Compare Apple Pay, Samsung Pay and Android Pay

Currently there are many payment solutions that are appearing on the market provided by many different companies, from small startups to big names like Samsung, Google, and Apple. Each solution has its own differences. In this article, I introduce to you three solutions that are currently concerned: Android Pay, Samsung Pay, Apple Pay. Let's see how they work, how different they are and what devices and services are compatible with them.

Before reading the article, please look at the following table to get a general idea. I have added PayPal and Google Wallet for comparison.

What is Apple Pay?

Apple Pay is a payment service developed by Apple and it has been deployed since the end of last year, while Samsung Pay or Android Pay has not been used in the market yet. According to Apple's announcement, more than 200,000 stores in the US accept Apple Pay and the company is still actively working to increase this number.

Active Apple Pay video (4:41 minutes)

The way Apple Pay works is similar to Samsung Pay, which is that you can use your phone in combination with a fingerprint sensor and connect NFC for transactions. The downside to Samsung Pay is that Apple Pay does not support sending information to payment machines using only magnetic cards.

And because only using NFC, Apple Pay has the same limitations as Android Pay because the speed of switching to using NFC payment machines of retailers is generally slow. Even in September, some stores disabled the NFC reader to make customers switch to using another payment system developed by themselves called CurrentC.

But things will change in the coming time because switching to NFC payment machines is an inevitable trend. Even US federal law requires stores to switch to using chip-assisted payment machines from now until 2016, and often chip machines are built-in NFC.

Apple Pay is highly appreciated for its security. At the first step, you still have to enter your credit card information into the Passbook application. However, Apple Pay will NOT SAVE bank card numbers and it will not save on Apple servers. Instead, every time you enter a new card, Apple will create a unique code for that card called " Device Account Number ", each with a separate " Device Account Number " and all of them contained on one Private security chip in iPhone.

When paying with Apple Pay, the iPhone will use the above code to communicate with the cash register, your actual card number will not be revealed. Each time the transaction is completed, Apple will generate one-time code to authenticate the transaction. And yet, Apple Pay also has an additional authentication step that is Touch ID to ensure you are the person who is doing this transaction. Note here that the store will not know the card number or other information about you.

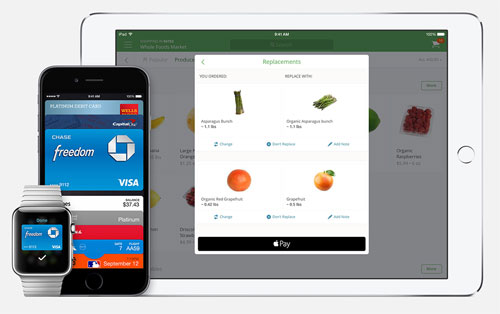

Currently Apple Pay only appears on iPhone 6 and iPhone 6 Plus because it is the first two smartphones of the company supporting NFC. In addition, the Apple Watch is also compatible with this payment service, at which time you do not need an iPhone 6 or 6 Plus, just need iPhone 5, 5c or 5s.

And you note, Apple Pay can also be used to pay both at normal retail stores and online websites or applications, similar to Android Pay.

What is Android Pay?

Introduced at MWC 2015, Android Pay is basically a framework that allows third-party programmers to use to develop their own apps. This is the most noticeable difference of Android Pay, while Samsung Pay and Apple Pay are two independent services. Sundar Pichai, senior vice president in charge of Android, Chrome and Google Apps, said: " We do it the way anyone can build a payment service above Android . In those places like China or Africa, we hope people will use Android Pay to build innovative services ".

In other words, with Android Pay, Google hopes that the company can attract third parties to build better and richer mobile payment solutions. This is a "bold" way of Google. Why? Look at Android, Google only provides basic platform, and hardware is produced by other firms.

The benefit of using Android Pay is that developers do not have to build their own infrastructure to support mobile payments. In addition, when hearing the name Google, users also feel more confident than having to give information to pay for a strange name. And yet, Android Pay can also be verified by fingerprints, support NFC connection to communicate with payment machines, can also be used in both normal stores and online stores.

Google did not disclose the official launch date of Android Pay. It is possible that we will hear about this information at the Google I / O 2015 event in May this year.

In theory, any Android device that supports NFC is able to use development services with Android Pay. If you have a phone with a fingerprint reader, it is better because Android Pay supports quick authentication with this solution besides entering a traditional password.

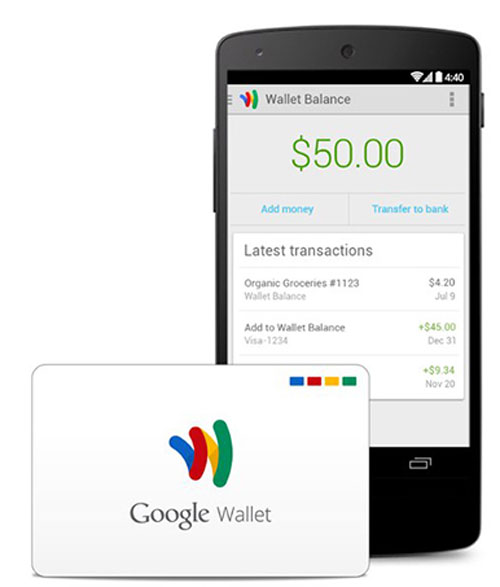

What about Google Wallet? Don't worry, this service will continue to appear. According to Google, you can think of Google Wallet as a service built with Android Pay, and there will be many other similar things that appear in the future. Google recently partnered with Softcard, a joint venture between three major US carriers, Verizon Wireless, AT&T and T-Mobile, specializing in mobile payments. Under the deal, Google will buy Softcard technology, and carriers will pre-install Google Wallet on Android phones they sell.

Wallet was born in 2011 but it was not used popularly, in part because of Google's strategy, partly because stores in the US are quite slow to install NFC payment machines. But in 2016, US business units were forced to upgrade to chip card reader systems and often those systems were already available NFC.

Samsung Pay

This service is a Samsung exclusive service, it is independent of Android Pay and is not related to Google Wallet. The feature that helps Samsung Pay stand apart from rival services is that it can be used with both card payment machines and not just NFC machines. That helps Samsung customers can pay at a much larger number of stores than Android Pay and Apple Pay, which can only use NFC, especially in countries outside the US.

Video using Samsung Pay

To do so, Samsung used a technology called Magnetic Secure Transmission (MST) acquired by Samsung from startup company LoopPay.

Using Samsung Pay is also quite simple. When you need to pay, take out the phone, touch the reader on the device with your finger, then bring the phone closer to the payment station ( NFC or magnetic card ).

Until now Samsung Pay is only available on the Galaxy S6 and Galaxy S6 Edge, both will start selling on April 10. These two new smartphone models have hardware integration to use MST. It is not clear whether Samsung Pay will be used with old Galaxy phones that only have NFC connectivity, and whether it will support payment in online stores ( or shopping apps ). Samsung Pay will begin to be deployed in the US and South Korea starting this summer.

We also do not know how Samsung Pay's transaction security is handled because it does not say much about this issue. Samsung only revealed that users can track the transaction history on their device, and the card-related information will also be contained in a separate security chip manufactured by Infinity. Perhaps Samsung will provide more details when the Galaxy S6 and S6 Edge start selling next month.

It is still very early to conclude whether any form of mobile payment is more convenient and more secure because 2 of the 3 names above have not been officially deployed. Will it be Apple Pay, Samsung Pay or Android Pay? Let's wait and see.

You should read it

- ★ The best touchscreen phones 2011

- ★ Samsung's latest ad scoffs for decades of iPhone history, and of course, don't forget the iPhone X

- ★ Samsung in turn swirled Apple's iPhone

- ★ Samsung admitted it was learning Apple, after a shareholder said his son wanted to buy an iPhone instead of a Galaxy smartphone

- ★ The most compact smartphone worth buying today