Excel functions calculate the debt age and the average balance

Debt accountants often have to calculate the age of accounts receivable of customers to know which account should be collected in advance, in addition to calculate the average balance of these receivables to " improve the quality of financial management. ". If there is no accounting software that provides these functions or has to work with Excel manually, I guarantee you will feel that the life of the accountant is no different from "eternity". The following two Excel functions can help you quickly regain the feeling of love.

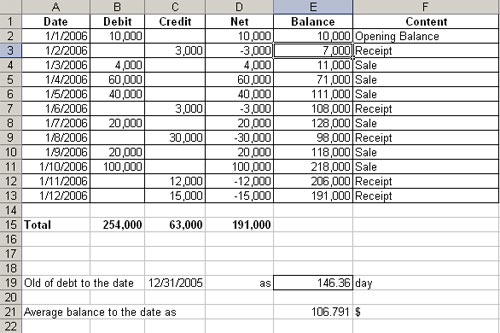

For example, we have a customer data sheet as shown below

• The first column is the date of transaction with the customer (sorted by increasing date)

• The second column is the amount of receivables from customers (debiting)

• The third column is the number obtained by the customer (credited)

• The fourth column is the second column except the third column

• The fifth column is balanced and receivable after each transaction, column 6 is a note

Calculations only need columns 1 to 4.

Create function

1. Function OldOfDebt (mRange As Range, toDate As Date) As Double

This function returns the age of the receivables by date, by answering the outstanding receivables at the last day of receivables of which days the principle that the collected amount will be paid for the receivables to first, then calculate the number of days by weight of each item for the balance.

The function has two parameters, the first mRange is the calculation area, in the example is A2: D13; second toDate is the date to determine the age (toDate must be greater than the last day of the transaction with the customer), in the picture is C19. For example, the calculation of the age of accounts receivable is 191,000 and is 146.36 days returned in cell E19.

2. Function AvgBalance (mRange As Range, toDate As Date) As Double

This function has the same parameter as the upper function, returning the average receivable balance of customers by the proportion of time. In the figure, the function calculates the average balance returned to cell E21 is 106.791 with mRange is A2: D13 and toDate is December 31, 2005. (You can calculate the loss that this customer occupies with the interest rate function in the interval A2 to A13).

Source code

Public Function OldOfDebt (mRange As Range, toDate As Date) As Double

Dim rDate As Range Cot now

Dim rDebit As Range Cot recorded no

Dim rCredit As Range Cot record co

Dim mPaid As Double Tong compared to skin

Dim mClose As Double So far, right toDate

Dim mAccDebit As Double Debit cong don

Dim thisAmount As Double

Dim thisDate As Double

Dim mRow As Long Bien

Dim i As Long

Dim ret As Double Click on the link

mRow = mRange.Rows.Count

Set rDate = mRange.Range (Cells (1, 1), Cells (mRow, 1))

Set rDebit = mRange.Range (Cells (1, 2), Cells (mRow, 2))

Set rCredit = mRange.Range (Cells (1, 3), Cells (mRow, 3))

mPaid = Application.WorksheetFunction.Sum (rCredit)

mClose = Application.WorksheetFunction.Sum (rDebit) - Application.WorksheetFunction.Sum (rCredit)

For i = 1 To mRow

If rDebit.Cells (i, 1) .Value <> 0 Then

mAccDebit = mAccDebit + rDebit.Cells (i, 1) .Value

If mAccDebit> mPaid Then

thisAmount = Application.WorksheetFunction.Min (mAccDebit - mPaid, rDebit.Cells (i, 1) .Value)

thisDate = rDate.Cells (i, 1) .Value

ret = ret + thisAmount * (toDate - thisDate) / mClose

End If

End If

Next i

OldOfDebt = ret

End Function

Public Function AvgBalance (mRange As Range, toDate As Date) As Double

Dim rDate As Range

Dim rAmount As Range

Dim mRow As Long

Dim mLenght As Long is busy to work right away

Dim i As Long

Dim ret As Double

mRow = mRange.Rows.Count

Set rDate = mRange.Range (Cells (1, 1), Cells (mRow, 1))

Set rAmount = mRange.Range (Cells (1, 4), Cells (mRow, 4))

mLenght = toDate - rDate.Cells (1, 1)

For i = 1 To mRow

ret = ret + rAmount.Cells (i, 1) * (toDate - rDate.Cells (i, 1)) / mLenght

Next i

AvgBalance = ret

End Function

Nguyen Van Thang

Email : thang_via@yahoo.com