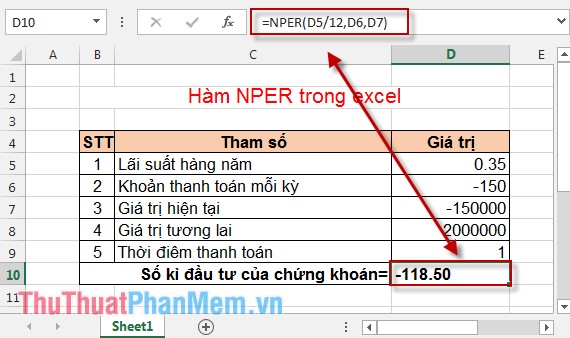

Example: Give the following data table.

- Calculate the number of periods of the investment.

- Calculate the number of periods of the investment minus initial payments.

- Calculate the number of periods of the first paragraph unless the future value is 0.

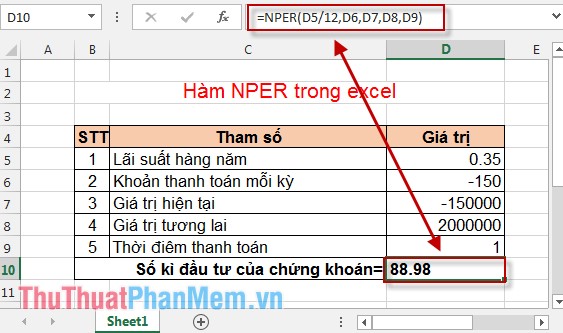

1. Calculate the number of periods of the investment

- In the cell to calculate enter the following formula: = NPER (D5 / 12, D6, D7, D8, D9) .

- Results:

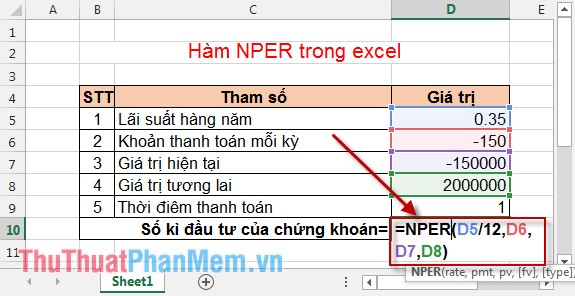

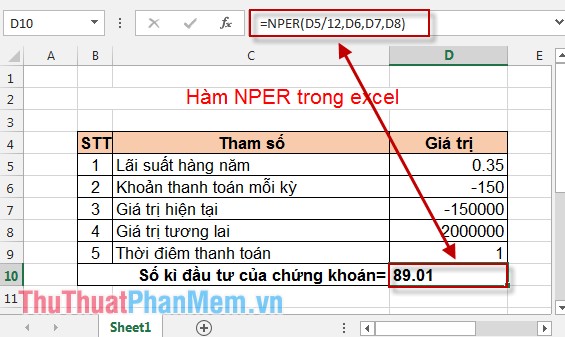

2. Calculate the number of periods of the investment minus the initial payments

- In the cell to calculate, enter the formula: NPER (D5 / 12, D6, D7, D8) implies the final payment.

- Results:

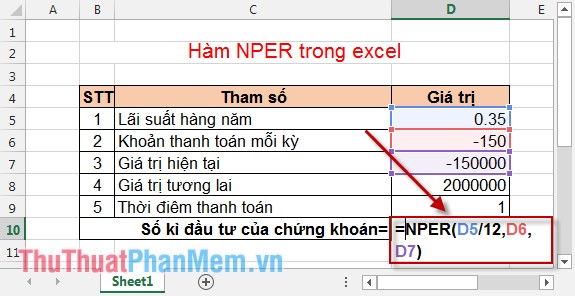

3. Calculate the number of periods in the first clause unless the future value is 0

- In the cell to calculate enter the following formula: = NPER (D5 / 12, D6, D7) .

- Results:

The result of comparing 3 cases if the payment at the end of the period is higher than that at the beginning of the period, the case of the future value equal to 0, the number of periods is too small to be negative.

Hopefully with the above article you will have the best choice.

Good luck!

You should read it

- ★ DATEDIF function - The function calculates the number of days, months, years between 2 dates in Excel

- ★ FVSCHEDULE function - Returns the future value of an investment that has variable or adjustable interest in period in Excel

- ★ How to use the DAVERAGE function in Excel

- ★ ISPMT function - The function that calculates interest for a specified period in Excel

- ★ COUPNUM function - The function returns the number of interest payments on a security in Excel