What's going on with Bitcoin?

'Winter is coming' is a famous quote in the movie Game of Throne, referring to a difficult period of winter and always being vigilant about the harsh weather.

With Bitcoin players, they can feel more clearly than ever, altcoin winter (grass coin, junk coin) is coming very close. A wide range of coins from diverse ecosystems like Ethereum, Binance Coin to trash like Dogecoin are all growing strongly despite Bitcoin's decline.

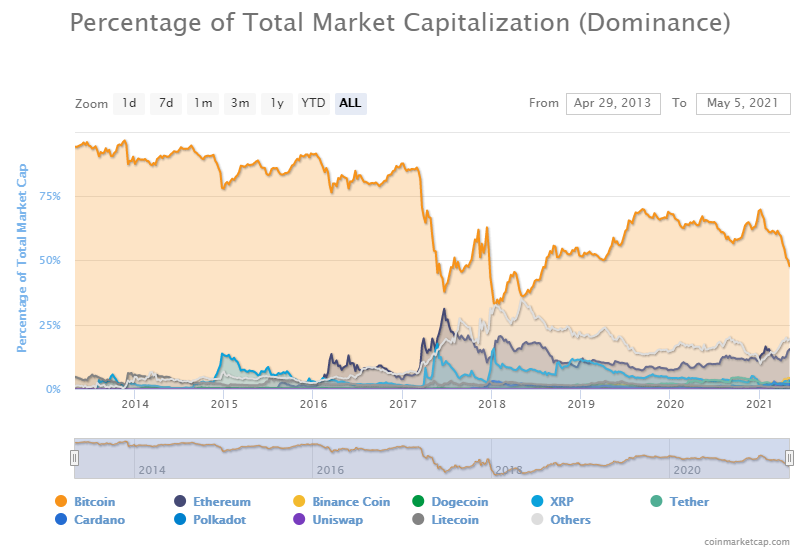

Indeed, for the first time since the end of winter 2018, when the virtual currency market experienced the worst bloodbath in history, Bitcoin has dominated less than 50% market share.

At the time, Bitcoin was very close to the $ 3,000 resistance mark and one saw a dystopian prospect of a complete market crash. Finally, Bitcoin still holds over 50% market share and the harsh winter is over.

Now, with a value of $ 54,000 and a capitalization of over $ 1,000 billion, Bitcoin is only 45.4% market share while it is just summer on Earth, but altcoin winter is very close.

This winter was signaled by a series of shark blow-ups that made Dogecoin's price abnormally high, peaking at $ 0.59, up 700% from April when Bitcoin peaked at $ 64,000. Dogecoin's market cap is also at an unprecedented high, reaching $ 76 billion although Dogecoin inflation will occur every year at a rate of 5 billion newly born.

Dogecoin's rally is expected to slow, but not other altcoins. The two capitalization currencies behind Bitcoin, Ethereum and Binance Coin, are continuously making new highs over the past few days, although their capitalization is still quite far from the number one, 390 billion and 97 billion USD respectively.

These coins are working to extend their influence on other alternative coins (tokens) on its ecosystem. Ethereum has become the primary option for buying virtual works of art (NFT) that exploded in February. By this June, Binance also entered the game by opening the NFT market.

Meanwhile, what creates value for Bitcoin is still the same, which is the terrible power-consuming process as well as the limit of 21 million coins created. Other infinite digital coins solve this problem by burning coins, a process of destroying virtual money by transferring it to a locked wallet.

However, Bitcoin and cryptocurrencies in general are seriously threatening the existence of central banks, which are the balance that controls the economy. This prompted the Bank of Turkey to ban cryptocurrency payments mid-last month, effective April 30.

Such bans targeting cryptocurrencies could cause Bitcoin to decline further, while altcoins suffer less due to their smaller capitalization. The balance of difference between Bitcoin and the rest is likely to be corrected further if more crypto market bans are enacted such as in Turkey.

How to renew an ATM card when the ATM card expires

How to renew an ATM card when the ATM card expires How to calculate the interest rate for bank deposits

How to calculate the interest rate for bank deposits How to change your username Vietcombank iB @ nking

How to change your username Vietcombank iB @ nking How to cancel active SMS on Vietcombank Mobile

How to cancel active SMS on Vietcombank Mobile Instruction to register F @ st Mobile Techcombank fingerprint

Instruction to register F @ st Mobile Techcombank fingerprint What is AirPay? Which bank does AirPay link to?

What is AirPay? Which bank does AirPay link to?