DURATION function - The function returns the periodic periodic interest payments in Excel

The following article details how to use the DURATION function to determine the period of periodic interest payment.

Description: The function that returns the validity of a bond is a weighted average of the current value of the cash flow.

Syntax: DURATION (settlement, maturity, coupon, yld, frequency, [basis]) .

Inside:

- settlement : The settlement date of a security is the date securities are sold to buyers after the issuance date, which is a required parameter.

- maturity : The expiry date of the stock, or the maturity date, is a required parameter.

- Coupon : The annual coupon rate of the security, is a required parameter.

- yld : Annual profit of the securities, is a mandatory parameter.

- frequency : Number of interest payment times per year, a required parameter.

- basis : The basis determined to calculate the number of days, is an optional parameter. The following values are available:

+ basis = 0: Calculates the number of days according to US standards, the number of days / year is 30/360.

+ basis = 1: The number of days / year is the actual number of days on the month / number of actual days per year.

+ basis = 2: The number of days / year is the actual number of days on the month / days on the year is 360.

+ basis = 3: The number of days / year is the actual number of days on the month / days on the year is 365.

+ basis = 4: Calculating the number of days according to European standards, the number of days / year is 30/360.

Attention:

- If the input parameters are decimal numbers => the function takes an integer part of the parameters.

- If the settlement date and expiry date of the CK are invalid => The function returns the error value #VALUE !.

- If coupon The function returns the #NUM error value.

- If frequency is outside the value set {1, 2, 4} => returns the #NUM! Error value

- If basis is outside the value set {0, 1, 2, 3, 4} => returns the #NUM! Error value

- If the expiration date is less than the settlement date => the function returns the #NUM! Error value.

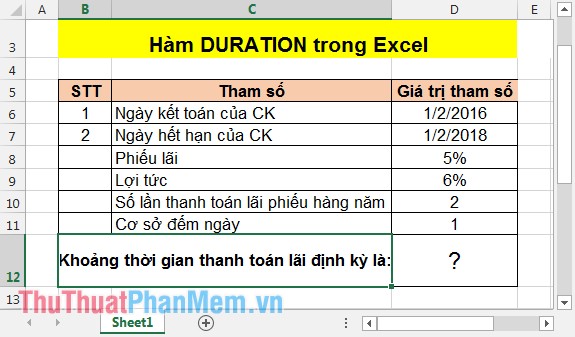

For example:

With the following table, calculate the period of time to pay interest annually.

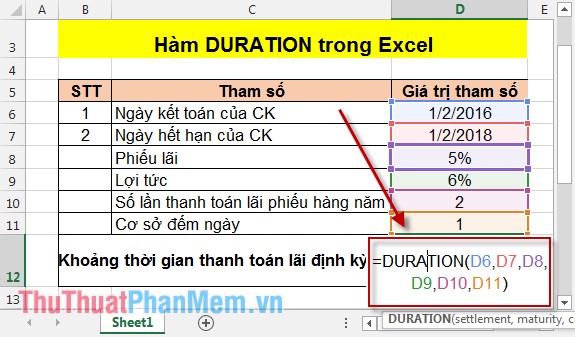

In the cell to calculate enter the following formula: = DURATION (D6, D7, D8, D9, D10, D11) .

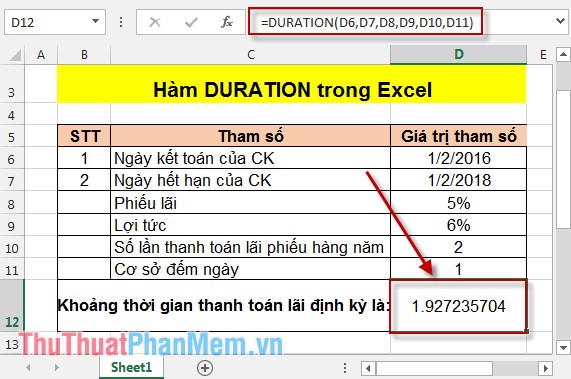

After pressing Enter the result is:

Thus, the term of bonds with the above terms is 1,927235704.

Above is the instruction for using the DURATION function.

Good luck!

You should read it

- ★ Enable / disable Periodic Scanning feature on Windows 10

- ★ FVSCHEDULE function - Returns the future value of an investment that has variable or adjustable interest in period in Excel

- ★ PMT function in Excel - Usage and examples

- ★ How to use the IF function in Excel

- ★ GEOMEAN function - The function returns the average of a positive array or range of data in Excel