How to Refinance an Auto Loan

Part 1 of 3:

Deciding to Refinance

-

Check for prepayment penalties. Before doing anything else, check your current auto loan agreement for any language about prepayment penalties. This is rare in auto loans, but if yours has these penalties, you will have to pay them during your refinance. If you can't locate the relevant language in your agreement, contact your current lender and ask them for assistance.[1]

Check for prepayment penalties. Before doing anything else, check your current auto loan agreement for any language about prepayment penalties. This is rare in auto loans, but if yours has these penalties, you will have to pay them during your refinance. If you can't locate the relevant language in your agreement, contact your current lender and ask them for assistance.[1] -

Refinance to lower your payments. The primary reason most people refinance is to lower their monthly auto loan payment. This can be done in two ways. For one, if you applied for a car loan during a time where interest rates were high or when you had lower credit than you do now, you can refinance and get the same loan duration with a lower monthly payment (because of your now lower interest rate). Alternately, you can refinance for a longer duration if you've fallen on hard times. This reduces your monthly payment by spreading out your payments over a longer time period.[2]

Refinance to lower your payments. The primary reason most people refinance is to lower their monthly auto loan payment. This can be done in two ways. For one, if you applied for a car loan during a time where interest rates were high or when you had lower credit than you do now, you can refinance and get the same loan duration with a lower monthly payment (because of your now lower interest rate). Alternately, you can refinance for a longer duration if you've fallen on hard times. This reduces your monthly payment by spreading out your payments over a longer time period.[2] -

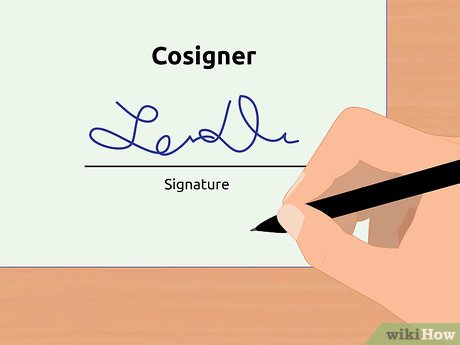

Add or remove a cosigner. Refinancing also gives you a completely fresh loan contract. This comes with the opportunity to add or remove a cosigner on the loan. For example, a young person could remove the cosigner who helped them get the loan in the first place now that they've built up their own credit. Alternately, you could add a cosigner with good credit to your loan to secure yourself a better interest rate.[3]

Add or remove a cosigner. Refinancing also gives you a completely fresh loan contract. This comes with the opportunity to add or remove a cosigner on the loan. For example, a young person could remove the cosigner who helped them get the loan in the first place now that they've built up their own credit. Alternately, you could add a cosigner with good credit to your loan to secure yourself a better interest rate.[3] -

Check your credit score. Before applying for a refinance, check your credit score to see where you stand. If you're refinancing because you think your credit score has improved since you got the original loan, check and make sure that this is the case. Otherwise, you may find it difficult to get a better rate.[4] You can check your credit score for free by visiting a website like Credit Karma or Credit Sesame.

Check your credit score. Before applying for a refinance, check your credit score to see where you stand. If you're refinancing because you think your credit score has improved since you got the original loan, check and make sure that this is the case. Otherwise, you may find it difficult to get a better rate.[4] You can check your credit score for free by visiting a website like Credit Karma or Credit Sesame. -

Assess your ability to get a better rate. In addition to poor credit, several other roadblocks may stand in the way of your refinancing your loan. In general, borrowers will have a hard time getting a refinanced loan for cars that are over a few years old, especially if the car has over 100,000 miles on it. Additionally, it will be very hard to get a refinance if you are "underwater" on your loan (if you owe more than the car is worth).[5]

Assess your ability to get a better rate. In addition to poor credit, several other roadblocks may stand in the way of your refinancing your loan. In general, borrowers will have a hard time getting a refinanced loan for cars that are over a few years old, especially if the car has over 100,000 miles on it. Additionally, it will be very hard to get a refinance if you are "underwater" on your loan (if you owe more than the car is worth).[5]- These criteria vary by lender. For example, one lender may only accept cars less than 7 years old and those between $7,500 and $40,000 in value.[6]

- If you owe more on the car than you make in a year, a lender might not offer you a very attractive interest rate.

Part 2 of 3:

Looking for Lenders

-

Define your goal loan terms. Think about your refinancing goals. Do you want to lower your payments by seeking a lower interest rate or by stretching out your loan? Alternately, you can reduce your total interest paid by refinancing to a shorter loan duration and lower interest rate, keeping your monthly payment close to the same but paying less in interest. Define your ideal refinanced loan and then work from there to identify lenders.

Define your goal loan terms. Think about your refinancing goals. Do you want to lower your payments by seeking a lower interest rate or by stretching out your loan? Alternately, you can reduce your total interest paid by refinancing to a shorter loan duration and lower interest rate, keeping your monthly payment close to the same but paying less in interest. Define your ideal refinanced loan and then work from there to identify lenders.- Even a small reduction in interest rate, like 1 or even 0.5 percent, can mean big savings over the life of the loan.

- For example, a borrower with a 5-year, $25,000 loan at 7.75 percent could save $450 over the life of the loan by refinancing to 6.75 percent after the first year.

- You will also need to know the payoff amount you need. Contact your current lender and ask for the payoff amount on your loan. This will be the principal on your new, refinanced loan.[7]

-

Contact local lenders. Check with your current lender to see if they will refinance the loan for you in-house. If you're looking to switch lenders, start with your local credit unions and banks. Credit unions often offer the best interest rates and are willing to give out auto loans. However, you'll have to open a checking or savings account with the credit union to take out a loan.[8]

Contact local lenders. Check with your current lender to see if they will refinance the loan for you in-house. If you're looking to switch lenders, start with your local credit unions and banks. Credit unions often offer the best interest rates and are willing to give out auto loans. However, you'll have to open a checking or savings account with the credit union to take out a loan.[8] -

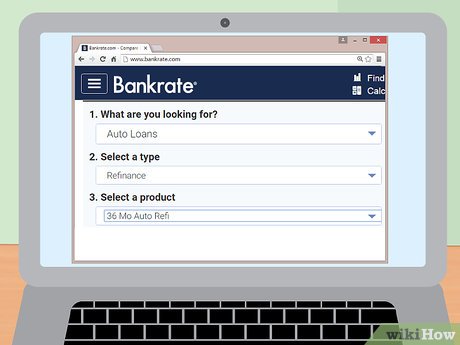

Consider alternate lenders. Check online with an aggregator like Bankrate to see what different lenders in your area and online are offering. Look for the most competitive stated rates and then apply to a few of them to see what you are quoted. Remember to also look at the loan terms for penalties, fees, or otherwise unexpected payment items. [9]

Consider alternate lenders. Check online with an aggregator like Bankrate to see what different lenders in your area and online are offering. Look for the most competitive stated rates and then apply to a few of them to see what you are quoted. Remember to also look at the loan terms for penalties, fees, or otherwise unexpected payment items. [9] -

Limit your credit applications. Don't apply to dozens of lenders for refinance quotes. This can have a negative impact on the credit score you've worked so hard to build up. Instead, check for low offered rates and apply to those to see what quotes you get.[10]

Limit your credit applications. Don't apply to dozens of lenders for refinance quotes. This can have a negative impact on the credit score you've worked so hard to build up. Instead, check for low offered rates and apply to those to see what quotes you get.[10] -

Choose the best loan available. Don't just accept the first deal that comes along. Wait to hear back from a number of lenders. Even if you have found a great deal locally or with a trusted bank, consider applying to at least one more lender just to make sure you aren't missing out on a great rate.[11]

Choose the best loan available. Don't just accept the first deal that comes along. Wait to hear back from a number of lenders. Even if you have found a great deal locally or with a trusted bank, consider applying to at least one more lender just to make sure you aren't missing out on a great rate.[11]- Be ready to give lenders proof of military connections or any other memberships. Doing so might result in a better deal for you.

Part 3 of 3:

Obtaining Your New Loan

-

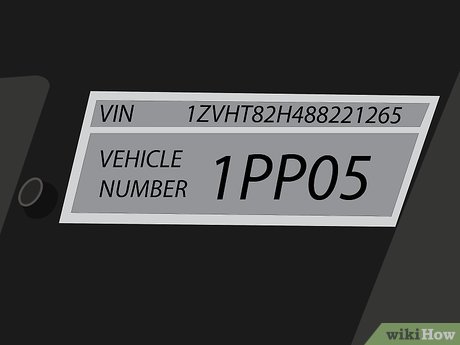

Finalize your chosen loan. Refinance auto loans can typically be applied for online. Visit the website for your chosen lender and apply for an auto loan if you didn't have to apply to get a quote. You'll likely be approved quickly; many lenders approved qualified borrowers in between 15 minutes and an hour. From here, the lender will provide you with a loan agreement and instructions on how to pay off your current loan. Follow their instructions.[12] When you apply, you'll usually need pertinent information like:

Finalize your chosen loan. Refinance auto loans can typically be applied for online. Visit the website for your chosen lender and apply for an auto loan if you didn't have to apply to get a quote. You'll likely be approved quickly; many lenders approved qualified borrowers in between 15 minutes and an hour. From here, the lender will provide you with a loan agreement and instructions on how to pay off your current loan. Follow their instructions.[12] When you apply, you'll usually need pertinent information like:- The year, make, and model of your car.

- The Vehicle Identification Number (VIN)

- Proof of insurance.

- The payoff and remaining duration of your current loan.[13]

-

Choose to pay the loan automatically. Some lenders give you the opportunity to pay your loan automatically out of your checking account or with your credit card. These lenders often offer incentives for choosing this option, such as a lower interest rate. This choice is made during the application process for the loan.[14]

Choose to pay the loan automatically. Some lenders give you the opportunity to pay your loan automatically out of your checking account or with your credit card. These lenders often offer incentives for choosing this option, such as a lower interest rate. This choice is made during the application process for the loan.[14]- If you choose this option, remember to keep enough money in the drafted account so that you aren't charged overdraft fees.

-

Contact your previous lender. Call your previous lender and let them know that you have refinanced. Give them the name and address for your new lender so that they can send over the title for the car.[15]

Contact your previous lender. Call your previous lender and let them know that you have refinanced. Give them the name and address for your new lender so that they can send over the title for the car.[15] -

Submit the required fees. Transferring the title in this way may result in some state fees being charged. You are typically responsible for these fees. These are usually a lien transfer fee, which is usually $5 to $10, and a state re-registration fee, which can be anywhere from $5 to $75.[16]

Submit the required fees. Transferring the title in this way may result in some state fees being charged. You are typically responsible for these fees. These are usually a lien transfer fee, which is usually $5 to $10, and a state re-registration fee, which can be anywhere from $5 to $75.[16] -

Pay off your old loan. Follow through with your new lender's instructions to pay off your old auto loan. You've now successfully refinanced your auto loan.[17]

Pay off your old loan. Follow through with your new lender's instructions to pay off your old auto loan. You've now successfully refinanced your auto loan.[17]

Share by

Lesley Montoya

Update 24 March 2020