Financial management method '6 jars' JARS

This article was published by Steve Martile , a life coach and author of personal improvement blog FreedomEducation.ca. Below Steve Martile has described in detail the six-jar money management method, which reminds me of Elizabeth Warren 's financial balance .

The JARS financial management method with just six jars is a world-renowned personal finance management formula that has been used for hundreds of years by successful people. In particular, they also passed on this useful method to educate thinking and striving to succeed for the next generation.

Managing money does not take away freedom - it creates freedom.

Surely this is not the first time you've heard of this method, right? If you want financial autonomy, you must start managing your own money. And I started doing this in 2006 after reading the book " Secrets of the Millionaire Mind " by T. Harv Eker.

Before that, my wife and I often only managed spending according to daily routine. We usually spend a lot of money on a monthly basis and don't save much. At the time, I was running the new Nissan 350Z brand, and earned a sum of $ 800 per month, excluding insurance and fuel costs for transportation.

JARS: Financial management method with 6 jars

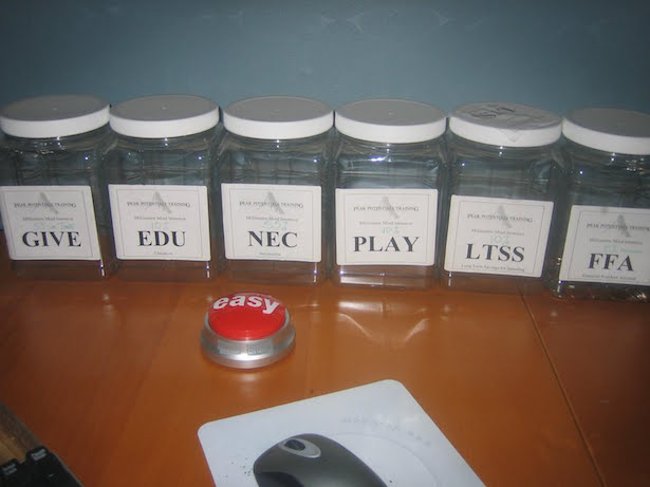

Then we started using the 6-bottle money management system mentioned in the book " Secrets of the Millionaire Mind ". What are those jars? Glass jars or plastic jars. Below is a photo of jars from my office:

The jars themselves are not really important. It is important that your personal financial management system. In fact, we buy jars as a direct reminder of the expenses when managing them. However, the six jars ( which can be safes or bank accounts ) - we call them six funds. Each bottle has a certain name and function.

Manage money to achieve success

As soon as I started financial management, I bought 350Z. After the first year, without any major changes in income and all costs are paid equally, our property value increases significantly by about 45%. When learning how to apply this system, we realized that it is quite simple and does not take too much of your own time.

Below are the results we obtained after applying JARS within 12 months:

- Net worth ( net worth ) increased by 45%.

- Buy the first house worth $ 337,000.

- $ 800 passive income per month by renting a basement.

- $ 200 interest from bank savings accounts. At that time, we used the ING Direct savings account which enjoyed 3.5% benefits.

- Creating peace in relationships because everyone has their own money.

The real secret to financial management is not what you do, but how you do it .

The name and usage of each vial are as follows

I consider 6 jars that represent 6 financial funds with certain names and functions. Whenever you have money ( salary, bonus, sales profit or whatever income source ), divide this money into 6 jars right away. This should be done right away to create a habit.

Essential needs (Necessity account - NEC - 55%)

Essential demand fund NEC helps ensure daily necessities of life. You use NEC fund to pay for food, living, entertainment, shopping bills and other expenses. Simple, it includes anything you need to live, things needed in life.

Note: If your NEC fund is currently above 80% of your income, you need to increase your income or cut costs to achieve financial freedom.

Financial freedom fund (Financial freedom account - FFA - 10%)

Financial freedom fund is when living a life as you desire without necessarily working or financially dependent on others. Therefore, you need to set up a FFA fund to have money to work on your behalf. In this way, you have created " goose " to lay golden eggs to use when no longer working. Remember: you can only use this fund to invest and generate passive income. The more money you work for, the less work you'll have to do.

Note: Never eat geese!

Education and training (Education account - EDUC -10%)

You need EDUC education training fund to train yourself every day. The best source of investment is investment in learning, the greater the " stature " of knowledge, the greater the appeal of big things, whether it's money, fame or happiness. Use EDUC funds to develop yourself by buying books - reading every day, taking courses, training, speaking or meeting, interacting to learn from successful people.

Long-term saving for spending accounts (LTSS - 10%)

You need LTS long-term savings because it's important not how much you earn, but how much you keep. Use funds for long-term goals and fulfill your dreams. Remember that this fund cannot be used without financial freedom.

Enjoy (Play account - PLAY - 10%)

The Foundation enjoys PLAY to nurture yourself, help you show your love, enjoy the feeling of successful people, do things like successful people and improve your ability to receive. Use the PLAY fund to do everything your heart desires: go to unprecedented places, take your spouse or family to a luxurious restaurant . On the last day of the month, you must Spend all the money in this fund.

Give away (Give Account - GIVE - 5%)

The fund gave GIVE to help show gratitude for life. Because life is a sharing, giving away is getting back. Use GIVE funds to make charities, help relatives, family and friends. Besides, you can use the money in this jar to give gifts to family and friends on birthdays, special occasions as well as holidays.

How does the JARS money-saving method work?

Below is a sketch of how we use 6 jars. In fact, we do not use jars but instead are 6 bank accounts. All our accounts are electronic savings accounts with essential needs accounts (NEC) which is the only exception: checking accounts. Trisha and I send all personal income to an essential needs account. Because the money in your account is essential to pay all your daily living expenses. And the money is divided equally for the remaining 5 accounts.

Luckily, I soon realized that the ratio between the jars was not important. To ensure financial success, just start using and building habits. That's the important thing.

You can even start spending $ 10 on each jar every month. There is an inspirational story in the " Secrets of the Millionaire Mind " that I have read: " A woman started dividing $ 1 into each bottle every month. In the first month, she left 10 cents. on PLAY, 10 cents on FFA, 10 cents on LTSS and so on, after that, she used 10 cents to buy chewing gum, and she received a mini comic book with a package of candy. She read comics, chewed gum and laughed, Two years later, she sent $ 10,000 into her FFA account, and who is laughing now ? "

Note

Giving money to these jars should be done EVERY DAY . If you work every day and the money only increases at the end of the month, then you are only working, earning money. Look for more passive sources of income to supplement your daily income.

PLAY enjoyment fund needs to be consumed continuously and must end at the end of the month. If you have excess money, you need to balance your life by thinking about caring for yourself. On the contrary, if you lack, you need to focus on making your money.

Regarding FFA financial freedom fund, you should never spend money in this fund but only use it to invest in generating passive income.

The ratio between the jars is not important. To ensure success in financial management, you just need to start using the system and build habits. New habits really are the key to success.

Refer to some more articles:

- 14 important steps to help you quickly get out of debt

- 7 personal financial management tips to know before age 30

- Top 10 most income-generating home jobs today

Good luck!