COUPPCD - The function returns the previous coupon date before the settlement date in Excel

In the previous article introduced to you the function returns the next coupon date after the settlement date. The following article introduces you to the COUPPCD function - The function returns the previous coupon date before the settlement date.

Description: The function returns the previous coupon date before the settlement date of the security.

Syntax: COUPPCD (settlement, maturity, frequency, [basis]) .

Inside:

- settlement : Is the date of settlement of securities (The day that securities are sold to buyers, only after issuance date), which is the required parameter.

- maturity : The maturity or maturity date of a security, which is a mandatory parameter.

- frequency : Number of coupon payments per year, a required parameter. There are values:

+ frequency = 1 => annual payment.

+ frequency = 2 => pay with a frequency of half a year.

+ frequency = 4 => payment quarterly.

- basis : The basis determined to calculate the number of days, is an arbitrary parameter. The following values are available:

+ Basis = 0 or omitted: calculate the US standard number of days of the month / days of the year is 30/360.

+ Basis = 1: the number of days in the month / days in a year is the actual number of days in the month / the number of actual days in a year.

+ Basis = 2: the number of days in the month / days in a year is the actual number of days in the month / 360.

+ Basis = 3: the number of days in a month / days in a year is the actual number of days in a month / 365.

+ Basis = 4: Based on European European standards the number of days in the month / days of the year is 30/360.

Attention:

- If the parameter value is decimal =. The function takes the value of the parameter as an integer.

- If settlement> = maturity => the function returns the #NUM! Error value.

- If basis is outside the values 0, 1, 2, 3, 4 => the error function #NUM !.

- If frequency is outside of value 1, 2, 4 => the function returns the #NUM! Error.

For example:

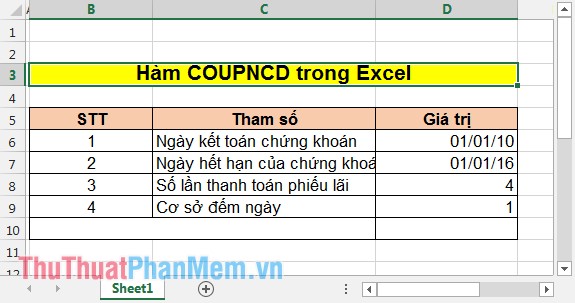

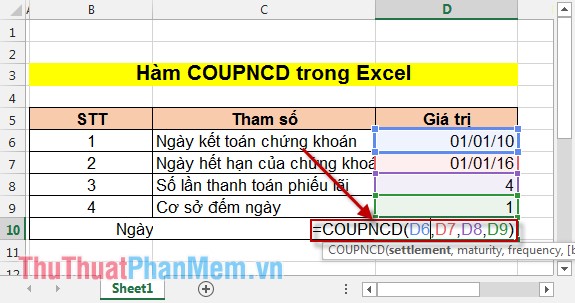

Calculate the coupon date of the previous stock, before the stock settlement date with the following parameter:

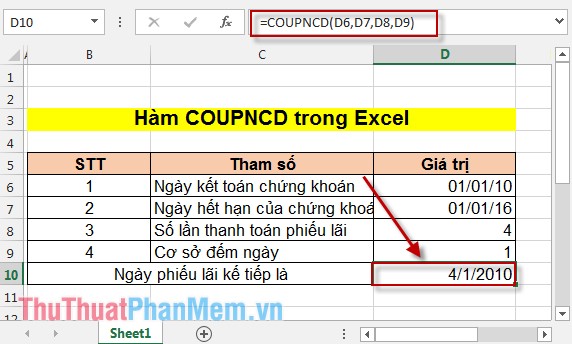

In the cell to be calculated enter the following formula: = COUPPCD (D6, D7, D8, D9) .

Results after calculation:

Thus, the coupon date of the previous stock is calculated before the settlement date.

Good luck!

You should read it

- ★ DATE function - The date function in Excel

- ★ DAY function - The function returns the date value of a specific date in Excel

- ★ NOW function - The function returns the current date and time in Excel

- ★ The WORKDAY.INTL function - The function returns a date before or after the date starting with a custom weekend in Excel

- ★ The WORKDAY function - The function returns a date before or after the start date of a number of working days in Excel