How to Live on an Income Under $20,000.00 a Year

Method 1 of 3:

Budgeting a Limited Income

-

Figure out all of your guaranteed monthly income, and how much it adds up to. Successfully living on a limited income is all about making the most of everything you've got. So you need to know what exactly you have available. You only want to add up the income that you know, without any doubt, that you will be receiving each month. While you get overtime, tips, or bonuses, don't account for them here -- if they all turned up empty, you need to know that you can live on your guaranteed income alone.

Figure out all of your guaranteed monthly income, and how much it adds up to. Successfully living on a limited income is all about making the most of everything you've got. So you need to know what exactly you have available. You only want to add up the income that you know, without any doubt, that you will be receiving each month. While you get overtime, tips, or bonuses, don't account for them here -- if they all turned up empty, you need to know that you can live on your guaranteed income alone.- Write this number down as "monthly income."

-

Track your expenses each month with receipts or online apps. Keep all of your receipts to get an accurate picture of your spending habits. Luckily, modern technology has made this easier than ever, as you can log-in online to see your bank and credit card activity. Most banks even break this up by type of spending as well, such as "Food/Groceries," "Gas," or "Rent." Apps like Mint, Mvelopes, and HomeBudget, sync with your financial accounts and provide graphs of your spending each week.[1]

Track your expenses each month with receipts or online apps. Keep all of your receipts to get an accurate picture of your spending habits. Luckily, modern technology has made this easier than ever, as you can log-in online to see your bank and credit card activity. Most banks even break this up by type of spending as well, such as "Food/Groceries," "Gas," or "Rent." Apps like Mint, Mvelopes, and HomeBudget, sync with your financial accounts and provide graphs of your spending each week.[1]- If you spend cash, keep the receipt and make a note of what you bought.

- Write this number down as "monthly expenses"

-

Break your expenses down into fixed, essential, and non-essential to make sense of what you absolutely must buy. Some things, like rent, are due every month no matter what. There are some expenses, like food, that change a bit but cannot be cut much shorter. But there are other expenses that, with hindsight, you realize you didn't need to spend. Putting your expenses into these categories helps you analyze places to save money. If you can, average the expenses from a few months to get a more accurate number.

Break your expenses down into fixed, essential, and non-essential to make sense of what you absolutely must buy. Some things, like rent, are due every month no matter what. There are some expenses, like food, that change a bit but cannot be cut much shorter. But there are other expenses that, with hindsight, you realize you didn't need to spend. Putting your expenses into these categories helps you analyze places to save money. If you can, average the expenses from a few months to get a more accurate number.- Fixed Expenses: Do not change month to month, but are due every single month. Including rent, car/loan payments, etc.

- Essential Expenses: These can't be avoided -- food, transportation, utilities -- but can potentially be cut down through careful budgeting and saving.

- Non-Essential Expenses: This is your entertainment, fun, and everything else fund. More often than not this is where you will be able to save the most money.

-

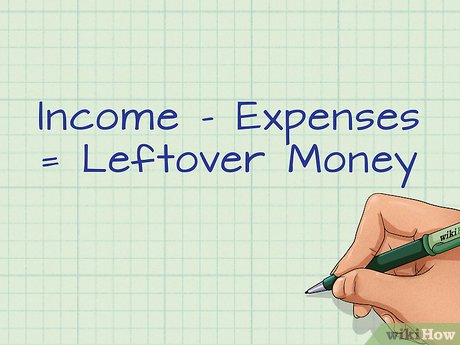

Determine how much free money you have by subtracting expenses from income. This is the amount of leftover money you have. Add back in the money from "Non-Essential Expenses" to determine the amount of money you have left after essential bills are paid. Now you know exactly how much free money you can spend every month and still live and pay rent.

Determine how much free money you have by subtracting expenses from income. This is the amount of leftover money you have. Add back in the money from "Non-Essential Expenses" to determine the amount of money you have left after essential bills are paid. Now you know exactly how much free money you can spend every month and still live and pay rent. -

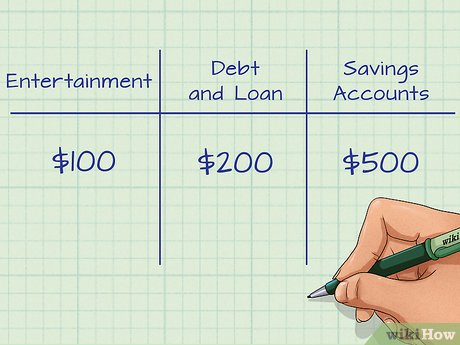

Split the rest of your money into broad categories to help you spend wisely. Once you know your expenses and your income, you know how much money you should have left for entertainment, debts, and savings. Figure out what you plan to spend on each category now to see how feasible each month will be.

Split the rest of your money into broad categories to help you spend wisely. Once you know your expenses and your income, you know how much money you should have left for entertainment, debts, and savings. Figure out what you plan to spend on each category now to see how feasible each month will be.- Entertainment: Everyone deserves to have fun, no matter how much money they make. Having low income doesn't mean you don't get to enjoy yourself. However, you need to be careful about spending your limited income. Having an "entertainment budget" will help.

- Debt and Loan Payments: Debt adds up quickly, and the faster you pay it off the more money you ultimately save. You should always have an eye on paying off debt with spare money. Whenever possible, pay more than the "minimum payment." to avoid growing interest

- Savings Accounts: Even low-income workers need to save -- as it is an essential safeguard in case of an emergency like a layoff or injury. You want at least three months of expenses covered, if not six.[2]

-

Repeat this record-keeping every month to find potential issues or savings before they surprise you. The enemies of a good personal budget are surprises. You cannot do this once and get a perfect budget, and you may find that you can spend or save more than you thought with practice. When you are living on a limited income, you need to keep an eye on your money regularly.

Repeat this record-keeping every month to find potential issues or savings before they surprise you. The enemies of a good personal budget are surprises. You cannot do this once and get a perfect budget, and you may find that you can spend or save more than you thought with practice. When you are living on a limited income, you need to keep an eye on your money regularly.- At the end of the month, compare how you did in reality to how you planned in your budget. Find the places where there were differences and think about how you can fix it.

Method 2 of 3:

Saving Money Everyday

-

Meal plan to get the most out of each grocery store run. Knowing what you are eating ahead of time is essential to avoid throwing out food or over-buying. It also helps you match up ingredients between meals, meaning you can buy some things in bulk to save money. Start small by planning only your dinners, making use of leftovers and carrying over ingredients whenever possible. As you get used to it, expand to plan lunches and breakfasts, ensuring you have the perfect amount of food at the right price.

Meal plan to get the most out of each grocery store run. Knowing what you are eating ahead of time is essential to avoid throwing out food or over-buying. It also helps you match up ingredients between meals, meaning you can buy some things in bulk to save money. Start small by planning only your dinners, making use of leftovers and carrying over ingredients whenever possible. As you get used to it, expand to plan lunches and breakfasts, ensuring you have the perfect amount of food at the right price.- Buy fruits and vegetables "in-season" to save money and get fresher food.

- Always buy generic or store-brand products. They are just as good and much cheaper. Generic medication must be exactly the same as name brand, too.[3]

-

Cook meals yourself, saving leftovers for lunch, instead of eating out. Restaurant food will rack up your budget quickly, leaving you with little for the rest of the week. Luckily, healthy foods are often the cheapest, and they are versatile enough to be in many dishes:[4]

Cook meals yourself, saving leftovers for lunch, instead of eating out. Restaurant food will rack up your budget quickly, leaving you with little for the rest of the week. Luckily, healthy foods are often the cheapest, and they are versatile enough to be in many dishes:[4]- Fruits and vegetables

- Canned tomatoes and beans

- Ground turkey

- Peanut butter

- Whole-wheat bread

- Tuna

- Eggs, milk, and plain yogurt

- Oatmeal

- Seasoning to make different meals with similar ingredients.[5]

-

Buy used or second-hand goods like furniture, clothing, and appliances. The majesty of the internet has made finding deals easier than ever. Head to Craigslist or eBay or, better yet, your local flea market. You'll save money, and you'll save perfectly great things from rotting in a landfill.[6]

Buy used or second-hand goods like furniture, clothing, and appliances. The majesty of the internet has made finding deals easier than ever. Head to Craigslist or eBay or, better yet, your local flea market. You'll save money, and you'll save perfectly great things from rotting in a landfill.[6]- If you're willing to clean or fix up objects a bit you can often get them for next to nothing. Don't ignore lightly worn or dirty items.

- Be ready to bargain. This doesn't mean you have to be harsh -- let people know your situation and a decent compromise and most people will give you a discount.

-

Buy items you use regularly in bulk. You can shave off some dollars from your "essential expenses" if you buy more things at once. You can grab toiletries, food, and cleaning supplies through the internet or at bulk stores to slash your expenses down bit by bit. Note, however, that you likely need to pay more upfront to get goods in bulk.[7]

Buy items you use regularly in bulk. You can shave off some dollars from your "essential expenses" if you buy more things at once. You can grab toiletries, food, and cleaning supplies through the internet or at bulk stores to slash your expenses down bit by bit. Note, however, that you likely need to pay more upfront to get goods in bulk.[7]- Unit price, the small "price per pound/ounce/gallon/etc." at the bottom of the price tag, is essential when buying in bulk. The bigger the item, the lower the unit price.

-

Keep an eye out for free entertainment. There is so much to do that costs absolutely nothing -- and all you have to do is look. Check out bars with free music, local art galleries or museums (that often have free nights), or your Parks and Recreation Department calendar. The classics -- going for hikes, setting up game or movie night, adult sports leagues -- are also great ways to make your own fun without spending a dime.

Keep an eye out for free entertainment. There is so much to do that costs absolutely nothing -- and all you have to do is look. Check out bars with free music, local art galleries or museums (that often have free nights), or your Parks and Recreation Department calendar. The classics -- going for hikes, setting up game or movie night, adult sports leagues -- are also great ways to make your own fun without spending a dime.- Join a group or adult team to get weekly fun for almost nothing.

- Many cities have websites devoted to free activities, like San Francisco's SF FunCheap.com. Do some online searching to see what's in your area.[8]

-

Shop with a purpose. Know what you are buying before you go to the store, and stick to it. Making lists of priorities, essentials, and goals will help you keep your head on straight when shopping, allowing you to make the most of every dollar. Remember -- every time you buy something you should ask, "do I need this? will this significantly increase my quality of life a week or month from now?" If you come into each store with a plan you can avoid impulse buys or indecision.

Shop with a purpose. Know what you are buying before you go to the store, and stick to it. Making lists of priorities, essentials, and goals will help you keep your head on straight when shopping, allowing you to make the most of every dollar. Remember -- every time you buy something you should ask, "do I need this? will this significantly increase my quality of life a week or month from now?" If you come into each store with a plan you can avoid impulse buys or indecision.

Method 3 of 3:

Preventing Overspending

-

Give yourself a savings goal, something to strive for instead of spending money. Why are you living on $20,000 or less, and how do you want to change things? Maybe you want to go on vacation, buy a car, move to a new city, save for school, etc. If you have a tangible reason to save money, it will be much easier not to blow it on a new video game. Give yourself an exciting financial goal and saving will be much more doable no matter what your budget is.[9]

Give yourself a savings goal, something to strive for instead of spending money. Why are you living on $20,000 or less, and how do you want to change things? Maybe you want to go on vacation, buy a car, move to a new city, save for school, etc. If you have a tangible reason to save money, it will be much easier not to blow it on a new video game. Give yourself an exciting financial goal and saving will be much more doable no matter what your budget is.[9] -

Try to live in a lower-cost area or city. Living off of $20,000 a year or less is very hard in NYC or San Francisco, though not impossible. Your dollars go a lot further in smaller towns, rural areas, and inland cities. While your salary or income might not be changing, you can change its relative value by moving to a city where everything costs less.

Try to live in a lower-cost area or city. Living off of $20,000 a year or less is very hard in NYC or San Francisco, though not impossible. Your dollars go a lot further in smaller towns, rural areas, and inland cities. While your salary or income might not be changing, you can change its relative value by moving to a city where everything costs less.- Search online for "Cost of Living Comparisons," which provide up-to-date information on prices across the country.

- Aim for rent to be no higher than $600, and much less when possible. This is a good financial cap for a $20,000 a year job.[10]

-

Cut down on addictive and needless habits like smoking, coffee, and sweets. Spending just $3 on coffee every day quickly adds up to $90 a month, or at least 5% of your total yearly income. Cigarettes will get even more expensive. At the end of the day, saving money and budgeting requires sacrifices -- you should find a way to cut out these needless expenses.

Cut down on addictive and needless habits like smoking, coffee, and sweets. Spending just $3 on coffee every day quickly adds up to $90 a month, or at least 5% of your total yearly income. Cigarettes will get even more expensive. At the end of the day, saving money and budgeting requires sacrifices -- you should find a way to cut out these needless expenses.- Even cutting these habits in half can make a big difference and is a great starting point.

- Find alternative, cheaper habits whenever possible. Whenever you get an urge (smoking), fill in your new habit (taking a walk around the block) as a replacement.[11]

-

Use credit cards very sparingly, making sure you can pay off in full each month. Credit cards aren't free-- they come with interest rates that will gouge your paycheck if you let them run rampant. Managing your money wisely means using your credit cards wisely-- as extensions of your well-planned budget. Some things to remember:

Use credit cards very sparingly, making sure you can pay off in full each month. Credit cards aren't free-- they come with interest rates that will gouge your paycheck if you let them run rampant. Managing your money wisely means using your credit cards wisely-- as extensions of your well-planned budget. Some things to remember:- Know your rates and how they can change. If confused, call your bank and make sure you understand your terms and interest.

- Pay more than the monthly minimum whenever possible, as this decreases later interest payments.

- Stay within 30-40% of your credit card limit. You never want to be reaching your limit, as the interest will become exponentially worse. Staying at our below 20% is a good benchmark for cautious spenders.[12]

-

Take cash out from the bank, separating it into envelopes for each expense if you struggle to budget. A debit card can be dangerous -- you keep spending without seeing the money leave. If you struggle to hit a budget, take all the expense money out at the beginning of the month and put it into envelopes -- food, gas, rent, utilities, fun, etc. This ensures you only spend the money where it was meant to be spent.[13]

Take cash out from the bank, separating it into envelopes for each expense if you struggle to budget. A debit card can be dangerous -- you keep spending without seeing the money leave. If you struggle to hit a budget, take all the expense money out at the beginning of the month and put it into envelopes -- food, gas, rent, utilities, fun, etc. This ensures you only spend the money where it was meant to be spent.[13] -

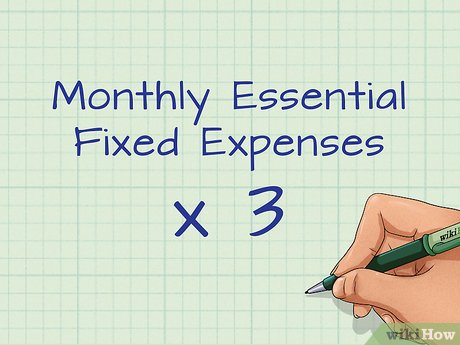

Ensure you have 3-6 months living expenses saved at all times. Many financial advisers even suggest going further, saving for at least 9-12 months, but 3 is the bare minimum. You need to be financially prepared in case of emergencies. Remember, also, that this money should only be spent in emergencies.

Ensure you have 3-6 months living expenses saved at all times. Many financial advisers even suggest going further, saving for at least 9-12 months, but 3 is the bare minimum. You need to be financially prepared in case of emergencies. Remember, also, that this money should only be spent in emergencies.- Multiply your monthly essential & fixed expenses by 3 or 6 months to get a good number for savings.

Share by

Marvin Fry

Update 28 March 2020