How is the world's largest bank secure?

When global financial activities are increasingly digitized to bring convenience to users as well as for banks. But with that is the concern about card safety, the status of hackers stealing login account information, payment card numbers . makes banks re-enter the security technology race.

The world's leading financial institutions such as Bank of America, Citibank, Barclays . all choose biometric technology in bank security to make transactions more secure and enhance the user experience. According to them, passwords are not safe enough for customers.

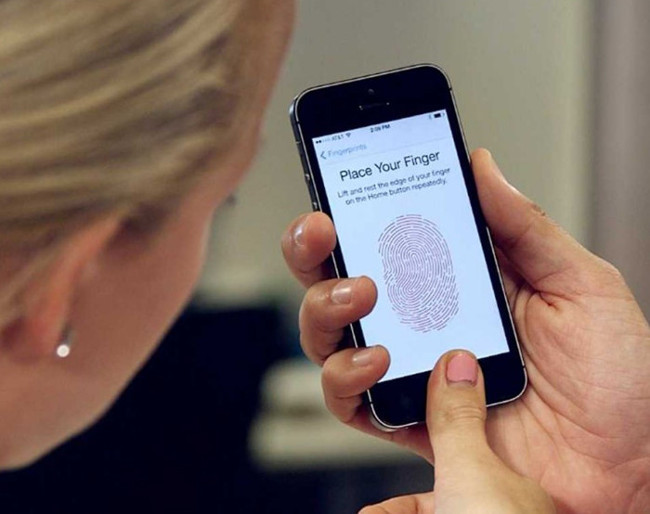

Bank of America: Fingerprint and Touch ID

Banks use Touch ID on Apple's iPhone and fingerprint scanner on Android smartphones as the second security layer.

In September 2015, Bank of America customers started using mobile fingerprint scanners to log in to the banking application on the device, minimizing user hassle.

Barclays: Hitachi Vein ID

Barclays fingerprint scanner

Even Barclays accepts to spend a large amount of money when cooperating with Japan's giant Hitachi to provide 'finger vein' technology to regular business customers with large transactions. Technology is especially safe because of the unique nature of the fingerprint patterns and largely unchanged throughout a person's life.

With this technology, to confirm the transaction, they just need to put a finger in the small desktop scanner instead of entering the password and PIN . Vein ID of Hitachi is currently being used at ATMs throughout Japan and Poland.

Royal Bank of Scotland and NatWest: Fingerprint technology

Royal Bank of Scotland (RBS) and NatWest are the first banks of England to choose security with fingerprint technology on mobile banking. Unlike Bank of America, the technology of RBS and NatWest is only compatible with Touch ID on iPhone. But this is not unsupported, not too big a problem as an average of 1.8 million iPhone users access RBS and NatWest mobile apps about 40 times a month.

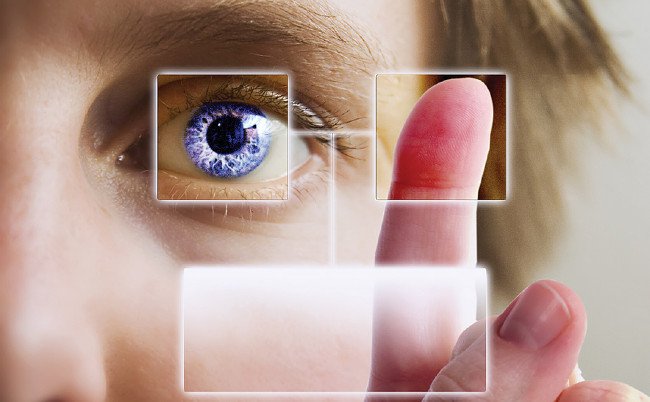

Wells Fargo: Office of Electronic Commerce (CEO)

Like Barclays, Wells Fargo introduced enhanced security features for business customers. Wells Fargo's mobile banking application users - including accountants, CFOs, and large asset owners - can choose between biometric security methods . The first method involves voice data and face . The second method requires photographing white eyes ; The unique red vein patterns in the eye are used to identify an individual and grant access to the application.

Citibank: Voice recognition

Citibank received two Gartner financial services awards in 2015 thanks to the voice recognition project. The new method uses voice to automatically identify a customer who is explaining the problem to a customer care agent over the phone. The system removes the confusing process of identity verification through ID numbers and personal information; Allow consultants to be faster. It took less than 1 minute to create voice samples and in February 2016 there were more than 250,000 US customers registered. According to Citibank Chief Executive Andrew S.Keen, voice biometrics fundamentally change the customer experience, from 'Who are you ' to ' Can I help you? '

When starting to apply new technology, the big challenge of banks is the uncomfortable feeling of users. But deep commitment to security and promotion can address those concerns. Not only in the field of commodity finance, biometrics also show promise in the retail and industrial sectors. Although there are many obstacles to overcome, it certainly plays an important role in banking, business and community in the future.

You should read it

- ★ Things to know about USB fingerprint reader

- ★ The universal face can 'crack' many identification systems

- ★ Facebook was sued collectively because of biometric data collection, which could cost billions of dollars

- ★ Find out how fingerprint security technology works

- ★ Fingerprint recognition will land on Windows Phone 8.1