MIRR function - The function returns the adjusted internal rate of return in Excel

Sometimes in the process of investing in securities you wonder and do not know when you can payback or how to calculate whether the next investment is profitable or not. The following article shows how to use the MIRR function to help you answer the above question.

Instructions for using the MIRR function

Description: Perform the calculation of the internal rate of return adjusted for periodic cash flow. Not only that, but MIRR allows calculating the cost and interest if reinvested.

Syntax: MIRR (values, finance_rate, reinvest_rate) .

Inside:

- values: Include payments, including negative values. This includes initial expenses, loans, etc.

- finance_rate: Interest paid on loans in the cash flow.

- reinvest_rate: Interest received when reinvesting.

Example: Give the following data table:

Calculate:

- Calculate the interest rate of the investment after a period of 3 years.

- Calculate the interest rate of the investment after a period of 5 years.

- Calculate the interest rate of the investment after a period of 5 years and use the reinvestment with the interest rate of 12%.

Perform the problem:

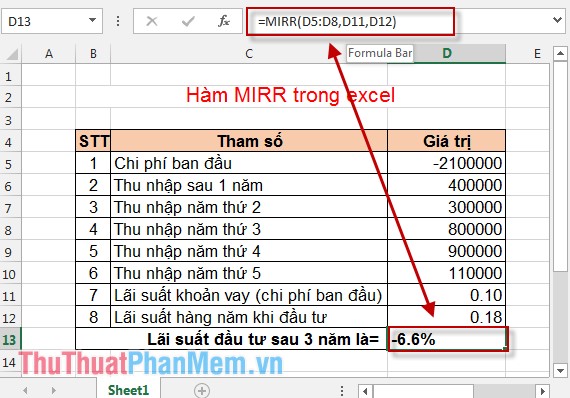

1. Interest rate of the investment after 3 years

In the cell to calculate enter the formula: = MIRR (D5: D8, D11, D12) .

Result:

So after 3 years, the interest rate = -6.6% => The investment after 3 years has no interest.

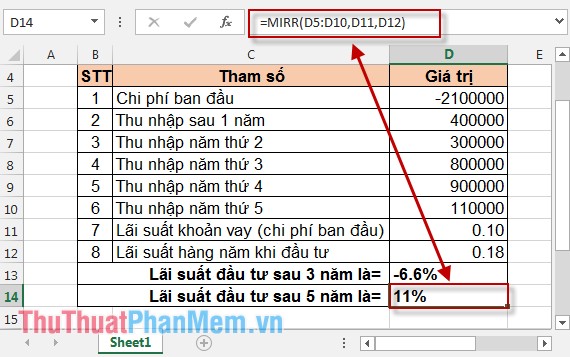

2. Interest rate after 5 years

In the cell to calculate enter the formula: = MIRR (D5: D10, D11, D12) .

Results after calculation:

So the investment after 5 years is profitable and the interest rate is 11% of the capital.

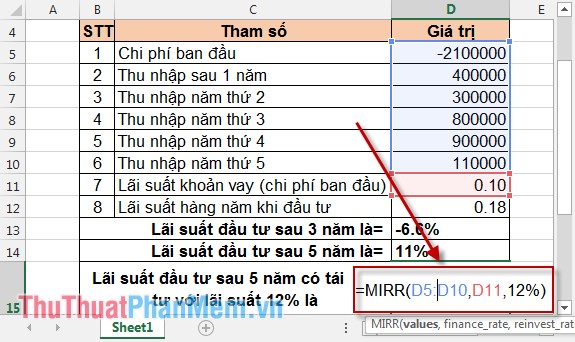

3. Interest rate received after 5 years with reinvestment receives interest rate of 12%

In the cell to calculate enter the formula: = MIRR (D5: D10, D11.12%) .

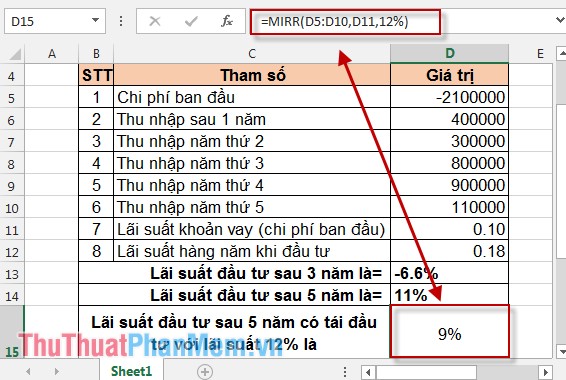

Result:

The interest rate after 5 years of reinvestment with the interest rate of 12% = 9% <11% => The effective reinvestment is not high, you should consider.

The above is the calculation and estimation of interest rates after investment and reinvestment. Hope you consider carefully before deciding to invest.

Good luck!

You should read it

- WEEKDAY function - The function returns the weekday of a corresponding date in Excel

- How to use the IF function in Excel

- How to use the IFS function in Excel 2016

- The DAY function - The function returns the day of the day, month and year in Excel

- CHISQ.TEST function - The function returns the independence test in Excel

- How to use the LEN function in Excel

NPER function - The function calculates the period number of an investment in Excel

NPER function - The function calculates the period number of an investment in Excel CUMIPMT function - The function of calculating accrued interest in Excel

CUMIPMT function - The function of calculating accrued interest in Excel Instructions for using the IPMT function in Excel

Instructions for using the IPMT function in Excel How to copy formulas that contain references in Excel

How to copy formulas that contain references in Excel Instructions for removing password PDF file online

Instructions for removing password PDF file online Instructions for hiding formulas in Excel

Instructions for hiding formulas in Excel