How to calculate interest rate using the RATE function in Excel

You can absolutely calculate interest rates right in Excel . The following are detailed instructions on how to calculate interest rates using the RATE function in Microsoft Excel .

Interest rates are an important component of financial management, for both loans and savings. This interest rate determines how much you will pay on a loan or earn from savings over time.

The RATE function is a tool that can help you accurately calculate interest rates, plan your finances, and make more manageable decisions. The loan and savings interest calculations are the same, just tweaked a bit for owners and debtors.

What are loan and savings interest rates?

Lending interest rate : When borrowing money, the interest rate represents the cost of borrowing. When borrowing money, the interest rate represents the cost of borrowing. It is calculated as a percentage of the principal amount borrowed and added to the original amount you owe. A higher loan interest rate means you will pay more over the life of the loan.

Savings interest rates : On the other hand, when you deposit money in a savings account, the interest rate determines how much your money will grow over time. This rate is expressed as a percentage, and the interest earned is usually added to your savings periodically.

A savings account is essentially a loan account, except that you are lending money to the bank and the bank now owes you money. So the longer your savings stay in the bank, the more the bank will owe you.

RATE function in Microsoft Excel

RATE is a financial function available in Excel, designed to calculate interest rates based on other financial factors. The syntax here is:

=RATE(nper, pmt, pv, [fv], [type], [guess])- NPER: Total number of payment periods, can be months, years, etc

- PMT: A periodic payment made or received each period, which can be negative for loans (payments) or positive for savings (deposits).

- PV: Principal amount, total initial amount involved.

In addition, the RATE function also has 3 optional arguments:

- FV: Desired future investment or loan value. If left blank, RATE will calculate the loan interest rate and set the FV to 0.

- Type: Indicates when payment is due. The default value is 0, meaning payment is made at the end of the cycle. 1 means payment is paid at the start of each cycle.

- Guess: Predict interest rates. It provides a starting point for the RATE function. By default, this function gives the value 10.

The RATE function calculates the interest rate required to achieve a specific future value using these parameters. The RATE function returns a fixed interest rate and cannot calculate compound interest.

If you're new to finance in Excel, it's best to start with the NPER function to understand the payment stages in loans and savings.

Example 1: Calculate loan interest rate

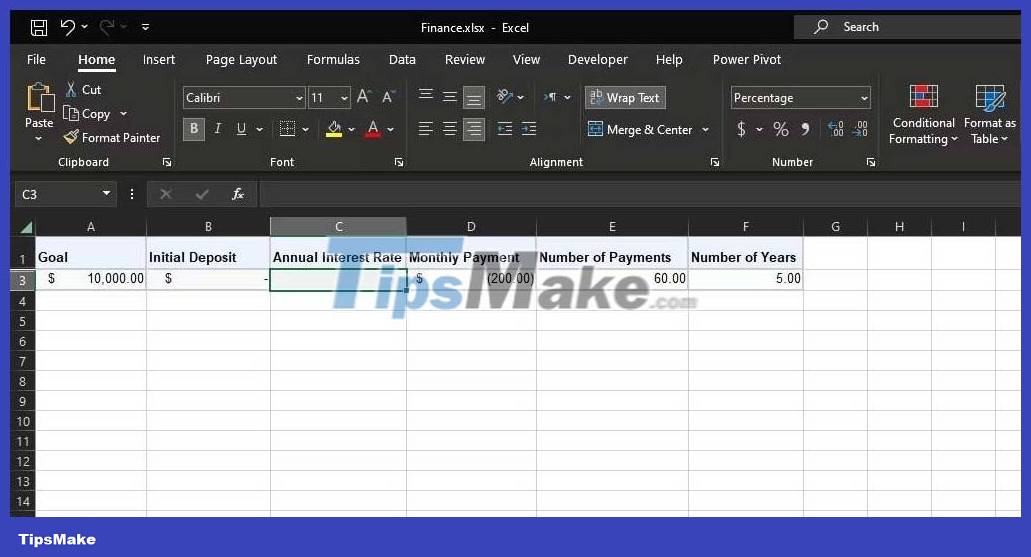

Let's say you're considering a $10,000 loan with monthly payments of $200 for 5 years and you want to calculate the interest rate. For loans, PMT, NPER, and PV will be the negative monthly payment amount, number of monthly payments, and loan amount, respectively.

You can use the RATE function as follows to quickly calculate the interest rate for a loan:

=RATE(E3, D3, A3)The result will be the monthly interest rate. To calculate the annual interest rate, you can multiply it by 12:

=RATE(E3, D3, A3)*12

Example 2: Calculate savings interest rate

Imagine you are planning to save $5,000 monthly by depositing $100/month for 3 years after making an initial deposit of $200. In this case, you have four arguments: PMT, NPER, PV, and FV. These would be the negative monthly payment amount, the number of monthly payments, the negative initial deposit amount, and the corresponding savings goal.

You can use the RATE function in Excel to calculate the interest rate needed to reach your loan goal as follows:

=RATE(E3, D3, B3, A3)The above function will calculate the monthly interest rate for you. Multiply it by 12 to calculate the annual interest:

=RATE(E3, D3, B3, A3)*12

The RATE function in Microsoft Excel is a valuable tool for those who have loans or savings. It simplifies complex interest rate calculations, allowing you to make informed financial decisions.

Understanding how to use this function can help you control your finances well in the future.

You should read it

- ★ EFFECT function - The function of calculating the annual real interest rate in Excel

- ★ PMT function in Excel - Usage and examples

- ★ The easiest way to calculate the percentage (%)

- ★ How to calculate the interest rate for bank deposits

- ★ CUMIPMT function - The function of calculating accrued interest in Excel