How to Make Car Accident Claims

Part 1 of 3:

Taking Steps Immediately After the Incident

-

Contact the authorities. Depending on the severity of the accident, you'll need to contact the authorities. Contacting the authorities is very important, since they will document the accident. In doing so, they will record the details of the accident in accordance to the testimonies of all the parties involved (including witnesses). Such documentation is vital as insurance companies will use it to determine which party is primarily responsible for damages.

Contact the authorities. Depending on the severity of the accident, you'll need to contact the authorities. Contacting the authorities is very important, since they will document the accident. In doing so, they will record the details of the accident in accordance to the testimonies of all the parties involved (including witnesses). Such documentation is vital as insurance companies will use it to determine which party is primarily responsible for damages.- In most cases, you'll want to call the police.

- In a case of minor car accidents, such as a fender bender in the parking lot or something similar, you might be able to contact another type of law enforcement officer who will document the accident.

- In the case of a more severe accident, emergency services will dispatch paramedics or firefighters to the scene. Remember, the safety and well-being of all parties is paramount to insurance-related claims.[1]

-

Get the details of the other party, if possible. It is your right to obtain the personal details of the other driver. It is also your obligation to give them your personal details. If the accident involved another person, make sure to have their:

Get the details of the other party, if possible. It is your right to obtain the personal details of the other driver. It is also your obligation to give them your personal details. If the accident involved another person, make sure to have their:- Name.

- Driver's license number.

- License plate number.

- Insurance information, if they have it.[2]

-

Obtain personal information of all witnesses. Getting the contact information of witnesses is also very important and can aid you in the claims process. Witnesses of the accident might want to talk about what they've seen. However, not all of them are willing to do that particular task.

Obtain personal information of all witnesses. Getting the contact information of witnesses is also very important and can aid you in the claims process. Witnesses of the accident might want to talk about what they've seen. However, not all of them are willing to do that particular task.- Don't be rude to them if they don't want to talk.

- In most cases, witnesses who remain on the scene will be happy to help.

- Politely ask for their names, phone numbers, and address.

-

Take pictures of the accident scene. If you are carrying a camera or camera phone when the accident happened, don't hesitate to take picture of the accident scene. Photographing the accident scene can potentially help your case when filing a claim. Pictures can include:

Take pictures of the accident scene. If you are carrying a camera or camera phone when the accident happened, don't hesitate to take picture of the accident scene. Photographing the accident scene can potentially help your case when filing a claim. Pictures can include:- The positions of the cars after the accident.

- The damages in your car.

- The name of the street or place where the accident took place.[3]

-

Gather your appropriate information. Before calling your insurance company and filing a claim, you need to make sure you have all of your appropriate information. This is important, as your insurer will be unable to complete a claim unless you have certain information. Make sure you have:

Gather your appropriate information. Before calling your insurance company and filing a claim, you need to make sure you have all of your appropriate information. This is important, as your insurer will be unable to complete a claim unless you have certain information. Make sure you have:- Your policy number.

- Other identifying information (like your date of birth or last four of your social) that the company can use to verify your identity.

- A basic description of the incident. Avoid making a call to the insurance company if you are in the middle of finding out what happened. Remember, document the incident and contact the authorities immediately.[4]

-

Prevent further damage. After you and the authorities have documented the accident, you'll want to take steps to prevent further damage. Most insurance companies require that their policy holders take reasonable steps to make sure insured vehicles do not experience any further damage after the accident.

Prevent further damage. After you and the authorities have documented the accident, you'll want to take steps to prevent further damage. Most insurance companies require that their policy holders take reasonable steps to make sure insured vehicles do not experience any further damage after the accident.- Many times, your first step will be to arrange for a tow truck to move the vehicle to a safer location (if needed).

- If your vehicle has any damage that would allow moisture to enter the interior, you should close off that damage with a tarp or thick plastic.

- Make sure the vehicle is stored or located in a place where theft or vandalism is unlikely.[5]

Part 2 of 3:

Contacting Your Insurance Company

-

Call your insurance company. After you've taken steps to contact the authorities and document the accident, you need to contact your insurance company. While sometimes you will phone the company through a 1800 number, depending on your insurer, you might have to call your specific agent. Regardless, contacting the company is important, since the insurance company will need appropriate information in order to begin the claims process. When calling your insurance company:

Call your insurance company. After you've taken steps to contact the authorities and document the accident, you need to contact your insurance company. While sometimes you will phone the company through a 1800 number, depending on your insurer, you might have to call your specific agent. Regardless, contacting the company is important, since the insurance company will need appropriate information in order to begin the claims process. When calling your insurance company:- Call your insurance company as soon as you safely can. Unless you are injured and hospitalized, you should make your call within 24 to 48 hours.

- Make sure that you or others in your party are not in further danger. Avoid calling your insurance company while on the side of a major interstate in rush hour traffic.

- Make sure that you are in an environment where you will be able to hear the agent or representative on the phone.

- Provide all information that your agent or representative requests.[6]

-

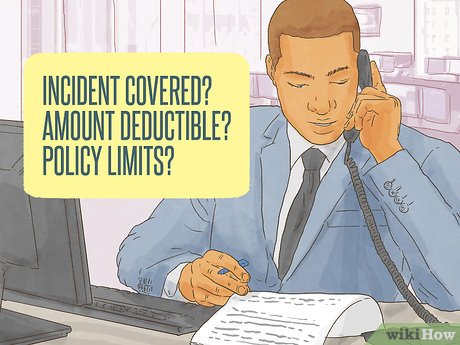

Ask your insurance representative important information you may not know. While on the phone with your insurer, it is important to ask them about any information you need to know going forward. This information will allow you to mentally prepare for the rest of the claims process.

Ask your insurance representative important information you may not know. While on the phone with your insurer, it is important to ask them about any information you need to know going forward. This information will allow you to mentally prepare for the rest of the claims process.- Will you be covered for the incident?

- What is your deductible?

- What are the limits of your policy?[7]

-

Talk to an adjuster. After your initial call to the insurance company, you'll be referred to an adjuster. What often happens is that the adjuster will call you several days after the claim is filed to set up a time to review your car.

Talk to an adjuster. After your initial call to the insurance company, you'll be referred to an adjuster. What often happens is that the adjuster will call you several days after the claim is filed to set up a time to review your car.- Make sure to make yourself available to the adjuster. The sooner you meet with him or her, the quicker your claim will be processed.

- The adjuster will inspect your car, accident reports, and other relevant information.

- The adjuster will come to a conclusion about the fault of the accident.

- The adjuster will provide an estimate of the repair cost of the vehicle.

- Very rarely, the adjuster will let you know that the car is a total loss. In this case, if the loss is covered, the insurer will pay you for the replacement cost of the vehicle (if the loss is covered).

- In some cases, your insurer will have you bring your vehicle to a body shop with an onsite adjuster. Often, this speeds up the claims process.[8]

Part 3 of 3:

Managing Your Claim After You have Filed It

-

Stay in contact with your insurer. After you've spoken with the adjuster, you need to maintain communication with your insurer. Maintaining communication is key in making sure the adjuster and the insurer stay proactive on your claim.

Stay in contact with your insurer. After you've spoken with the adjuster, you need to maintain communication with your insurer. Maintaining communication is key in making sure the adjuster and the insurer stay proactive on your claim.- Phone your insurer two days after the adjuster has viewed your car.

- Ask them the status of your claim.

- Request a timeline of your claim.[9]

-

Prepare to deal with your deductible. Your deductible is the amount of the damage to your vehicle that you are responsible for independent of your insurer. After you speak with your insurance company, you should prepare to pay or otherwise deal with your deductible.

Prepare to deal with your deductible. Your deductible is the amount of the damage to your vehicle that you are responsible for independent of your insurer. After you speak with your insurance company, you should prepare to pay or otherwise deal with your deductible.- In the event of a total (covered) loss, your insurer will provide you with a check for the replacement cost of your vehicle minus your deductible. For example, if the replacement cost is $5,000 and your deductible is $500, your insurer will provide you with a check for $4,500.

- In the event that your car sustained a limited amount of damage and can be repaired at a body shop, you will be responsible for paying the deductible to the body shop and the insurer will either pay the body shop directly or reimburse you the covered amount.

- Policies and procedures vary by company, so make sure to ask your insurer how they will deal with your deductible.

-

Negotiate or dispute your claim, if you need. Sometimes the adjuster will provide an estimate of repairs (or the replacement cost) for your car that is either unrealistic or just too low. In these cases, you'll need to call and dispute the estimate and negotiate with your insurer.

Negotiate or dispute your claim, if you need. Sometimes the adjuster will provide an estimate of repairs (or the replacement cost) for your car that is either unrealistic or just too low. In these cases, you'll need to call and dispute the estimate and negotiate with your insurer.- If you think the replacement cost of your car (in the event of a total loss) is too low, you should provide 3-5 examples of the cost to replace your car in your region. Make sure to find examples that match your totaled car.

- If you think the estimate for repairs of your car is too low, have several body shops in your area provide estimates for the repairs. After you have the estimates, submit them to your adjuster and/or insurer.

- If you think your insurer and the adjuster are not treating you fairly, make sure to persist and escalate your dispute to managers and supervisors within the company.[10]

-

Choose a body shop. Within a couple days of meeting with the adjuster, they will probably provide you with an estimate and let you know what is covered. At that point, it'll be time for you to choose a body shop. Choosing a body shop is an important part of the claims process, as it will be one of the last steps in closing your claim.

Choose a body shop. Within a couple days of meeting with the adjuster, they will probably provide you with an estimate and let you know what is covered. At that point, it'll be time for you to choose a body shop. Choosing a body shop is an important part of the claims process, as it will be one of the last steps in closing your claim.- Make sure to choose a body shop that is proficient in repairing the make and model of your car.

- Your insurer might suggest several body shops that they frequently work with. Remember, though, you do not have to pick one of these shops.

- Make sure you are comfortable with the shop you pick and the work they do.[11]

-

Document and submit all of your expenses to your insurer. Remember to also document all of your expenses as they occur. This is important, because your insurer might cover certain expenses related to your accident. As a result, make sure to be diligent about tracking expenses.

Document and submit all of your expenses to your insurer. Remember to also document all of your expenses as they occur. This is important, because your insurer might cover certain expenses related to your accident. As a result, make sure to be diligent about tracking expenses.- Keep copies of your receipts, invoices, and estimates.

- Keep copies of associated medical bills.

- Your insurer might pay for a rental car, in some circumstances.

- Your insurer might pay for a tow truck to relocate your car.[12]

Share by

Kareem Winters

Update 24 March 2020