This app reveals your credit card's secret perks

Once while traveling home, my evening flight was canceled due to weather. That meant I needed a hotel, but because there wasn't a mechanical issue to blame for the cancelation, the airline didn't offer to foot the bill. I was stuck with it.

What I didn't know was that the bank whose credit card I used to book the flight, Chase, would have stepped in to cover my hotel expense. Like many (most?) folks, I'm woefully unaware of the various benefits afforded me as a cardholder. Sure, I knew about the points I earned with each purchase, and I was fairly sure I could get an extended warranty on certain product purchases. But travel insurance? I had no idea.

Enter Sift, a service that catalogs every perk offered by a wide variety of credit cards, with complete descriptions of each one and instructions for how to access it.

That's already quite useful, but Sift also tracks your purchases and notifies you of price drops, return options, warranty coverage and more. It can even automatically get you a refund if there's an applicable price-protection policy.

Here's how to get started.

Install the app or visit the website

The Sift app is available for Android and iPhone, but the company also has a website if you prefer to use a browser. By the way, there's no direct cost to using Sift, but if the service is able to save you money (see below), you'll be charged 25% of those savings.

Link your cards and accounts

To make the most of Sift, you'll need to add at least one credit card. Fortunately, that doesn't mean sharing your actual card number. You can add one or more cards just by browsing or searching the list and selecting them by name.

If you want to see (and enjoy) the benefits associated with individual purchases -- price protection, return options and so on -- add the last four digits of your card number. That'll allow Sift to match your purchase receipts to the correct card.

To do that, you'll also need to link an email address. Sift will scan your messages in search of receipts. (Other services, like Paribus, work similarly. Obviously if you have privacy concerns, you'll want to check out Sift's privacy policy.) Note that if you are part of Google's Advanced Protection Program, which requires a physical key to log into your Gmail, Sift will not be able to access your email, so this aspect of the service won't work.

Finally, in another stab at freaking out the privacy-minded, Sift asks you to link your Amazon account -- again for purposes of price protection, help with returning purchases and other services.

Review your benefits and purchases

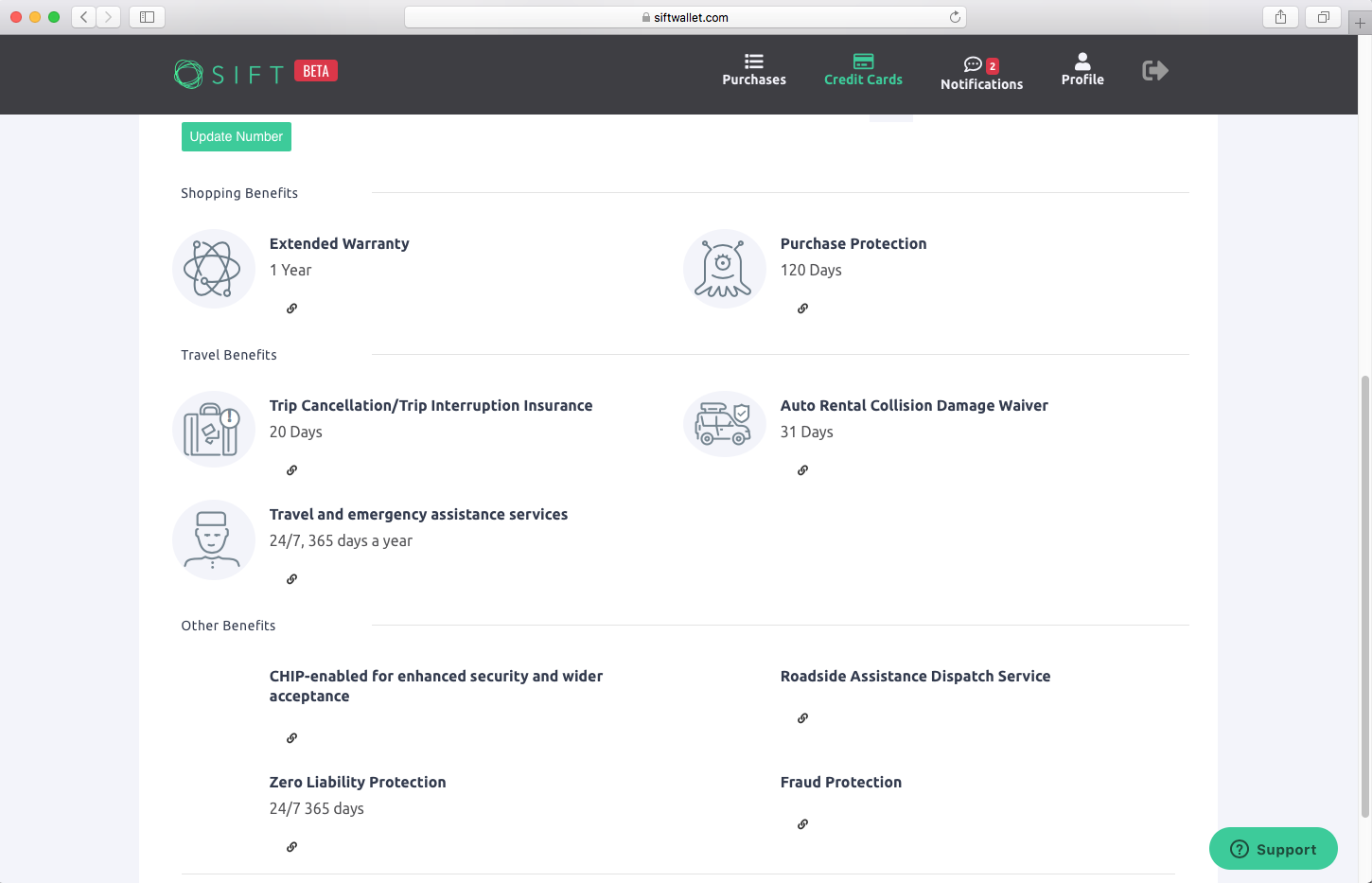

Once you've completed these Sift profile steps, you can start investigating the various benefits. Select the Credit Cards tab at the top of the the website or tap Cashback on the bottom of the app and then tap Credit Cards up top for a summary of each card's benefits. You can select any one of them to get more information -- including, in some cases, a link and a phone number for claiming the benefit.

I must admit, I loved seeing all these perks listed in one convenient place. Most of them were news to me. It's not like they're listed anywhere in my Chase app, and even poking around the Chase site wasn't particularly fruitful. I actually had to do some Googling to find the bank's card benefits, and even then they weren't presented as completely or efficiently as they were here.

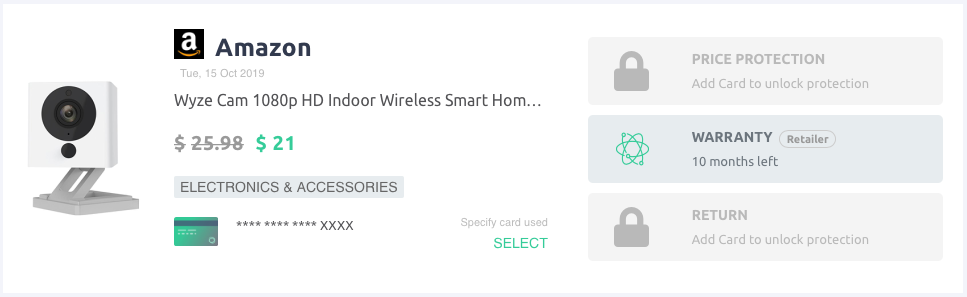

Next, check out Purchases to see items you've bought via Amazon and your linked credit cards. For any given item, you'll see which price-protection, warranty and return options are available. You can also search for a specific purchase -- helpful for long lists -- and filter the results based on item category.

Tap Drops for an automatically updated list of price changes for your past purchases. (Pro tip: Give the app permission to notify you when it detects one, so you don't miss the window.) Where possible, Sift will actually intervene on your behalf to file a price-drop claim, either with your credit card or the store.

To take advantage of this, however, you'll need to keep a credit card on file so Sift can charge you 25 percent of whatever it's able to save you. (This charge occurs once per month.) So, for example, if the service finds three price drops in a month, and is able to score price-protection refunds totaling $20, that money will be refunded to whichever cards you used to make the purchases -- but you'll also incur a separate charge of $5.

Sure, you could monitor each and every purchase yourself and file individual price-protection claims yourself. Would you catch each and every one? And how much time would that take? Although 25 percent may seem steep, chances are good you'll still come out way ahead. Call it unexpected-cashback-after-the-fact.

Additionally, much like other finance apps such as Credit Karma and Mint, Sift has a tab on the mobile app called Best Cards that offers up credit card recommendations based on your credit score (which you must provide -- Sift does not pull your credit score like some other apps) as well as other factors. Of course, Sift lets you know it may make a commission from any cards you apply and are approved for through the Sift app.

Bottom line: Sift rocks. It provides some pretty useful and enlightening data about your credit cards, and if you're willing to provide some personal information, it can save you money as well.