COUPNCD - The function returns the next coupon date in Excel

Currently, stock investment is no stranger to people, the matter is concerned daily. Therefore, the following article introduces the COUPNCD function in detail to help you calculate the next coupon date.

Description: The function returns the next coupon date after the settlement date of the security.

Syntax: COUPNCD (settlement, maturity, frequency, [basis]) .

Inside:

- settlement : Is the date of settlement of securities (The day that securities are sold to buyers, only after issuance date), which is the required parameter.

- maturity : The maturity or maturity date of a security, which is a mandatory parameter.

- frequency : Number of coupon payments per year, a required parameter. There are values:

+ frequency = 1 => annual payment.

+ frequency = 2 => pay with a frequency of half a year.

+ frequency = 4 => payment quarterly.

- basis : The basis determined to calculate the number of days, is an arbitrary parameter. The following values are available:

+ Basis = 0 or omitted: calculate the US standard number of days of the month / days of the year is 30/360.

+ Basis = 1: the number of days in the month / days in a year is the actual number of days in the month / the number of actual days in a year.

+ Basis = 2: the number of days in the month / days in a year is the actual number of days in the month / 360.

+ Basis = 3: the number of days in a month / days in a year is the actual number of days in a month / 365.

+ Basis = 4: Based on European European standards the number of days in the month / days of the year is 30/360.

Attention:

- If the parameter value is decimal =. The function takes the value of the parameter as an integer.

- If settlement> = maturity => the function returns the #NUM! Error value.

- If basis is outside the values 0, 1, 2, 3, 4 => the error function #NUM !.

- If frequency is outside of value 1, 2, 4 => the function returns the #NUM! Error.

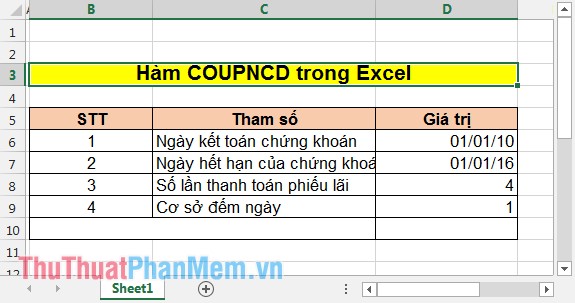

For example:

Calculate the next coupon date of the securities when knowing the following parameters:

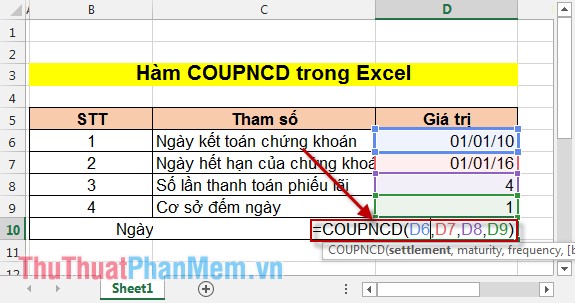

In the cell to be calculated enter the following formula: = COUPNCD (D6, D7, D8, D9) .

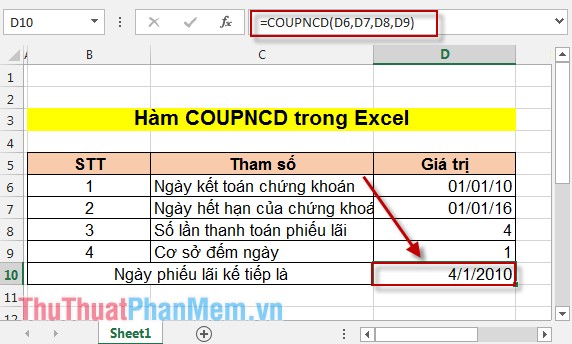

The result has been calculated for the next coupon date:

Note: In this article, you should note that selecting the cell format returns the result of the COUPNCD function in the same date format as the securities settlement date and securities expiry date. You can use a brush to format the result cell.

Above is how to use the COUPNCD function to help you when investing in securities.

Good luck!

You should read it

- ★ NOW function - The function returns the current date and time in Excel

- ★ Coupdays function - Calculates the number of days in a coupon period and contains the settlement date in Excel

- ★ DATE function - The date function in Excel

- ★ WEEKDAY function - The function returns the weekday of a corresponding date in Excel

- ★ YEAR - The function returns the year corresponding to a date in Excel