ISPMT function - The function that calculates interest for a specified period in Excel

In the investment process, the most important thing is the interest - based on the determination of the interest payable to have the most appropriate adjustment direction. The following article introduces in detail ISPMT function - The function of calculating interest in a definite term helps you have the best direction.

Description: The function calculates the interest of an investment for a specific period.

Syntax: ISPMT (rate, per, nper, pv) .

Inside:

- rate: The interest rate of the investment, which is a required parameter.

- per: The period you want to calculate interest, the value determined from 1 -> nper, is a required parameter.

- nper: Total number of terms in the investment process, which is required.

- pv: Present value of the investment, where the investment is the borrowed value, pv is the amount borrowed to invest, pv is the required parameter.

Attention:

- Between nper and pv, it is necessary to be consistent about units, for example, if nper is calculated by month, then pv is required to be monthly.

- With the payables shown as negative numbers, and amounts such as dividend checks, deposits are represented by positive numbers.

For example:

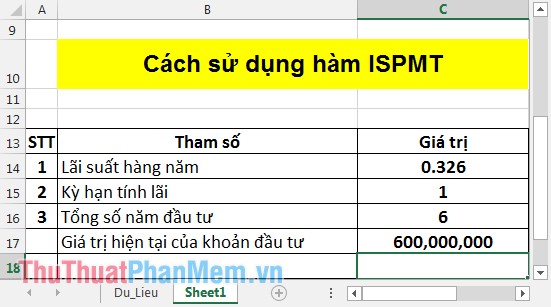

Calculate the amount of interest payable in the first and second month of an investment knowing the following parameters:

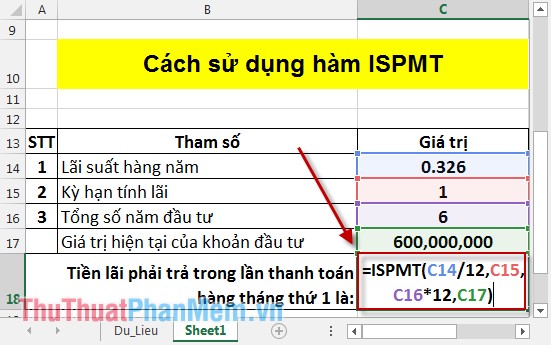

- Calculating interest payable in the first month is:

In the cell to be calculated enter the following formula: = ISPMT (C14 / 12, C15, C16 * 12, C17) .

Because interest is calculated in the 1st month, the interest rate is divided annually c14 / 12 and the total investment period is calculated monthly C16 * 12.

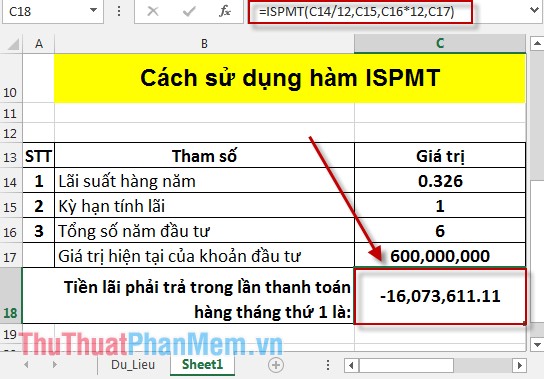

Pressing Enter results (because the interest value should be negative):

So with an investment of 600 million loans at the interest rate of 0.326 the first month to pay more than 16 million interest.

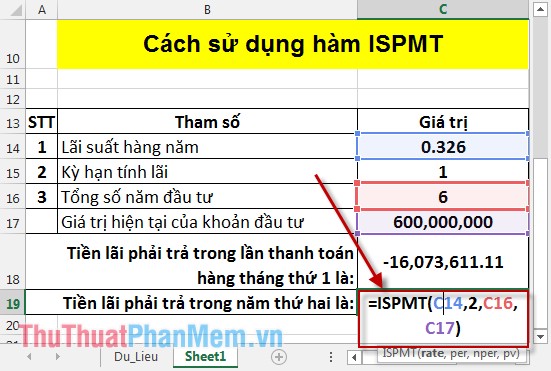

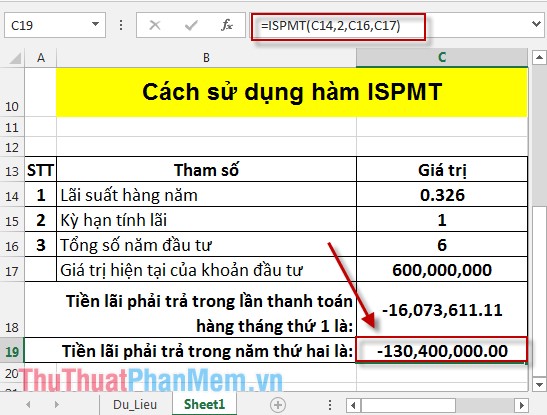

- Calculating interest payable in the 2nd year.

In the cell to calculate enter the formula: = ISPMT (C14,2, C16, C17) .

Pressing Enter results (because the interest value should be negative):

So if in the 2nd year, the investment is not paid, it must pay interest of over 130 million.

The above is a detailed guide on how to use the ISPMT function. Hope to help you in determining the amount of interest to pay from there in the right direction.

Good luck!

You should read it

- ★ FVSCHEDULE function - Returns the future value of an investment that has variable or adjustable interest in period in Excel

- ★ How to use the DAVERAGE function in Excel

- ★ DURATION function - The function returns the periodic periodic interest payments in Excel

- ★ COUPNUM function - The function returns the number of interest payments on a security in Excel

- ★ Use the cumulative interest calculation function in Excel