How to Raise Car Deficiency Counterclaims

Part 1 of 3:

Identifying Counterclaims

-

Check your state law. Each state has laws which cover the repossession of goods, such as motor vehicles. The law will list many of the counterclaims that you can bring against the lender in a deficiency lawsuit. You should begin your research as soon as the car has been repossessed.

Check your state law. Each state has laws which cover the repossession of goods, such as motor vehicles. The law will list many of the counterclaims that you can bring against the lender in a deficiency lawsuit. You should begin your research as soon as the car has been repossessed.- To find your state's law, you can search the Internet for 'your state' and 'car repossession.'

- You might also visit your nearest law library. It is probably located at your courthouse or at a nearby law school. You can ask the librarian to show you the law on repossession.

- If you don't understand the law as you are reading it, then you should schedule a consultation with a lawyer. You can get a referral by calling your local or state bar association. Consultations usually last a half hour, and you can ask the lawyer questions about what counterclaims you can bring.

-

Look at your notices. The lender must give you certain notices after it repossesses your car. If the lender fails to give you notice—or if the notice is deficient—then the law allows you to bring a counterclaim. You may be entitled to statutory damages for deficient notices. In Illinois, for example, you can get the finance charge plus 10% of the cash price for the vehicle.[1]

Look at your notices. The lender must give you certain notices after it repossesses your car. If the lender fails to give you notice—or if the notice is deficient—then the law allows you to bring a counterclaim. You may be entitled to statutory damages for deficient notices. In Illinois, for example, you can get the finance charge plus 10% of the cash price for the vehicle.[1]- Your state law will identify what information must be in the notices. Generally, you must be informed of the following:[2]

- the time, date, and location of a public auction

- the date of a private sale, if the car is sold privately

- your right to redeem the car

- a new notice if the sale is rescheduled

- Your state law will identify what information must be in the notices. Generally, you must be informed of the following:[2]

-

Check if the sale was commercially reasonable. The lender cannot simply hold onto your car and sue you for the deficiency. Nor can the lender sell the car to a relative for a low price. Instead, the law requires that the lender sell your car in a 'commercially reasonable manner.' You should check that the lender did the following:[3]

Check if the sale was commercially reasonable. The lender cannot simply hold onto your car and sue you for the deficiency. Nor can the lender sell the car to a relative for a low price. Instead, the law requires that the lender sell your car in a 'commercially reasonable manner.' You should check that the lender did the following:[3]- Sold the car at auction. Although a private sale is not prohibited, auctions are more standard. Furthermore, private sales to family, friends, or business associates are not commercially reasonable.

- Sold the car quickly. After repossession, the lender cannot sit on the car and let it lose value. Instead, it must sell the car in a reasonable amount of time.

- Advertised the sale. The lender must let the public know when the auction is being held. Without sufficient advertisement, it cannot assure itself of getting the highest price possible.

- Described the car accurately. In the advertisement, the lender must give an accurate description of the vehicle. It should accurately state the car's make, model, year, and mileage.

- Let prospective purchasers inspect the car. The manner of sale must also be reasonable. This includes letting prospective bidders look at the car if they want.

-

Identify protections for military personnel. Federal law provides special protections to service-members, reservists, and National Guard members. When repossessing your car, the lender must first get a court order. If the court grants it, then the court can force the lender to repay all of your payments or the court may stay the repossession.[4]

Identify protections for military personnel. Federal law provides special protections to service-members, reservists, and National Guard members. When repossessing your car, the lender must first get a court order. If the court grants it, then the court can force the lender to repay all of your payments or the court may stay the repossession.[4]- You are covered by the law if you entered a loan agreement before you entered military service. You also must have made at least some payment on the loan and not have signed a waiver giving up your rights.[5]

- The protection lasts for as long as you are in the service. It ends up to 90 days after you leave or are discharged.

-

Demand the return of your personal property. When your car was repossessed, you may have had personal property in the car: a shovel, clothes, school books, etc. The lender must return your personal property. If it doesn't, then it is liable for theft or conversion because it took your property when it took the car.[6]

Demand the return of your personal property. When your car was repossessed, you may have had personal property in the car: a shovel, clothes, school books, etc. The lender must return your personal property. If it doesn't, then it is liable for theft or conversion because it took your property when it took the car.[6]- Think back to what you had in the car and in the trunk. Type up a list. It is best to be over-inclusive and include anything in your list that you think might have been in the car when it was repossessed.

- You should send the lender a letter.[7] Identify each piece of property that you want returned and ask that the lender call you to schedule the pick-up of your possession.

- Mail the letter certified mail, return receipt requested. The receipt will be proof that the lender received the letter.

-

Identify if the lender breached the peace. State law strictly limits how the lender can repossess your vehicle. Specifically, a lender cannot 'breach the peace' when repossessing your car.[8] Breaching the peace is not clearly defined, but it typically involves the following:[9]

Identify if the lender breached the peace. State law strictly limits how the lender can repossess your vehicle. Specifically, a lender cannot 'breach the peace' when repossessing your car.[8] Breaching the peace is not clearly defined, but it typically involves the following:[9]- breaking into a garage to take the vehicle

- trespassing on your property

- threatening to use force or using actual force

- taking the vehicle over your stated objection

Part 2 of 3:

Drafting Your Answer

-

Note the deadline for responding. After selling the car, the lender will file a lawsuit to sue you for the deficiency. It will then send you a copy of the complaint and the summons. You should read them closely.

Note the deadline for responding. After selling the car, the lender will file a lawsuit to sue you for the deficiency. It will then send you a copy of the complaint and the summons. You should read them closely.- The summons should tell you the deadline for responding to the lawsuit.[10]

-

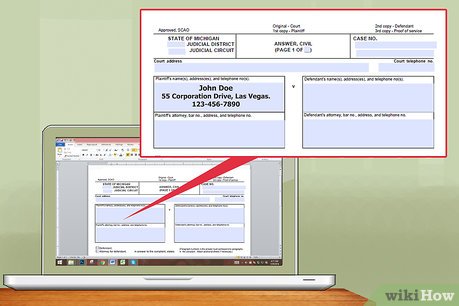

Get an answer form. Most courts will have 'fill in the blank' answer forms already printed for you to use. Stop into the court clerk's office and ask.

Get an answer form. Most courts will have 'fill in the blank' answer forms already printed for you to use. Stop into the court clerk's office and ask.- If the court has no form, then ask whether or not the court has a sample motion you could use.

- You must file your answer in the same court in which the lender filed the deficiency suit against you.

-

Admit or deny allegations. Before raising the counterclaims, be sure to respond to each allegation in the complaint. You must go through each one, admitting, denying, or claiming insufficient knowledge to admit or deny.[11]

Admit or deny allegations. Before raising the counterclaims, be sure to respond to each allegation in the complaint. You must go through each one, admitting, denying, or claiming insufficient knowledge to admit or deny.[11]- If you don't know for sure, then be safe and claim insufficient knowledge. You can always go back and amend your answer later to admit or deny an allegation after you investigate further.

-

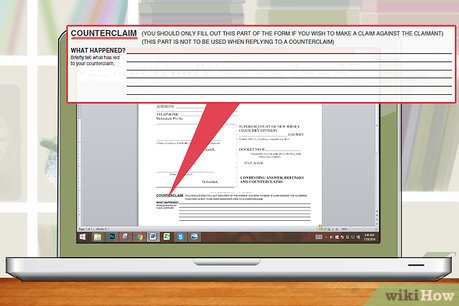

Insert a section on counterclaims. After responding to each allegation, you then should insert a header for 'Counterclaims.' Underline the word and bold it. Center it between the left and right margins.

Insert a section on counterclaims. After responding to each allegation, you then should insert a header for 'Counterclaims.' Underline the word and bold it. Center it between the left and right margins.- If you are using a printed form, there should already be a section for counterclaims. If not, then attach a piece of paper.

-

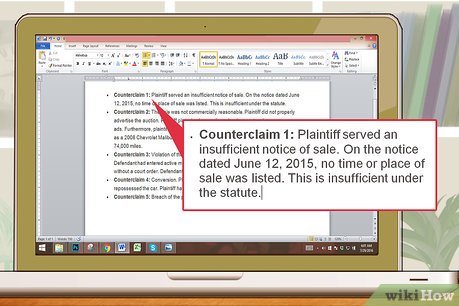

List your counterclaims. Underneath the heading, you can list all of your counterclaims. You do not need to go into extensive detail when listing your counterclaims. Instead, you could write the following:

List your counterclaims. Underneath the heading, you can list all of your counterclaims. You do not need to go into extensive detail when listing your counterclaims. Instead, you could write the following:- 'Counterclaim 1: Plaintiff served an insufficient notice of sale. On the notice dated June 12, 2015, no time or place of sale was listed. This is insufficient under the statute.'

- 'Counterclaim 2: The sale was not commercially reasonable. Plaintiff did not properly advertise the auction. Plaintiff placed only an online advertisement and no newspaper ads. Furthermore, plaintiff did not describe the car accurately in the ad. It listed the car as a 2008 Chevrolet Malibu with 122,000 miles. The car is a 2010 Chevrolet Malibu with 74,000 miles.'

- 'Counterclaim 3: Violation of the Service-members Civil Relief Act of 2003. After Defendant had entered active military service, Plaintiff repossessed the motor vehicle without a court order. Defendant signed no waiver giving up his rights.'

- 'Counterclaim 4: Conversion. Plaintiff converted Defendant's property when it repossessed the car. Plaintiff has not returned Defendant's property valued at $1,000.'

- 'Counterclaim 5: Breach of the peace. Plaintiff breached the peace when it trespassed onto Defendant's property and opened the garage door to repossess the car.'

-

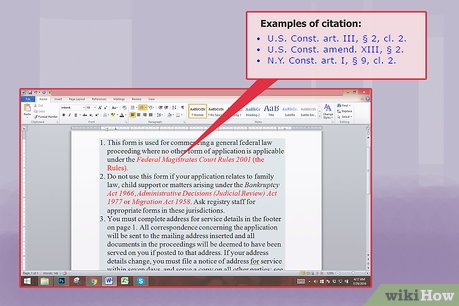

Cite the relevant law. Be sure to cite relevant law after each counterclaim. You want the judge to understand that your counterclaim is authorized by the law.

Cite the relevant law. Be sure to cite relevant law after each counterclaim. You want the judge to understand that your counterclaim is authorized by the law.- You can refer back to the legal research that you did earlier. Cite the statute number at the end of your counterclaim. If you found a court case which authorizes the counterclaim, then include the case name.

-

File the answer. After you finish listing your counterclaims, you need to file your answer with the court. Make several copies and take them all to the court clerk. Ask to file.

File the answer. After you finish listing your counterclaims, you need to file your answer with the court. Make several copies and take them all to the court clerk. Ask to file.- You will need to serve a copy of your answer on the lender or the lender's attorney.[12] Ask the court clerk for acceptable methods of service.

- Keep one copy for your own records.

Part 3 of 3:

Gathering Supporting Evidence

-

Hold onto your notices. If you are suing for a deficient notice, then you will need to show them to the judge at some point, either during trial or earlier. Make sure to preserve them so that you can introduce them into evidence.

Hold onto your notices. If you are suing for a deficient notice, then you will need to show them to the judge at some point, either during trial or earlier. Make sure to preserve them so that you can introduce them into evidence.- If you misplaced your notices, then don't panic. You can request a copy from the lender after you file your answer during a process called 'discovery.' In discovery, you can request any document relevant to the lawsuit, so you can get a copy of the notices the lender sent you.[13]

- However, you shouldn't raise a counterclaim unless you are sure that your counterclaim has factual support.

-

Request documents about the sale. You can get more information about the sale of your vehicle during discovery. To help prove a counterclaim that the sale was not commercially reasonable, you should request the following:

Request documents about the sale. You can get more information about the sale of your vehicle during discovery. To help prove a counterclaim that the sale was not commercially reasonable, you should request the following:- copies of all advertisements

- the dates all advertisements ran

- the name of the auctioneer (if one was used)

-

Look at your loan document. If you are a service-member, then you need to make sure that you didn't sign a waiver when you filled out your loan documents. A waiver is your agreement to give up your rights granted by the law. In order to be legal, the waiver must be:[14]

Look at your loan document. If you are a service-member, then you need to make sure that you didn't sign a waiver when you filled out your loan documents. A waiver is your agreement to give up your rights granted by the law. In order to be legal, the waiver must be:[14]- in writing

- conspicuous, in at least 12-point type

- contained in a document separate from the loan agreement

-

Hold onto your communications with the lender. For example, if you wrote the lender to demand the return of your personal property, then you should hold onto the letter. It is proof that you gave the lender notice that it was in possession of your personal property.

Hold onto your communications with the lender. For example, if you wrote the lender to demand the return of your personal property, then you should hold onto the letter. It is proof that you gave the lender notice that it was in possession of your personal property.- Also hold onto any other communication with the lender. For example, the lender might have written back.

- If the lender returned your property but it was damaged, then you should preserve the property. You can sue for damaged property as well.

-

Gather evidence of a breach of the peace. You can support any counterclaim for breach of the peace by taking photographs or video of damage the repo person caused when taking your car. For example, if the repo person drove across your lawn, then take pictures of the tire marks.

Gather evidence of a breach of the peace. You can support any counterclaim for breach of the peace by taking photographs or video of damage the repo person caused when taking your car. For example, if the repo person drove across your lawn, then take pictures of the tire marks.- If he broke into your garage, take a photograph.

- Also, if you had a confrontation with the repo person, then write down your memories of the confrontation as soon as possible. What did the person say? Did he make any threatening gestures?

- If you called the police, then get a copy of the police report. This is important evidence.

Share by

Kareem Winters

Update 24 March 2020