Intrate function - Calculate interest rates in Excel

In the field of securities before investing in any type of stock, you should know that company is developing. It should be noted that you should also calculate the possibility that if investing in that stock, the interest rate is how much is the largest value. The following article details how to use the Intrate function to calculate the interest rate of invested securities.

Intrate function

Description: The function returns the interest rate of invested securities (calculated in percentage).

Syntax: INTRATE (settlement, maturity, investment, redemption, [basis]) .

Inside:

- settlement: The date of settlement of securities (it is a required parameter). The securities settlement date is determined as the date after the issue date of securities to be sold to others.

- maturity: Is the expiry date of the stock, or maturity, is a required parameter.

- investment: Total amount invested in stocks, required parameters.

- Redemption: Total amount received when stock expires, required parameters.

- basis: Define a date counting basis (not required if no default date parameter is entered). Basis has the following values:

+ Basis = 0 => basis of US-based US date counting (NASD) 1 month 30 days / year 360 days.

+ Basis = 1 => The actual number of days in the month / The number of actual days of the year.

+ Basis = 2 => Number of actual days of the month / Days of the year is 360.

+ Basis = 3 => Number of actual days of the month / Days of the year is 365.

+ Basis = 4 => According to European standards, the number of days in a month is 30 days / day of the year is 360 days.

Calculation formula:

INTRATE = (redemption - investment) / investment * (SN / TN)

Inside:

- SN: The number of days in a year depends on the day counting basis.

- TN: Total number of days counting from the settlement date to the expiry date of securities.

For example:

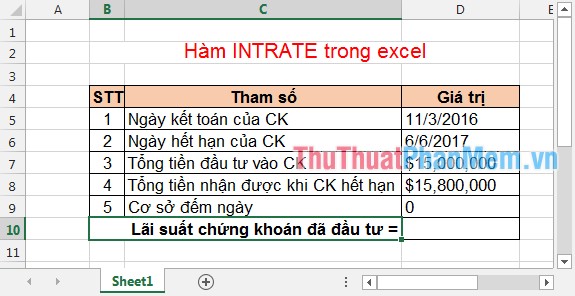

Calculate whether or not investing in this stock is profitable or unknown:

To calculate whether an investment in a securities is profitable or not, we calculate the value of INTRATE if a positive return indicates that the investment is profitable, otherwise the investment is inefficient.

Calculate interest rates with this stock. Enter the following formula: INTRATE (D5, D6, D7, D8) .

Result:

The value of Intrate = 9.1% => Investing in this stock is profitable and if investing, the interest rate is 9.1% compared to the value.

So the article above introduces you to how to calculate interest rates on securities. Hope you always have a thorough calculation and choose the appropriate type of stock to bring the highest benefit.

Good luck!

You should read it

- ★ Use the cumulative interest calculation function in Excel

- ★ The easiest way to calculate the percentage (%)

- ★ How to use the SUM function to calculate totals in Excel

- ★ COUPNUM function - The function returns the number of interest payments on a security in Excel

- ★ PMT function in Excel - Usage and examples