Google Wallet: 5 things to know

Google's Google Wallet service creates a new platform for mobile payments.

>>>Google launches Google Wallet mobile wallet service

>>> Google against allegations of eBay and PayPal

Google has officially launched the Google Wallet mobile payment platform, turning the smartphone into an electronic wallet to pay anywhere. Here are 5 things you need to know about Google Wallet.

1. Payment anywhere. You will be able to use your smartphone to pay for goods or services. The NFC technology Google Wallet sends extremely short signals to NFC tags (built-in payment devices in stores) close to completing the payment. According to Google's expression, you just need to put your smartphone lightly (or glide through) the store's credit card processor, and simply that. Of course, stores that want to accept this payment method will need to integrate their NFC readers into their credit card processors so that your Google Wallet e-wallet gets paid. Currently, there are 15 big commercial names that accept payments from Google's new electronic wallet, like RadioShack, American Eagle Outfitters, Subway, Macy's, Footlocker and Walgreen .

2. A virtual card type. You can use any existing credit card to transfer money to your smartphone as a Google prepaid card - " Google Prepaid Card ". Google describes this as a " virtual card ", which can receive money transferred from any existing credit card. In general, this (money transfer) process is similar to transferring money from a checking account to your PayPal account. That is, you transfer a certain amount of cash to your Prepaid Card, then use the card to pay at any store that accepts Google Wallet payment wallet. You also have the option of integrating Citi's MasterCard credit card right into your smartphone and saving digital gift cards on Google Wallet for use at member stores.

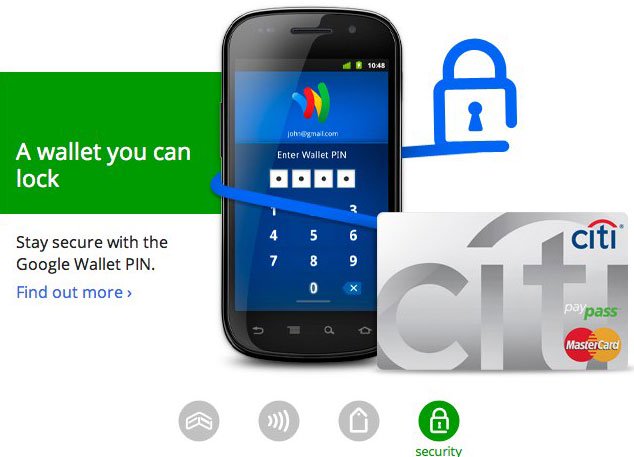

3. Security card. Obviously you don't want someone to steal your smartphone and use it to shop comfortably in stores. So you really want your Google Wallet to be top security. Therefore, from the beginning Google has provided three main features to keep your e-wallet safe. First is a simple PIN code that you will need to enter before making any purchase payments. This basic security measure is the same as when you pay for purchases with a debit card.

Google also created a separate security chip for its e-wallet, called Secure Element . This security chip stores credit card data and insulates the phone's memory. Google said the chip was designed to "self-destruct" if someone tried to intervene and it was built with resistance to laser attack. And finally, Google also uses MasterCard's PayPass technology to encrypt your credit card information when this information is sent from your phone to an NFC card.

Of course, Google cannot protect you absolutely, and the company notes that you will still have to call your credit card issuer to cancel your card if someone steals a smartphone equipped with a Google wallet. Your wallet.

4. Combined with location-based services. Google will use user-based technology to provide services to you. If you don't like being followed by Google everywhere and knowing what you're doing, you probably won't use Google Wallet. The Google Offers program will pinpoint your current location and provide you with countless points of sale in that area that accepts payments with Google Wallet. You will also receive notes from Google Offers about a retailer's store chain selling a specific item for Google Wallet owners.

5. Only the beginning. Currently, Google has only implemented Google Wallet testing for Google Nexus S 4G smartphone running on Sprint network (USA). Until Google applies Google Wallet to many Android devices, to use Google's electronic wallet, your smartphone must run Android 2.3 (" Gingerbread ") or higher to take advantage of NFC capabilities.

Moreover, NFC is not expected to become an inevitable part of smartphones in the next few years. Media chip maker Broadcom estimates that only 10% to 15% of smartphones will be NFC capable next year. Nor did Google expect NFC to become popular until after 2014. That's why ABI Research analyst Mark Beccue thinks Google Wallet is less likely to change the world today, but certainly will have a top position in the mobile payment market when it comes to the time when smartphones integrate NFC become the standard.

According to this position, the journey of NFC mobile payment is as arduous as the first time of POS payment system. NFC is the technology of the future, and now is just the starting point.

You should read it

- ★ 7 measures to enhance security for e-wallets you should not ignore

- ★ Google Wallet will become PayPal's rival

- ★ Vietnamese users can receive money through Google Wallet

- ★ Instructions for paying postpaid mobile bills on MoMo wallet

- ★ [Infographic] The effects of Blockchain on E-commerce and Security