How Is Loan Interest Calculated?

We have AdvanceSOS CEO and founder Nick Wilson to thank for sharing his expertise for this article. As an experienced loan officer, Nick imparts his wisdom on the loans industry and some trade tricks. AdvanceSOS's easy and fast application helps you reach direct lenders and get payday loans in California, Florida, Texas, Ohio.

What is Loan Interest?

Loan interest is the price you pay your lender for lending you money. It's compensation for your lender, who took a certain amount of risk to serve you when you needed it. Remember borrowing $100 some time ago but ended up paying $110 in the end? $10 was the fee you paid your lender, also called loan interest.

How to Calculate Loan Interest?

Terms to Remember: Principal vs. Interest

Your loan principal is the exact amount you borrow from a lender. The loan interest is the added charge or fee you pay your lender for their service. Your loan principal and interest added together is your repayment amount.

Interest Type 1: Simple Interest

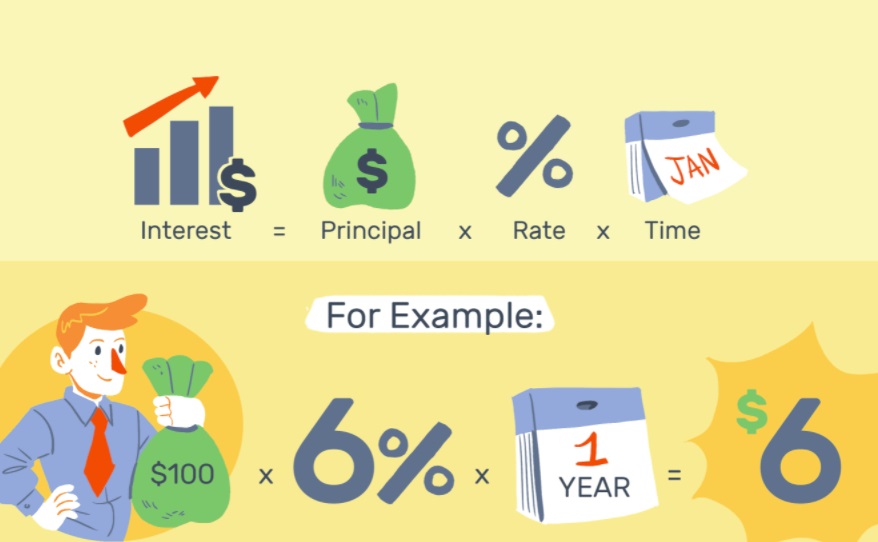

Know the following to calculate for simple interest:

- P = principal amount (the money you borrowed/borrowing)

- r = rate (interest rate expressed in decimal form: ex. 10% = 0.1)

- t = time (loan term in years)

Then use the following formula to calculate your total interest amount:

A=P ×r×t

If, for example, you took out a loan of $1,000 for a year with a simple interest rate of 6%. Your calculation will be as follows:

A=$1,000 ×0.06×1 yearA=$60

Interest Type 2: Compound (Amortizing) Interest

Know the following to calculate for your compound (amortizing) interest per month:

- r = rate (interest rate expressed in decimal form: ex. 10% = 0.1)

- m = the number of payments you must make per year

- b = your remaining balance that month

Then use the following formula to calculate your interest amount for that month:

A=(r/m)×b

To calculate your total interest, add all your monthly payments.

For example, you borrowed $1,000 for a year with 6% compounding interest and paid for it monthly. Your calculation for your monthly interest payments will be as follows:

Month 1: A=(0.6/12 payments) × $1,000 = $50

For Month 1, you must pay $50 for interest. Your Month 2 calculation will now depend on how much you pay to your principal. If you spend $100 towards your principal, your Month 2 interest calculation will be as follows:

Month 2: A=(0.6/12 payments) × $900 = $45

For month 2, there is now less interest for you to pay - $45.

What Can Affect How Much Interest You Pay?

Loan Amount

The more significant the amount you borrow, the more risk it is to your lender. Your lender will charge you higher interest to make up for this risk.

Interest Rate

Higher interest rates are obvious markers that a lender may be charging you too much. But how your lender calculates the rate compared to your principal may matter more.

Loan Term

The loan term always matters in calculating loan interest. The longer you hold onto the loan, the more interest you must pay. It's the fee for the extra time your lender does not have their money back.

Repayment Schedule

The more often you repay your loan, the sooner you can finish it off. The sooner you fully repay your lender, the less interest you pay.

Repayment Amount

The amount per payment matters, of course. Paying in bulk faster will decrease your loan interest as your lender gets their money back quickly.

How Can You Get the Best Loan Interest Rate?

Optimizing Your Credit Score

Your credit score is your number one asset when borrowing money in the US. Review and 'fix' your credit score as needed. See if there are questionable entries on your credit report. Report if you find any to make sure your score represents you right.

Choosing a Shorter Repayment Schedule

Shorter is better when choosing a repayment schedule. Again, this has to do with how your lenders want their money back ASAP. Plan your loan and pick a due date as close as you can tolerate, avoiding high interest.

Improving Your Debt-To-Income Ratio

The more debt you have, the more dangerous (credit-wise) you look to lenders. The riskier you look, the more interest you will pay your lender. Pay back your loans before getting new ones to avoid high interest.

About the Author | Amanda Girard

Amanda Girard is a senior financial copywriter AdvanceSOS is proud to have. Amanda has led, with grace, the content writing team of Advance SOS since its founding. We can publish quality finance articles for our valued customers like you, thanks to her.