Instructions for using the IPMT function in Excel

Before you decide to invest in a certain field, make sure you consider it very carefully, calculating what the capital is spent and how much is earned over the period of time with how much interest. . The following article is a guide to using IPMT function to help you answer this question.

Description: The function returns the interest payment for an investment within a certain agreed period.

Syntax: IPMT (rate, per, nper, pv, [fv], [type]) .

Inside:

- rate: The interest calculated periodically, is required parameters.

- per: The number of periods for interest calculation is from 1 -> nper, is a required parameter.

- nper: The total number of terms to be paid during the investment period, is the required parameter.

- pv: The present value of the loan, is the required parameter.

- fv: Future value obtained after investment, is an optional parameter if the default value is omitted to 0.

- type: Time of interest payment, Optional parameter if omitted by default is 0. There are 2 values of type = 0 => final payment, type = 1 => payment at the beginning of the period.

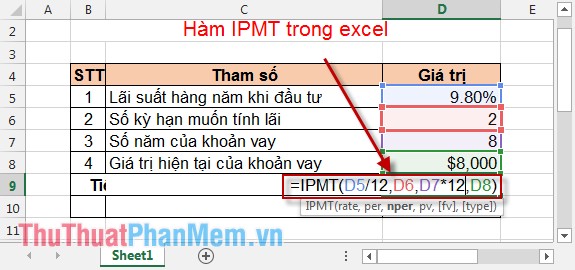

Example: Give the following data table:

Calculate:

- Interest is due in the 1st month after investing.

- Interest due in the last year of the loan.

Perform the problem:

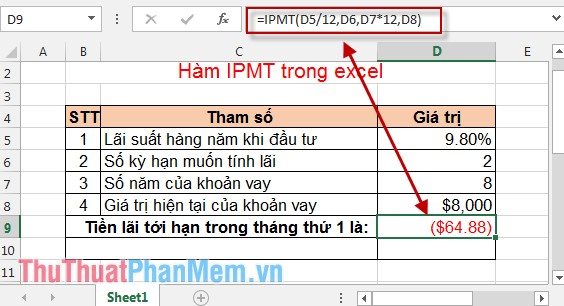

1. Interest is due in the 1st month after investing

In the cell to calculate enter the formula: = IPMT (D5 / 12, D6, D7 * 12, D8) .

Result:

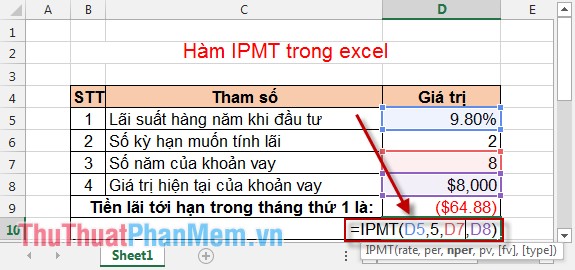

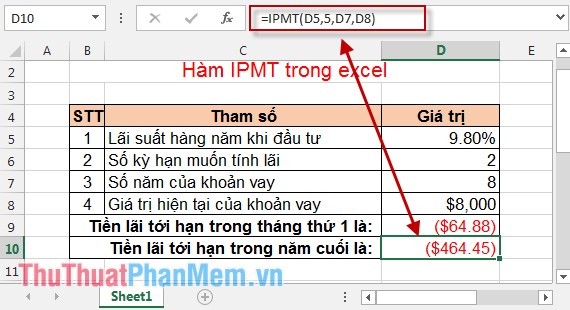

2. Interest is due in the last year of the loan

In the cell to calculate enter the formula: = IPMT (D5,5, D7, D8) .

Result:

The above is a detailed guide on how to pay interest when you decide to invest in a certain period of time. Compare it with the interest payments and the profits earned and then make a decision.

I wish you the best investment efficiency.

How to copy formulas that contain references in Excel

How to copy formulas that contain references in Excel Instructions for removing password PDF file online

Instructions for removing password PDF file online Instructions for hiding formulas in Excel

Instructions for hiding formulas in Excel Summary of technical functions in Excel

Summary of technical functions in Excel Create a border around Word documents

Create a border around Word documents Set the default file type when saving Word documents

Set the default file type when saving Word documents