Building a private data security strategy: Challenges with financial businesses

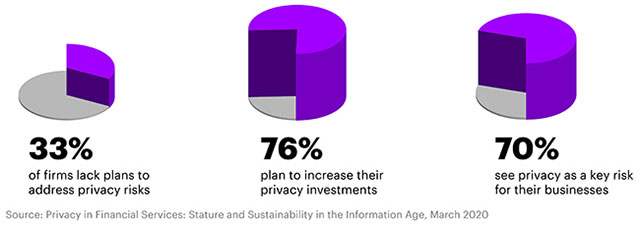

As reported by cybersecurity organization Accenture, up to a third of all businesses operating in the financial services sector lack a clear plan or the resources needed to address security risks. Privacy can occur in relation to their customer data - a truly alarming number, especially for sensitive sectors such as finance.

Accenture's report is based on a survey of 100 executives from banks, insurance and capital markets in North America and Europe. The survey is mainly focused on how companies use, store and protect customer data, as well as the relationship with binding regulations such as the General Data Protection Regulation (GDPR) and Ethics. California consumer privacy law (CCPA) - laws that are designed to ensure consumer privacy.

The increased demand for a clear security strategy

According to the report, 7 out of 10 business executives surveyed (70%) consider privacy to be a major risk for their companies, increasing the need for a clear data security strategy and effective. Note that nearly three-quarters (72%) of companies surveyed are willing to tailor products and services to customers, incorporating privacy into customer benefits by giving customers control. more than their data.

It can be said that with the new sanctions, regulations and huge financial penalties being applied by regulatory agencies, it is not surprising that businesses put customer privacy first. However, how to build an effective customer data security strategy is not easy.

According to experts, companies should consider a greater opportunity to enhance the customer experience around privacy. Consumers are willing to share information if it is valuable to them, such as offering personalized, better service packages or more competitive prices. In general, businesses that know how to position their customers to understand their perceptions, and value data privacy will have more opportunities to make a difference for themselves.

Build trust with customers

When asked about which privacy risks will require the most effort to overcome, financial business managers consider it to monitor privacy risk (51%), accuracy and ability. process records / information assets (44%), and manage records and store / delete data (41%). GDPR and CCPA both have provisions that allow consumers to ask companies to delete their personal data when necessary, making records / user data management an important task for enterprise.

In addition, the report noted that up to 76% of business executives surveyed plan to increase their investment in the security aspect next year, but most of these companies do not have a strategy to protect their businesses. In fact, that may prevent them from reaping the expected value of these investments. In contrast, companies that can devise a clear strategy and convey a culture of awareness, as well as transparency of privacy will make a difference for themselves and build customer trust.