Want to be rich, apply money management method 50/20/30

- Throwing money through the window because I don't know how to manage spending on the following three issues

- Applying 10 things, the goal of financial autonomy at age 30 will come to you

- Applying this tip you can save money super effectively even if your salary is not high

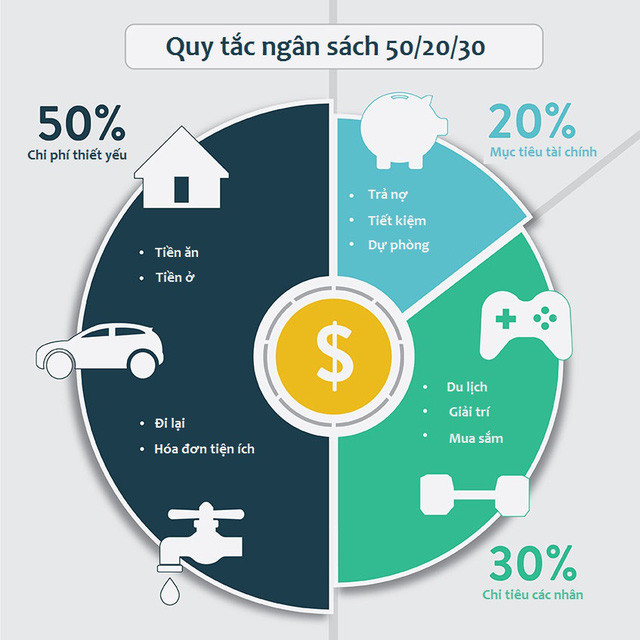

You are a student, or a working person, you are headache to find a way to manage your budget to care for the future later. If you are wondering yet mastering the art of the budget, you can learn 50/20/30 rules , a simple framework to divide your money.

Budget management is not simply about paying bills on time, but determining what items to spend and what items to spend. For example, when traveling, you should calculate in advance what you should spend, what to buy, to avoid overreacting.

How does this rule work?

This rule will break your income into 3 main categories with the following percentages:

1. 50% spent on necessary and fixed elements

To start implementing this method, spend about half of your monthly income on the needs of life. 50% of the salary with many people 's spending will probably be enough, but for many people the figure of 50% is too little. So see the categories you need to spend in this account.

Clearly, essential expenses are those that you definitely have to spend regardless of where you are, what you do or what plans you have in the future. Usually, these costs are usually the same for most people, including meals, accommodation, travel expenses and utility bills like electricity and water.

With the above expenses, you should calculate how to make the total cost not exceed 50% of the salary. If the number is higher, don't be discouraged. For example, if your fixed cost is up to 60%, you will have 2 options:

- Find ways to reduce money bills

- Reduce 5% on each subsequent category, more flexibility and make a difference. (Experts advise you to cut down on flexible spending, not reduce your financial goals).

2. 20% spent on financial goals

The next salary you should use to spend on financial goals, prepare for the future and take care of yourself. This amount we need to spend on savings, self-contingency and indispensable are the debts you need to pay in the course of study as well as the previous job.

3. 30% of flexible spending

This final spending will be used for your personal spending fund such as shopping, travel, entertainment .

Once you have the necessary expenses and your savings, you can enjoy and reward yourself after hard work or meeting friends. Distributing reasonable expenses will help you avoid debt this month.

It should also be noted that whether you spend 50% on fixed costs, pay attention, watch out and cut down on wasteful spending. These will help you keep your financial priorities perfect.

Rule 50/20/30 is a great starting point for us when we need an easy-to-remember structure to allocate spending appropriately. This rule offers a flexible way to fit your 'unique' financial situation.

However, it should be noted that this 50/20/30 rule cannot be applied perfectly to everyone in any case that they are just a guide for you to apply flexibly to the fund my book. You can flexibly change the percentage based on your own finances.

Having fun!

You should read it

- ★ 10 ways to save money so you don't have to cut down on your friends

- ★ 11 bad habits that prevent you from getting out of debt

- ★ Throwing money through the window because I don't know how to manage spending on the following three issues

- ★ Attendance of 20 things is wasting your money

- ★ Misa: App effectively manage spending on phone and usage