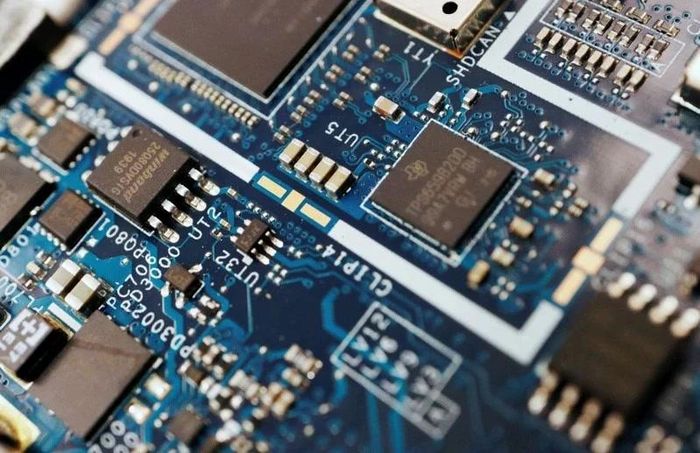

China is concerned about the US's move to tighten chip export regulations

China expressed concern about the US move to tighten regulations on exported semiconductor products, saying that these regulations have created more obstacles to trade activities and caused more instability. for the chip industry.

US President Joe Biden's government last week revised regulations to limit China's access to US artificial intelligence (AI) chip products and chip manufacturing tools.

This is part of a larger effort to rein in China's chip manufacturing industry due to national security concerns.

Over the past five months, the US has implemented regulations aimed at blocking the shipment of more advanced AI chips designed by Nvidia and other companies to China. It is expected that the revised regulations will take effect from April 4.

The new regulations clarify that restrictions on shipping chips to China also apply to laptops containing these chips.

The US Department of Commerce, which oversees export controls, said it plans to continue updating restrictions on technology shipments to China to strengthen and refine the measures.

A spokesman for China's Ministry of Commerce said: "The US has expanded the concept of national security, been inconsiderate in revising regulations and tightening control measures. That not only causes more obstacles and a heavier regulatory burden for Chinese and American companies that want to cooperate normally with each other economically and commercially, but also causes great instability for global semiconductor industry.'

The spokesman said the US move had 'severely affected the mutually beneficial cooperation between Chinese and foreign companies.'

In October 2023, the US applied regulations prohibiting companies such as Nvidia and AMD from stopping semiconductor exports. A spokesperson for the Chinese Ministry of Foreign Affairs said China is willing to work with all parties to strengthen mutually beneficial cooperative activities and promote the security and stability of the global semiconductor industry, as well as supply chain.

Meanwhile, the race for leadership in the growing high-bandwidth memory (HBM) chip market is increasingly fierce, as Nvidia reveals plans to secure orders for advanced components from Samsung Electronics, The Korean chip giant is looking to overcome rival SK hynix. Mr. Jensen Huang, co-founder and CEO of Nvidia, recently publicly supported Samsung Electronics and revealed its plans to use HBM chips. produce this Korean chip in the future.

US-based Nvidia is the largest buyer of advanced HBM chips - which have become key components for artificial intelligence graphics processing units.

In response to Mr. Huang's support for Samsung, industry officials explained that Nvidia may want to implement a multi-vendor strategy to minimize the risk of having only one supplier.

When new memory chips are developed, they go through a quality testing process to verify compatibility with the customer's product. When a chip qualifies, it means it is ready to begin mass production.

HBM chips have come into the spotlight as a new technology that stacks DRAM chips vertically to speed up data processing. HBM3 is currently widely used, but chip manufacturers are introducing an extended version HBM3E.

SK hynix is expected to be the first supplier to supply the 8-cell HBM3E to Nvidia, as it announced that it has begun mass production and plans to supply the advanced chip to Nvidia later this month.

To secure the advantage, Samsung claims to have developed the 12-cell HBM3E, with the industry's largest capacity of 36 gigabytes, and says it plans to begin volume production in the first half of this year.

The company also confirmed that it is preparing to mass produce the 8-cell HBM3E around June and July. Micron Technology also said it will begin mass production of HBM3E and deliver products to Nvidia in the first half of this year.

Although HBM chips currently only account for about 1% of the total memory chip market in terms of revenue, it is expected to rapidly expand its presence following the AI boom.

According to market tracking firm TrendForce, SK hynix is currently the leader in the HBM market, securing about 53% of the market volume, while Samsung accounts for about 38%. US-based Micron Technology accounts for the remaining 9% of the market.

At the regular shareholder meeting on March 20, Samsung Chairman Kyung Kye-hyun, in charge of the company's chip division, said: "This year will be a year of complete recovery and growth (for with Samsung)."

'We will regain the No. 1 position in the global chip industry in the next 2-3 years,' he added, saying the company will start mass production of 12-layer HBM3E chips in the first half of this year.

According to experts, global chip demand, mainly for data centers related to AI and the electric vehicle (EV) sector, is expected to begin to recover in the second quarter of 2024, when manufacturers Large chip manufacturers increase output, thereby boosting the global economy.

Nikkei surveyed 10 institutions and individuals, including research agencies, analysts and trading firms, to assess chip supply and demand this year on a five-point scale in each year. precious, from oversupply to undersupply according to each type and level of use.

According to American research firm Gartner, 80% of companies globally will use generative AI in business operations by 2026, up from less than 5% in 2023. Microsoft, Amazon.com and other companies will increase AI offerings.

According to market research firm Statista (Germany), the AI chip market value is forecast to increase to 119.4 billion USD by 2027, accounting for nearly 20% of the global chip market.

Omdia analyst Akira Minamikawa believes that AI will be used for smartphones and personal computers. Investment related to generative AI will recover and significantly boost the growth of the chip market./.

You should read it

- Offer PDF Export Kit - a PDF converter to other formats for $ 49, which is free

- How to set up and use the Quick Export feature in Photoshop

- How to export emails from Mail to Note on Mac

- How to export printing images in Photoshop

- The difference between H1 chip and Apple W1 chip

- Steps to export Microsoft Access data to Word documents

Apple-Google: The handshake that can shake the technology world

Apple-Google: The handshake that can shake the technology world Google's dilemma

Google's dilemma China builds rockets that deliver goods to anywhere on Earth within 1 hour

China builds rockets that deliver goods to anywhere on Earth within 1 hour How Mark Zuckerberg, Jensen Huang, Sam Altman and CEOs of major technology companies use AI

How Mark Zuckerberg, Jensen Huang, Sam Altman and CEOs of major technology companies use AI 20 years of Gmail's birth: From April Fool's joke to the pinnacle of technology

20 years of Gmail's birth: From April Fool's joke to the pinnacle of technology Will civil supersonic aircraft return?

Will civil supersonic aircraft return?