Different Ways of Trading Online to Be Aware of

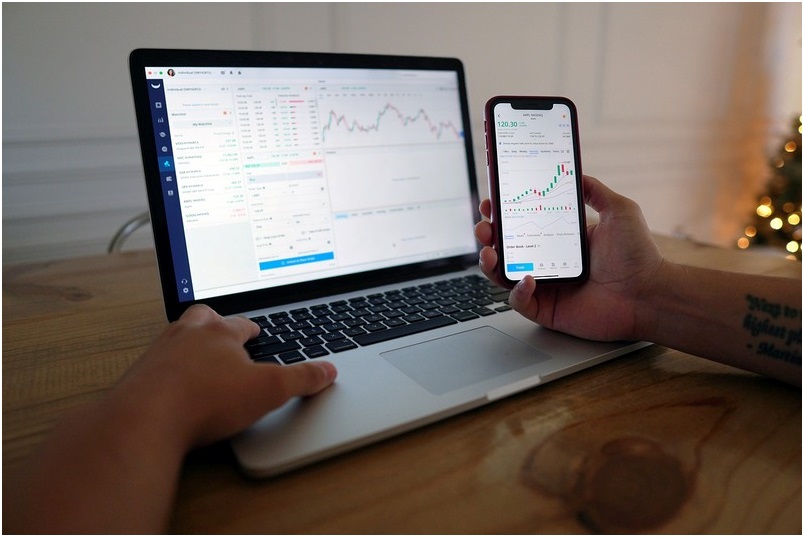

The introduction of online trading platforms lets us now do this simply wherever we are, but how do they work?

Choose What You Want to Trade

You can trade just about any type of asset, from stocks to currencies and from commodities to bonds. There are different reasons for choosing each one, as you might feel comfortable with an area you have knowledge of or you might be looking for something that is either high or low risk, which will vary according to your appetite for risk.

One way of trading on any of these markets is with contracts for difference (CFDs), which is where you trade using assets without actually owning them, so you're looking purely for price swings. For example, with a CFD forex approach where you enter the world's biggest and most liquid market to trade currency pairs including or excluding the US dollar in this way. You need to understand terms such as spread, which is the difference between the buy and the sell price to do this well.

Choose a Trading Site and Platform

Once you know what you want to trade, the next step is to decide where to do it. The good news is that this is now easier to do than ever before, as the main trading platforms are easy to use. Get started by choosing a trading site that has good reviews and gives you a sense of confidence.

You then fund your trading account and decide how to make your first move. It's a good idea to use a demo account that lets you practice with dummy money before you use your own cash to trade with. This lets you get any possible mistakes out of the way without any lasting negative effects.

Keep on Researching and Practicing

As we've seen, getting started and taking your first trading step is easy to do, but you don't want to dive in and just start making moves before you're completely sure what you want to do. The more research you carry out, the better your decisions are likely to be, so you'll want to study the latest news from the financial markets and perhaps look for tips from experts too.

As you carry out more trades, you should become quicker and more efficient at the process involved. This means that you can start to carry out quick trades using techniques such as scalping or day trading, where you take advantage of trends to quickly buy and sell assets.

The more strategies you're aware of, the greater your potential for making a solid investment, although the risk of loss remains, so it's a good idea to continue to learn as you go. You might find the perfect approach that suits your personality right away or it might take longer for you to reach this stage.

Trading online is easier than you might think it is, but you still need to spend enough time on it to make the right decisions and feel confident about doing it well.