EFFECT function - The function of calculating the annual real interest rate in Excel

The following article details how to use the EFFECT function - The annual real interest rate calculation function which is very helpful for accountants and offices.

Description: The EFFECT function helps you to calculate the actual interest rate to be paid in each year.

Syntax: EFFECT (nominal_rate, npery) .

Inside:

- Nominal_rate : Nominal annual interest rate, is a required parameter.

- Npery : The number of periods for compounding in each year, which is the required parameter.

Attention:

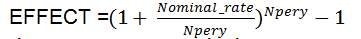

- The calculation formula of EFFECT function is as follows:

- The parameters must be numeric values otherwise the #NUM !.

- If 1 of the above 2 parameters is less than 0 => The function returns the #NUM! Error value.

- Where Npery is a function decimal, it will take the integer value of Npery.

For example:

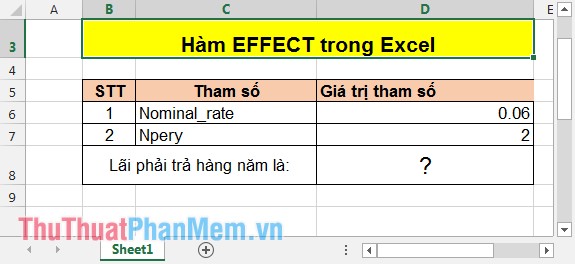

With the following data sheet, calculate the interest rates payable for investments.

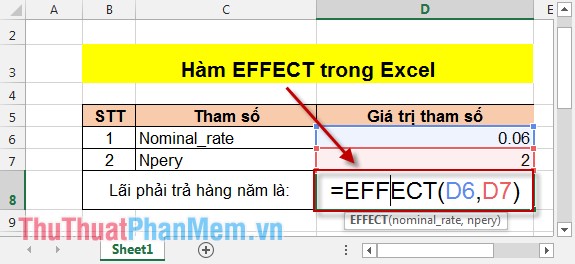

In the cell to be calculated enter the following formula: = EFFECT (D6, D7) .

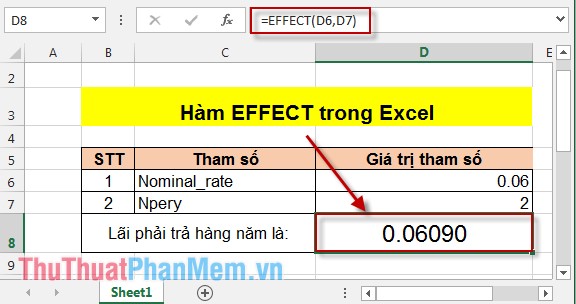

After pressing Enter the result is:

So you have to pay nominally at the interest rate of 0.06% but in fact you have to pay the annual interest rate of 0.06090 => there arises extra.

Above is a detailed guide on how to use the EFFECT function, hoping you can calculate it correctly and get the investment with the lowest interest rate.

Good luck!

You should read it

- ★ How to use the MOD function and QUOTIENT function in Excel

- ★ How to use the SUM function to calculate totals in Excel

- ★ How to use the SUBTOTAL function in Excel

- ★ NPER function - The function calculates the period number of an investment in Excel

- ★ TBILLYIELD function - The function calculates the discount rate for a bond in treasury in Excel