Should we trust financial advice from AI tools like ChatGPT and Bard?

Investors want a simple yet effective solution when it comes to financial advice. Today, they rely on Artificial Intelligence (AI) models to help guide their investments. But should you rely on such technologies when investing your hard-earned money?

To answer this question, let's delve into the complexities of AI in finance, weighing the pros and cons to help you decide whether to trust these digital advisors or not.

Should we trust AI when we need financial advice?

Before getting into the specifics, let's try out the disruptive technology to see if 3 Generative AI tools, Google's Bard AI, OpenAI's GPT-3.5 (free), and OpenAI's GPT-4, can help you diversify whether the portfolio contains different asset classes or not.

As a test, the author wrote a prompt that read:

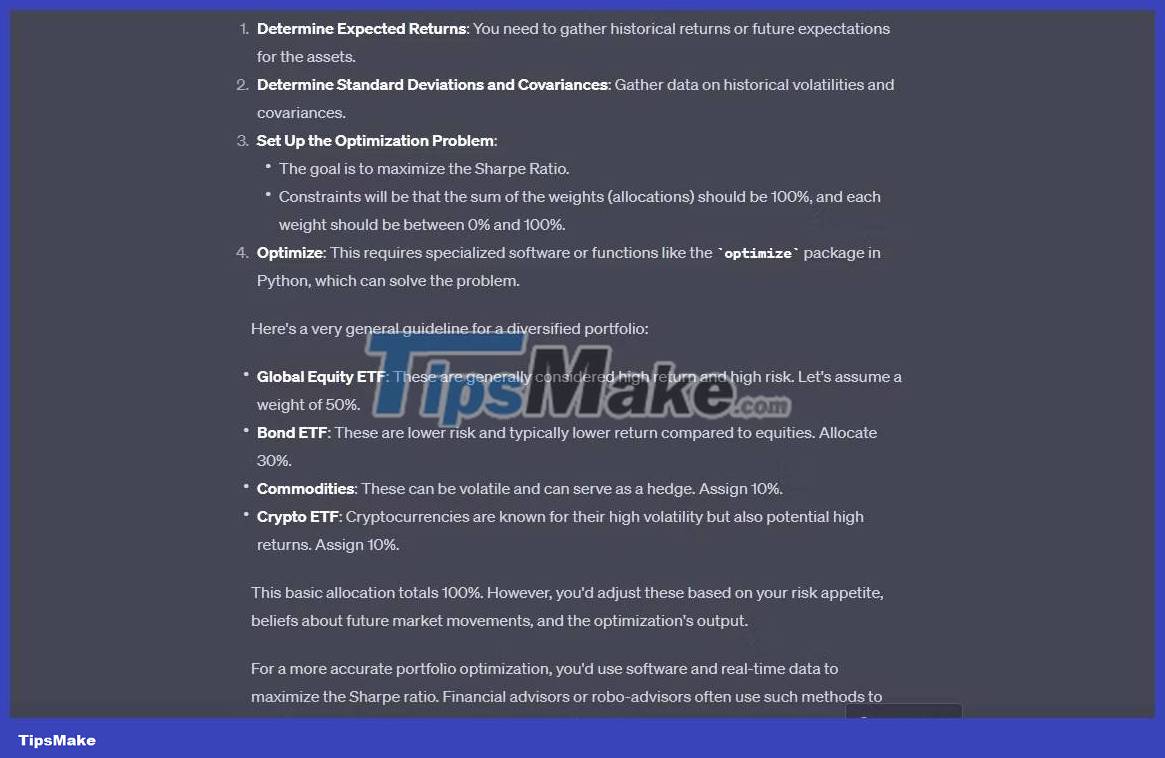

You are a finance expert AI designed to optimize a portfolio with a size of $20,000 that needs to be allocated to the following assets: global equity ETF, bond ETF, commodities, and crypto ETF. Perform portfolio optimization for the Sharpe ratio metric and provide an output in terms of percentage allocation.

Roughly translated :

You are an AI financial expert designed to optimize a $20,000 portfolio that needs to be allocated to the following assets: Global equity ETFs, bond ETFs, commodities, and money ETFs electronic. Perform portfolio optimization for Sharpe ratio index and provide output in terms of percentage allocation.

The Sharpe Ratio is typically calculated as follows: Sharpe Ratio = (Asset Return - Risk-Free Rate) / Asset Volatility . This is a commonly used measure in finance to help investors evaluate the risk-adjusted return of an investment or portfolio.

Google Bard's response:

Google's AI model focuses on the importance of investing for the long term, rebalancing your portfolio and diversifying it. Moving on, let's see the results on ChatGPT models - GPT-3.5 (free version) and GPT-4 (paid subscription).

ChatGPT-3.5 response:

ChatGPT-4's response:

Even when using ChatGPT models, the focus is still on the long-term aspect. In all cases, the portfolio allocation is designed to maximize the Sharpe ratio while maintaining a diversified portfolio.

Global equity ETFs provide exposure to global equity markets, which have historically delivered the highest returns over the long term. Bond ETFs provide exposure to fixed income assets, offering lower returns and volatility. Commodity ETFs provide exposure to commodities, which can protect against inflation. Cryptocurrency ETFs provide exposure to the cryptocurrency market, which is a new and volatile asset class.

But the situation may change. That is, traditional or even emerging asset classes could win and deliver higher returns depending on market conditions. Conversely, the possibility of a financial market crash could wipe out your profits.

Learn about the rise of AI in finance

Artificial intelligence has completely changed the way the financial industry operates in recent years. AI uses extensive training data and massive processing power to quickly review tons of information, find patterns, and even predict things that only humans could do before. Because of this, AI has made personal development tools truly popular among people, including the financial sector.

But before you try to use artificial intelligence tools to get financial advice, it's important to understand the upsides and downsides that come with it.

Advantages of trusting AI for financial advice

Using artificial intelligence models has certain benefits that can be beneficial to users.

Artificial intelligence (AI) systems offer many advantages for financial decision making. Their power lies in data-driven analytics, allowing these tools to expertly process large amounts of financial data, scrutinize market trends, and analyze economic indicators. This analytical ability allows them to provide insights that are difficult for human advisors to surpass.

Furthermore, the AI platform escapes the constraints of office hours, providing round-the-clock availability. This means you can conveniently access financial advice whenever you need it, without the hassle of scheduling an appointment or waiting for a call back.

Another notable strength of AI in this context is its ability to remove emotional bias. Human emotions often cloud judgment when making financial choices. However, AI systems like ChatGPT and Bard only make recommendations based on data, thereby eliminating emotional bias that can lead to impulsive or irrational decisions. This streamlined approach enhances the quality of the advice provided.

Finally, AI-powered financial advisory services are often a cost-effective alternative to traditional human advisors. Low costs make high-quality financial guidance accessible to more individuals. In essence, AI not only enhances analytical capabilities in financial decision-making but also brings convenience, objectivity and cost-effectiveness, ultimately reshaping the landscape of advisory services. financial consulting.

Such advantages may be the main reason why investors trust this new model. In fact, according to an August 22, 2023 report published by Certified Financial Planners, 31% of US-based investors would consider following AI-generated financial advice without needing to verify with another source.

The study surveyed more than 1,100 adults to demonstrate investors' general comfort with trusting AI without verifying information. The poll clearly shows that AI can possess the skills to demonstrate financial acumen to investors. However, AI also has some pitfalls.

Disadvantages of trusting AI models in financial advice

Trusting AI like ChatGPT and Bard for financial advice can be a double-edged sword and has significant downsides to consider.

First, these AI systems cannot truly understand your unique financial situation and goals. They operate based on algorithms and historical data, so their recommendations may not suit your needs. Financial decisions are deeply personal, and a one-size-fits-all approach can lead to unexpected results.

Another important disadvantage is the possibility of errors. AI systems are not immune to glitches or inaccuracies. Relying solely on AI advice without verification can expose you to significant financial risk. A simple data error or failure to account for unexpected market events can lead to significant losses.

Furthermore, AI does not provide emotional support. Financial decisions can be stressful, and AI lacks the empathy and human touch that a human financial advisor can provide. Sometimes, you need someone to talk to, especially during times of market turmoil.

Ultimately, AI systems cannot provide broader context about your financial life. Life events, such as plans to get married, have children or retire, can significantly affect your financial decisions. AI may not be able to pick up on these nuances, giving you advice that doesn't take your overall situation into account.

5 factors to consider before using AI for financial advice

Overall, the decision whether to trust AI for financial advice ultimately depends on your circumstances and preferences. Here are some factors to consider:

- The complexity of your financial situation : If your financial situation is relatively simple, AI may be good enough to provide basic guidance. However, if your situation is more complex, you may benefit from the insights that a human advisor can provide.

- Risk tolerance : Your risk tolerance plays an important role in your financial decisions. The AI system may not fully understand your risk tolerance, so if this is important, you should consult a human expert.

- Emotional Needs : Do you need emotional support and guidance when dealing with financial matters? If so, a human advisor can provide the empathy and reassurance that AI lacks.

- Cost considerations : AI-based financial advice is often more cost-effective than human advisors. If your budget is tight, AI may be a more practical choice.

- Hybrid approach : Consider taking a hybrid approach by combining AI advice with occasional consultations with a human financial advisor. This way, you can benefit from both AI's data-driven analysis and human experts' personalized insights.

This is an important list and can help you get off to a good start.

You should read it

- ★ Building a private data security strategy: Challenges with financial businesses

- ★ 7 financial mistakes most people often get

- ★ How to use Excel for financial analysis

- ★ Software Development Consulting: How It Works and Why You May Need It?

- ★ Robots take away their current jobs, but they also create 20 new jobs in the future